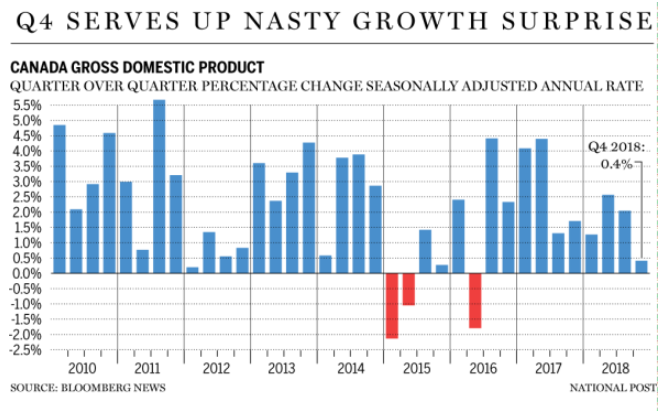

Canada’s Dollar slumped last Friday due to worse-than-expected gross domestic product data. Canada’s economy practically grinds to a halt at the end of 2018. Real GDP grew by just 0.1 percent in the fourth quarter of 2018. This equals to 0.4% annualized rate, which is significantly lower than analyst expectations of around 1%. This is the worst quarterly performance in two and a half years. For the full year, Canada’s economy grew by 1.8%, compared to the U.S. which grew by 2.9%. In December, Canada’s economy actually contracted by 0.1%.

Statistics of Canada says the decline in crude oil prices hit the exports during the period, which contributes to reduce Canada’s quarterly growth. The Loonie responded by weakening more than a full cent to 1.33 against the US Dollar. The Pound-to-Canadian-Dollar rallied more than 2 full cents as Poundsterling continues to be G10’s best performing currency in 2019. Following the release, the market has started to reprice the odds of a Bank of Canada’s rate hike lower. The report should reinforce the expectation of a prolonged rate hike pause by Bank of Canada.

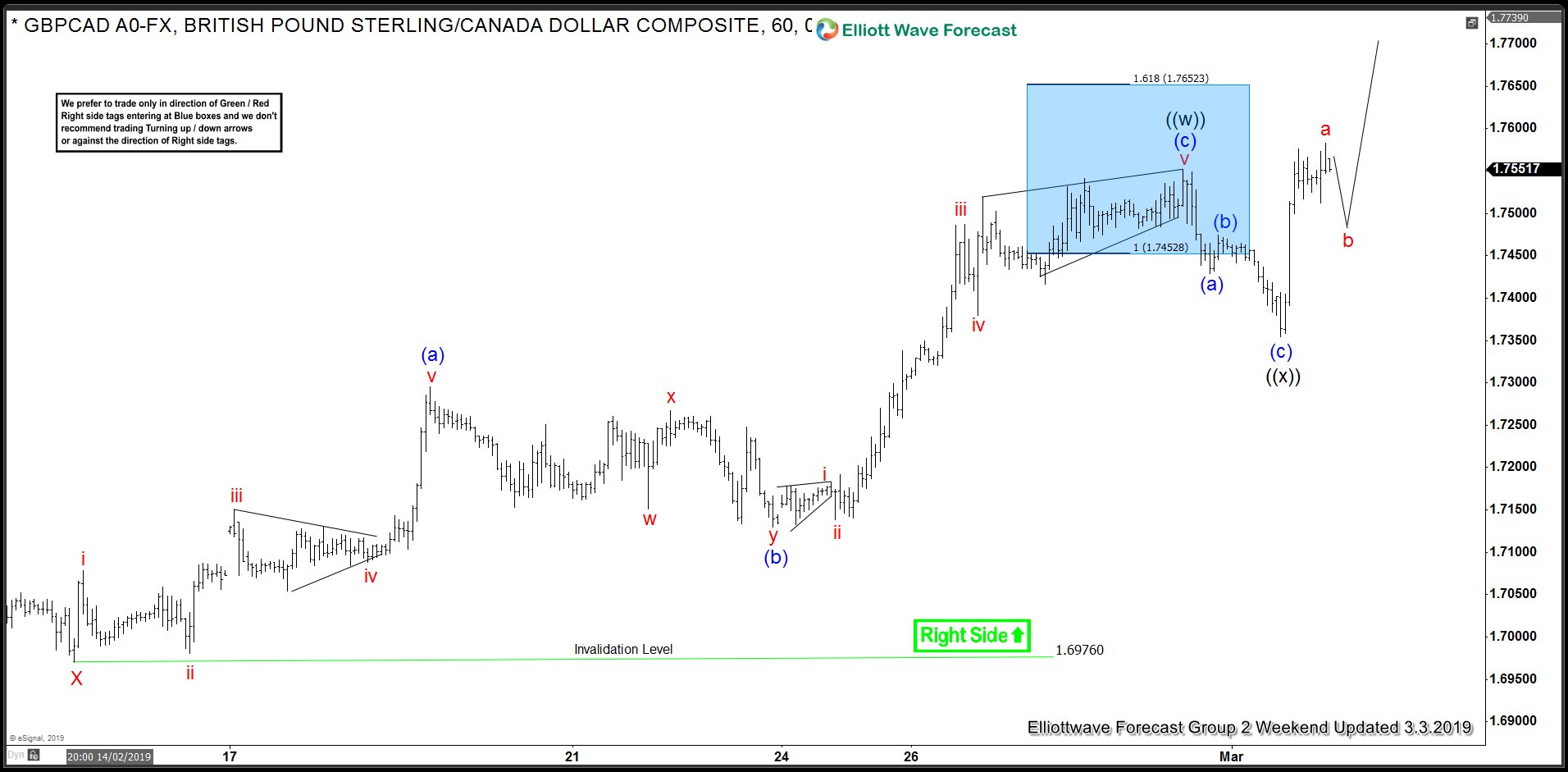

GBPCAD 1 Hour Elliott Wave Forecast

Pair shows an incomplete bullish sequence from Aug 30, 2018 low and Jan 11, 2019 low, favoring further upside. The chart above shows right side stamp higher in green which suggests we don’t like selling the pair. The rally from 1.6976 low is unfolding as a double three Elliott Wave structure where wave ((w)) ended at 1.755 and wave ((x)) ended at 1.735. Near term, while pullback stays above 1.735, and more importantly above 1.697, expect pair to extend higher. Potential target to the upside is 1.773 – 1.791 which is the 100 – 123.6% Fibonacci extension from January 14 low.