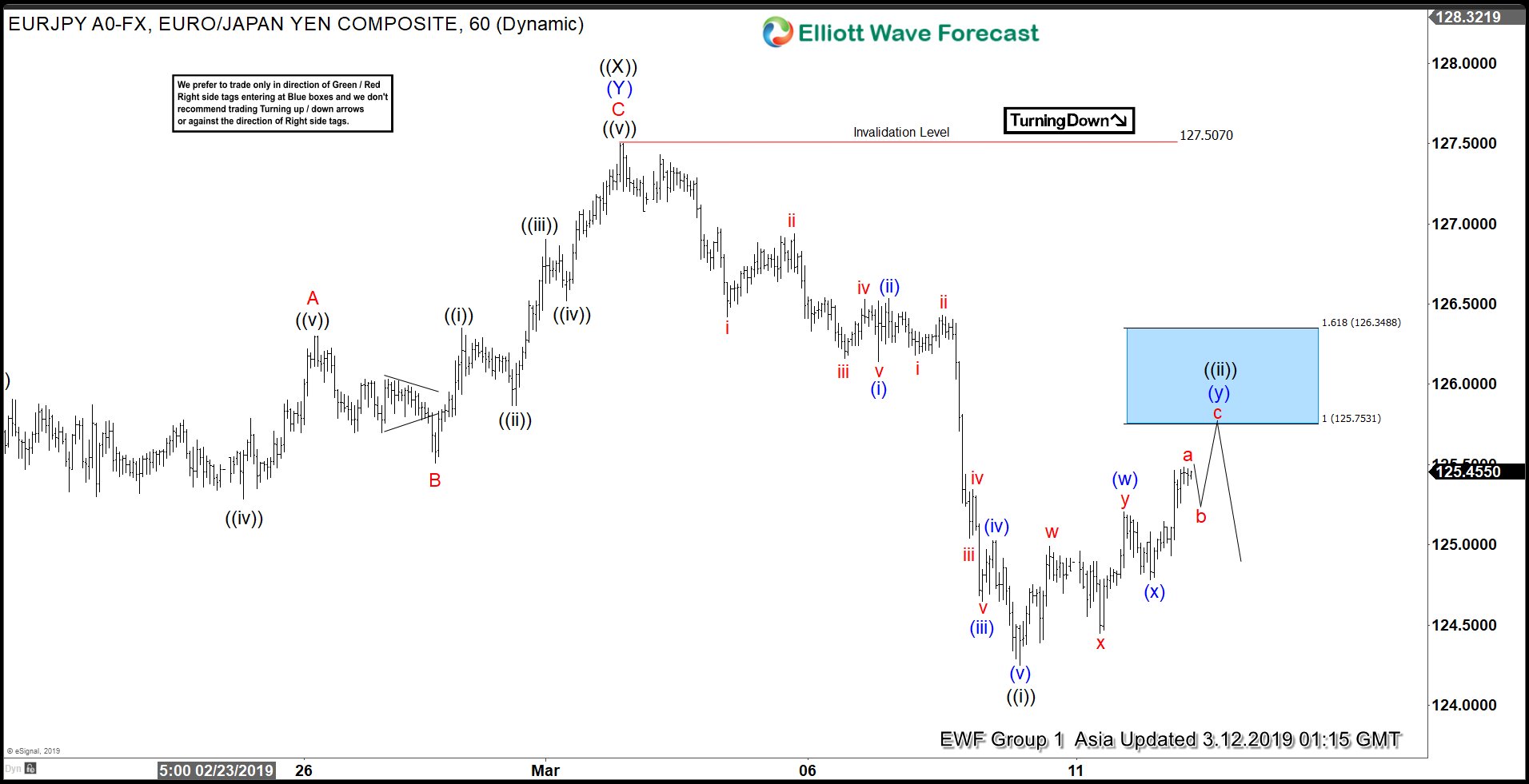

EURJPY has ended the cycle from Jan 3, 2019 low at 127.5. We label this rally from Jan 3 to March 1, 2019 as wave ((X)). This means the pair is in the initial stage of turning lower and eventually can break below Jan 3, 2019 low (118.51). At minimum, the pair should be correcting the cycle from 1/3 low in larger 3 swing. The first swing ended at 124.25 on March 8 as wave ((i)). The internal of wave ((i)) takes the form of as a 5 waves impulse Elliott Wave structure. Down from 127.5, wave (i) ended at 126.14 and wave (ii) ended at 126.53. Pair then declined in wave (iii) to 124.65, and bounce to 125.02 ended wave (iv). The last push lower to 124.25 ended wave (v) of ((i)).

Wave ((ii)) bounce is currently in progress to correct the decline from March 1 high (127.5) as a double three Elliott Wave structure. Up from 124.25, wave (w) ended at 125.2 and wave (x) ended at 124.78. Wave (y) of ((ii)) is expected to see sellers at 125,75 – 126.3 blue box area and pair can either resume to new low from here or pullback in 3 waves at least. As far as pivot at 127.5 high stays intact, expect pair to see sellers in 3, 7, 11 swing and extends lower.

1 Hour EURJPY Elliott Wave Chart