Chipotle Mexican Grill (NYSE: CMG) is an American chain of fast casual restaurants which has 29 locations outside of the United States.

Last month, the company announced fourth-quarter sales, revenue, and earnings growth that topped Wall Street’s expectations. The news helped its stock to extend the ongoing rally and CMG is now already up +49% year-to-date. Overall, since early 2018 low, the stock has seen 160% grow and it’s now facing the 2015 peak where a break higher would open a new bullish cycle.

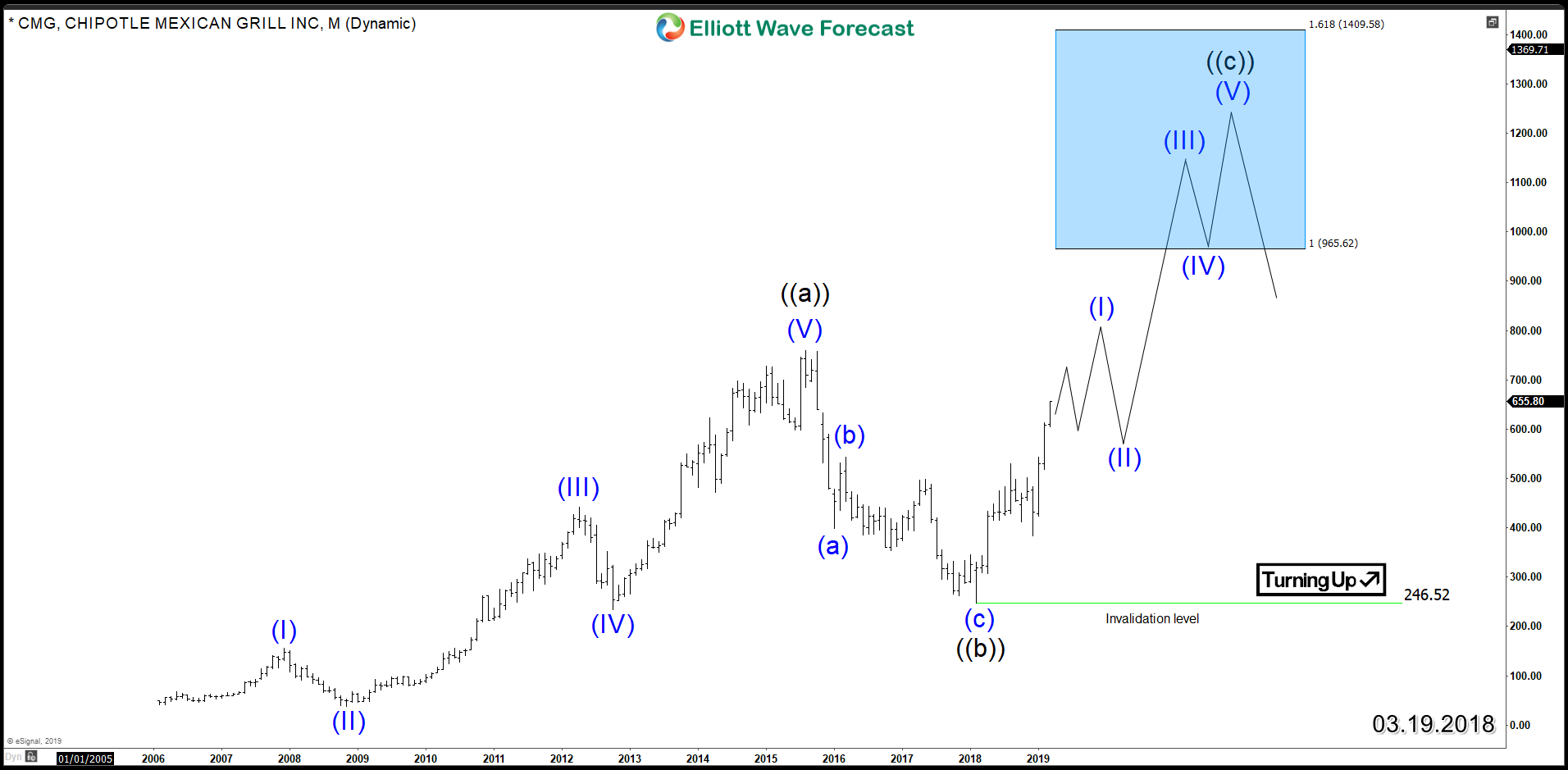

Using the Elliott Wave Theory, we can notice that CMG is only showing 3 waves advance at this stage from 2018 low and aiming for the 100% Fibonacci extension area at $666. Therefore, the stock still needs to do a 4th wave pullback followed by a 5th wave higher to complete an impulsive 5 waves advance.

During that move higher, CMG will be looking to challenge 2015 peak $758 as a break is still needed to confirm a new bullish cycle has started. However, if it fails to break higher then the possibility of a double three correction from that peak will remain alive until the stock shows otherwise.

CMG Elliott Wave Weekly Chart 03.19.2018

Consequently, breaking above 2018 peak will be the key level for CMG to open a new bullish sequence to the upside with a minimum target around 100% – 161.8% area $965 – $1400. In that case, Investors will be looking forward to buy the pullbacks in 3, 7 or 11 swings against 2018 low to join the new rally.

CMG Elliott Wave Weekly Chart 03.19.2018