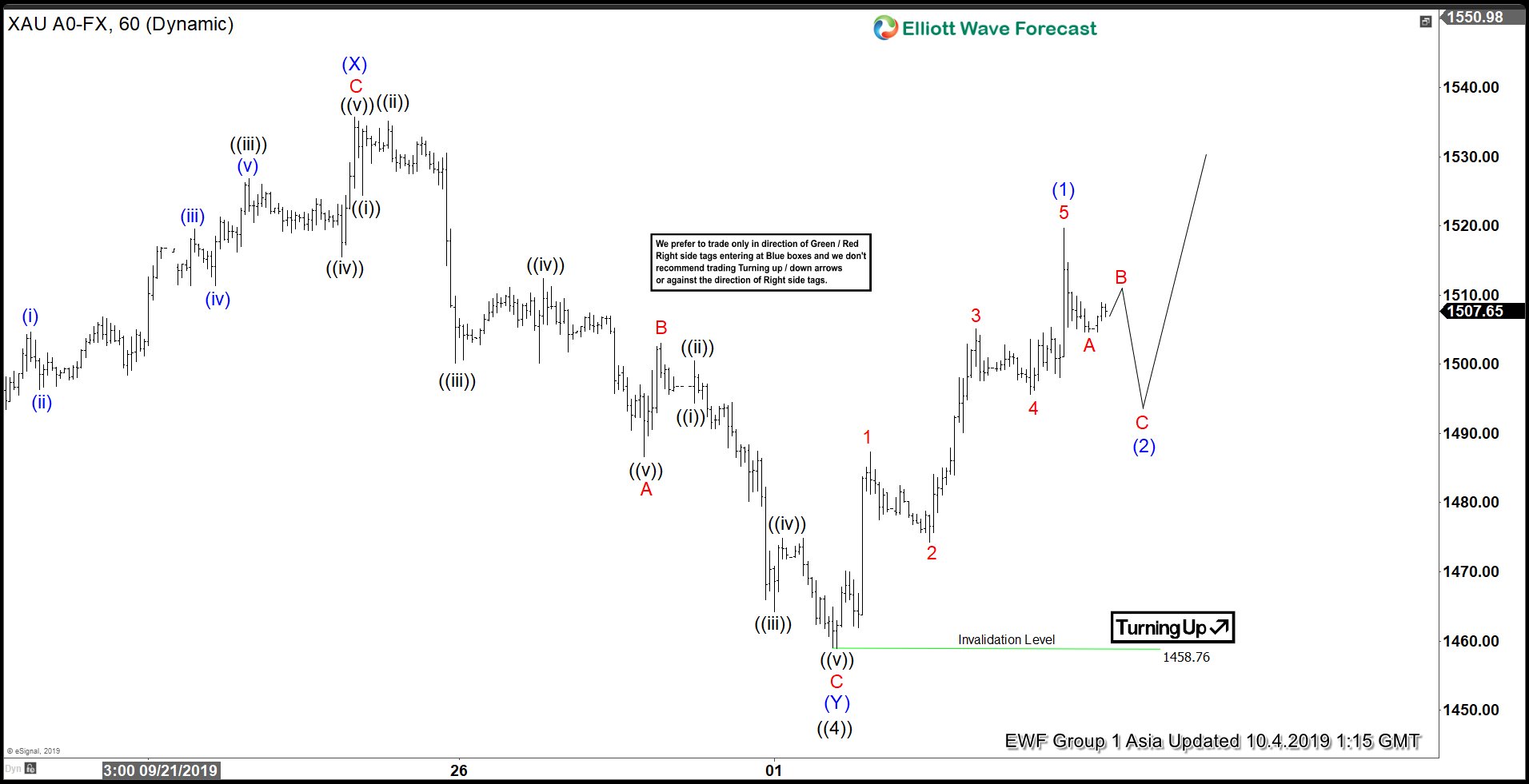

Elliott Wave view on Gold suggests the rally from August 2018 low last year remains in progress as a 5 waves impulse Elliott Wave structure. On the 1 hour chart below, we can see wave ((4)) of this impulse is proposed complete at 1458.76. Internal subdivision of wave ((4)) unfolded as a double three where wave (W) ended at 1484.2, wave (X) ended at 1535.69 and wave (Y) ended at 1458.76. Gold has since turned higher and the structure of the rally from 1458.76 unfolded as a 5 waves.

Up from 1458.76, wave 1 ended at 1487.3 and wave 2 pullback ended at 1474.3. The yellow metal then resumes higher in wave 3 towards 1502.13, wave 4 pullback ended at 1495.6 and wave 5 ended at 1519.7. The 5 waves move completed wave (1) in higher degree. The metal should pullback in wave (2) to correct cycle from Oct 1 low in 3, 7, or 11 swing before the rally resumes. The yellow metal still needs to break above September 4, 2019 high (1557.1) to rule out the possibility of a deeper correction. We don’t like selling Gold.

XAUUSD 1 Hour Elliott Wave Chart