The Coca-Cola Company (NYSE: KO) is an American multinational corporation and it’s the world’s leading soft-drink company.

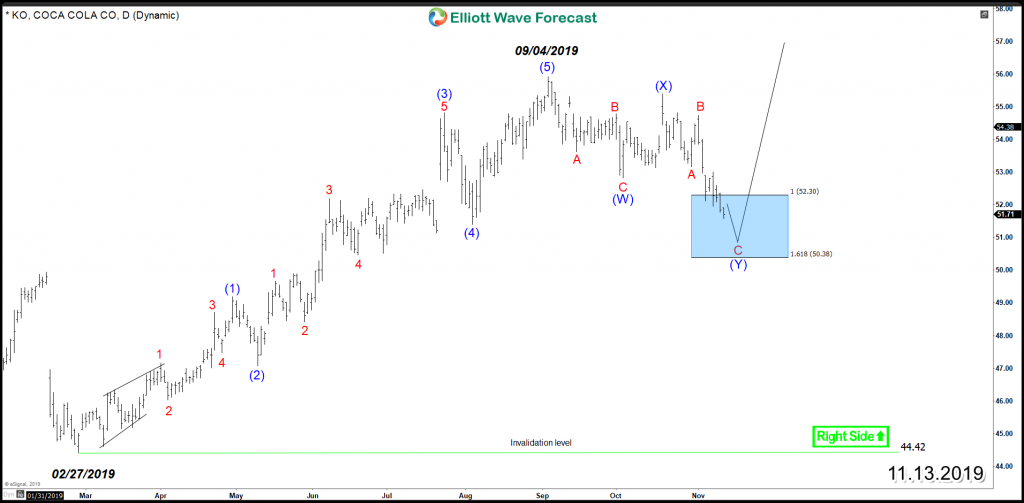

Since February 2019, KO rallied higher within an impulsive 5 waves advance breaking to new all time highs and opening further extension. Down from $56 peak, the stock started a correction lower which is currently unfolding as Double Three Structure which reached the equal legs area $52 – $50 from where buyers are expected to show up to resume the rally within the main bullish trend or provide a 3 waves bounce at least.

KO Daily Chart 11.3.2019

The above blue box is a High-frequency area where the stock is likely to end the cycle because it’s a zone used as a hedging area where buyers and sellers agrees on a technical reaction to take place from there allowing the stock to turn . Therefore, as long as the trend remains intact and more importantly $44 low is holding then KO will find support and bounce to the upside.

If the expected bounce fail to break to new highs, the stock can still do a 7 swings correction from September peak and find another extreme area later on at lower level before buyers would step in again for another chance to buy it.

KO Daily Chart Double Correction

In Conclusion, KO bullish cycle should remain intact as long as February low is holding and buyers are looking to remain in control because the stock is doing a corrective decline which is expected to presenting buying opportunities before resuming the move to the upside.