Kirkland Lake Gold Ltd. (NYSE: KL) is gold mining growing company with highly productive yet low-cost mining operations in Canada and Australia.

On October 9, Kirkland Lake announced record production for its third quarter of 2019. President and CEO Tony Makuch said, “Q3 2019 was our best quarter to date driven by exceptional results at Fosterville and a solid quarter of performance at Macassa.” It posted record cash flows and net earnings per share for Q3 2019. The company credits strong production growth and better unit costs.

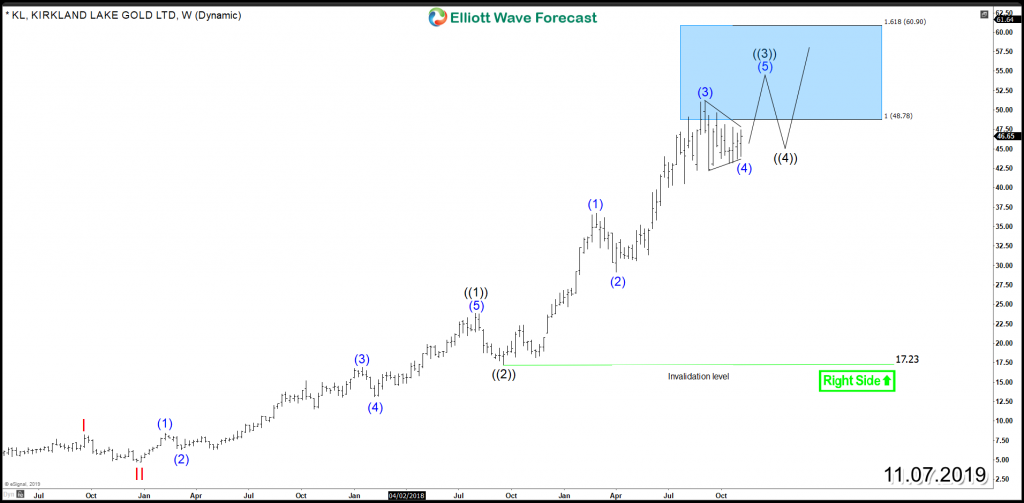

Since IPO, KL traded higher within an impulsive Elliott Wave structure which is still in progress within the 3rd wave as cycle from 2016 low has an incomplete number of swings. Currently, the stock reached equal legs area $48.78 – $60.90 from September 2018 low and it’s expected to end wave (3) of III around that area followed by a 3 waves pullback before resuming the upside.

KL has been trading within a sideways range in the recent 2 month and after the good Earnings report it has the potential of breaking higher toward target area $53 – $56 as long as $43 low is holding. If it fails to break higher, then wave (3) could be already in place and Kl can do a double three correction lower toward equal legs area $40.8 – $38.6 before buyers show up again for 3 waves bounce at least. Consequently, traders can look for buying opportunities during pullbacks in 3 or 7 swings as the overall picture for the stock remain supported within a bullish trend.

KL Weekly Chart 11.07.2019