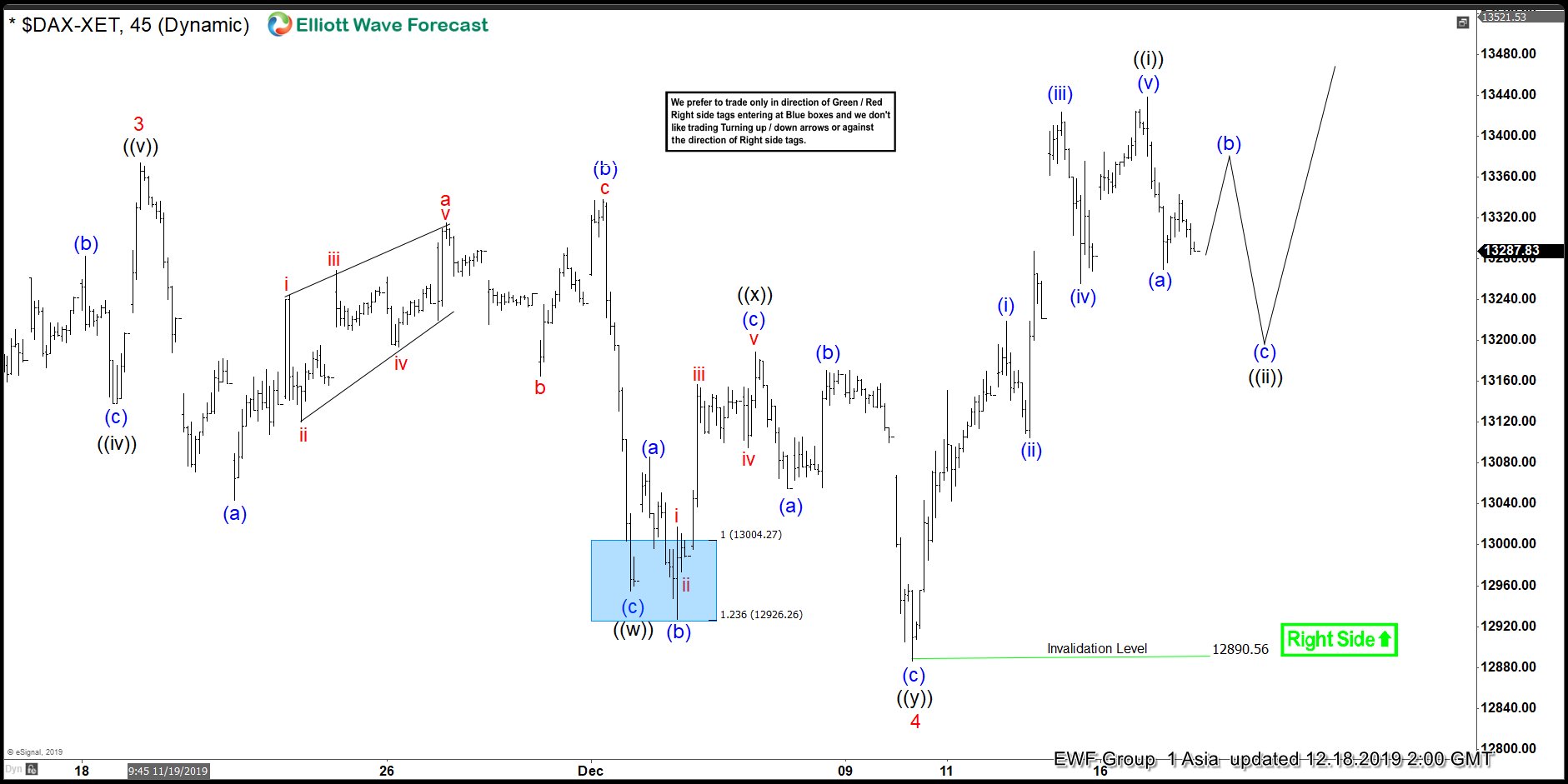

Elliott Wave view in DAX suggests that Index shows an incomplete bullish sequence from December 27, 2018 low favoring more upside. On the 1 hour chart below, we can see the rally to 13374.27 ended wave 3 and the pullback to 12890.56 on December 10, 2019 low ended wave 4. The Index has resumed higher in wave 5 with internal subdivision as a 5 waves Elliott wave impulsive structure. Up from 12/10/2019 low, wave (i) ended at 13219.03 and wave (ii) pullback ended at 13124.24. Index then extended higher in wave (iii) towards 13423.41 and wave (iv) pullback ended at 13255.55. The final leg wave (v) is proposed complete at 13407.66 and this ends wave ((i)) of 5 in larger degree.

Expect Index to pullback in wave ((ii)) to correct the cycle from December 10, 2019 low before the rally resumes. We don’t like selling the pullback. As far as pivot at 12890.56 low stays intact, dips should continue to find support in the sequence of 3, 7, or 11 swing. Potential target higher is 100% – 123.6% Fibonacci extension from December 27, 2018 low which comes at 13640 – 14204 area.

DAX 1 Hour Elliott Wave Chart