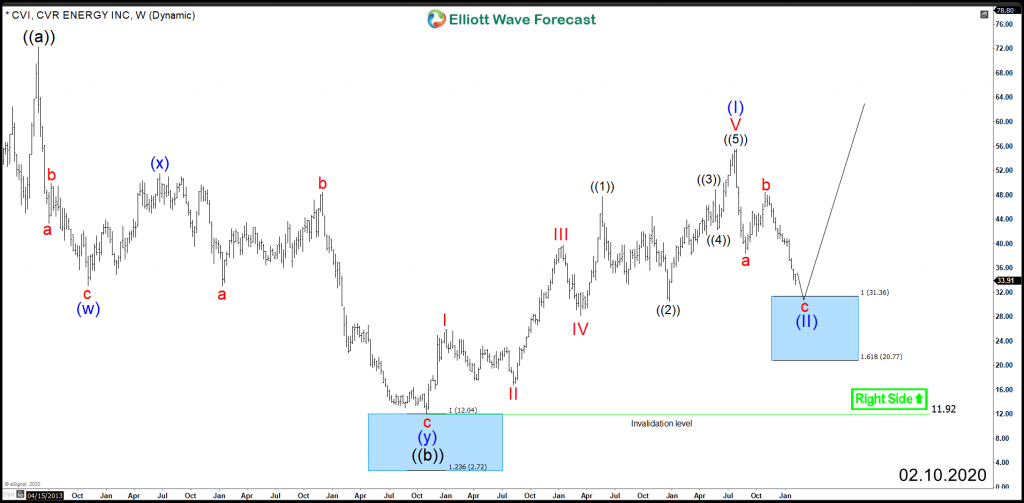

CVR Energy (NYSE:CVI) lost almost 40% of it’s value since July of last year, as the stock started correcting the impulsive 5 waves advance from 2016 low.

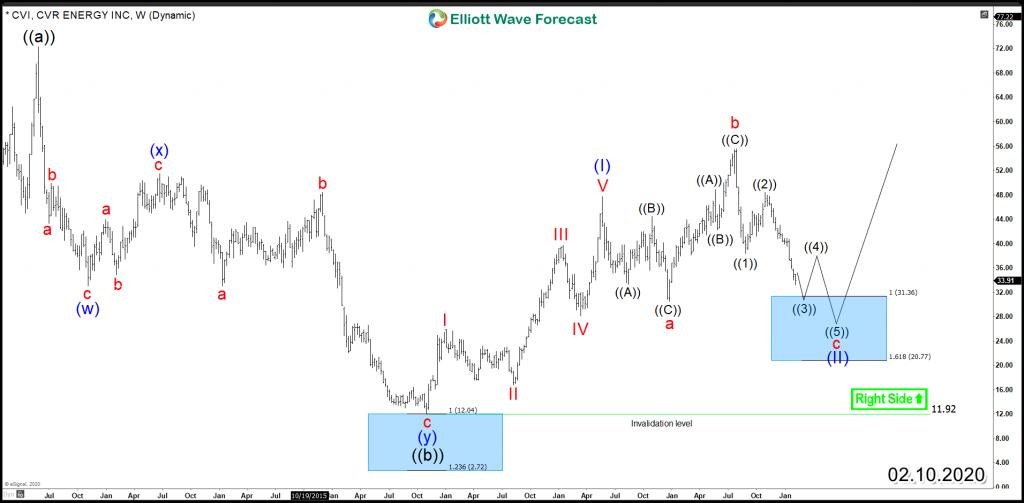

The correction taking place is unfolding as 3 waves Zigzag structure which can ideally find support at equal legs area $31.36 – $20.77 from where a reaction higher is expected to take place. However if the bounce fail and another leg lower takes place then the move could turns out to be a corrective Flat structure and the decline from 2019 peak is a wave ” c “.

In both scenarios, CVI is expected to end the correction and find support for the coming few months as a bounce is expected to take place in #energy sector based on correlation with related instruments like Chevron , EQT Corporation and Crude Oil .

CVI Weekly Chart

CVI Flat Scenario

The presented blue box in the above charts is a High-frequency area where the Market is likely to end cycle and make a at least a 3 waves bounce to allow investors to create a risk free position. Consequently, until the stock manage to break above July 2019 peak, it can still do a 7 or 11 swings correction lower before ending wave (II).