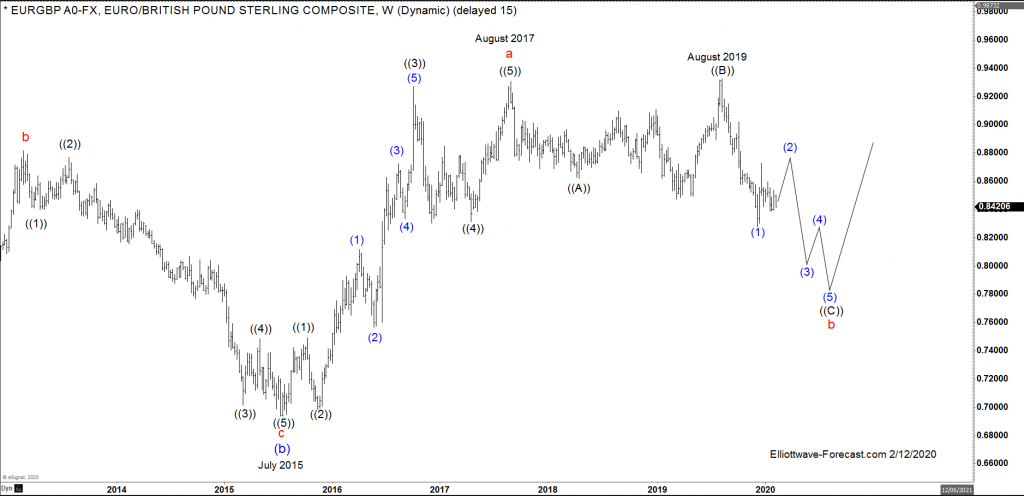

$EURGBP FX Pair Longer Term Cycles and Elliott Wave

Firstly as seen on the monthly chart below there is data back to January 1975 in the pair. The EUR part being derived from the German Deutsche Mark up until the point EURUSD currency existed.

Secondly as seen on the monthly chart below I will describe how I think the pair has risen thus far & what can be seen in the future. You can see the bounce from the February 1981 lows appears to be 3 swings to the November 1995 highs. There are usually a few counts that can be valid. This move appears to be a double three. I prefer to use momentum indicators to show when a cycle ends from any point in time. Whenever a proposed wave two, B, X or wave four of any degree has been taken by the momentum indicator it is likely it has ended that cycle whether it is up or down.

The analysis continues below the monthly chart.

From the November 1995 highs the pair declined hard enough to the May 2000 lows to suggest it was correcting the cycle from the February 1981 lows. The pair has not made another low since then. From the May 2000 lows it made another high in December 2008. From there it declined until July 2015 hard enough to suggest it was correcting the cycle up from the February 1981 low. That suggests the move from the February 1981 low to the December 2008 high was of three swings. The aforementioned December 2008 to July 2015 lows move appears to have been another typical three swings.

The analysis and Elliott Wave part of this continues below the weekly chart.

Thirdly and in conclusion. From the July 2015 lows it made a relatively clean five waves impulse higher to the August 2017 highs. The pullback from there thus far is in three waves however it has another high in August 2019. The momentum indicators suggest this pullback is correcting the cycle from the July 2015 lows as a flat before it turns back higher. This is a wave ((C)) which is an impulse. Unfortunately due to the nature of an impulse wave they can extend in any degree. This makes the area expected to reach difficult to forecast. As of right now I would assume it can reach the .7850-.7500 area before the pair turns back higher above the August 2017 highs firstly then later the December 2008 highs.