Bristol-Myers Squibb (NYSE: BMY) is an American pharmaceutical company which manufactures prescription pharmaceuticals and biologics in several therapeutic areas with particular success in cardiovascular treatments.

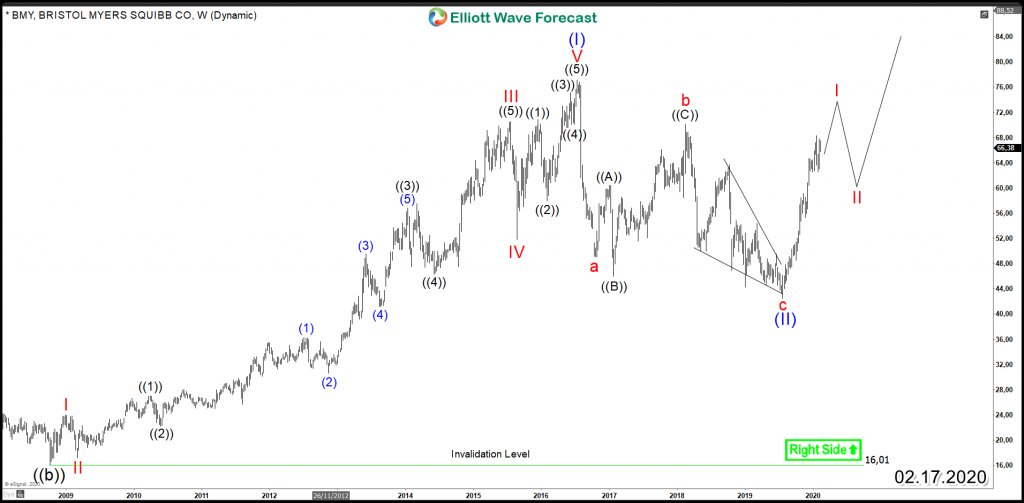

Since 2008, BMY established an impulsive rally taking the stock to new all time highs after it managed to break above 1999 peak which opened a multi-year bullish sequence. The cycle lasted for 8 year before it finally ended in 2016 and started a 3 years correction.

Based on the Elliott Wave Theory , after five waves takes place, a three waves pullback follows. The stock turned lower and did a Zigzag structure lower until 07.23.2019, as we show in the following chart.

BMY Weekly Chart

Up from there, BMY started to rally within a new impulsive structure suggesting the end of the correction and the resuming of the main trend which is bullish. Consequently, the stock is expected to remain supported during short term pullbacks against $42.48 and will be aiming for a break above $77.12 which will open a new weekly bullish sequence aiming for a target at equal legs area $103 – $118.