Beyond Meat Inc (NASDAQ: BYND) is a producer of plant-based meat substitutes including products designed to simulate chicken, beef, and pork sausage.

After IPO, BYND surged 250% for 3 months then it came down erasing all gains and settling around 15% on December 2019. Last month, the stock soared 46% looking to start a new cycle similar to last year. So let’s take a look at the Elliott Wave Structure for the stock.

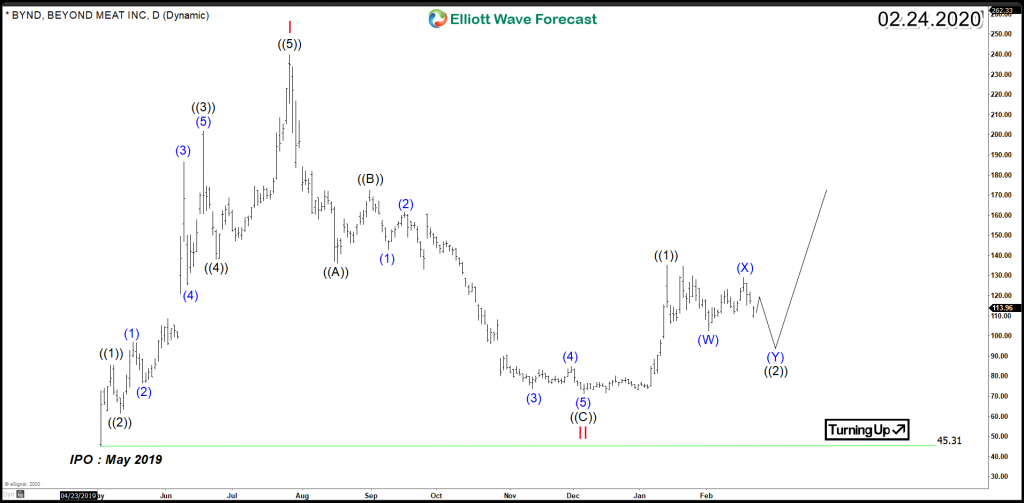

The initial rally from May 2019 low unfolded as an impulsive 5 waves advance establishing the main bullish trend which reached a high of $245.9 before that cycle ended. Based on Elliott Wave Theory , after the 5 waves advance, a 3 waves pullback would follow and that’s exactly what took place as BYND started a corrective 3 waves Zigzag Structure which ended on December 2019 at $71.3.

Up from there, BYND started another impulsive advance looking to resume the rally within the main trend which was established last year, therefore current correction is expected to remain supported above $71.3 low for the stock to rally higher and aim for a potential new all time highs. Currently, BYND can be looking for a 7 swings corrective structure to take it lower toward equal legs area $96 – $88 from where buyers are expected to show up for the stock to resume the rally higher or bounce in 3 waves at least.