Kirkland Lake Gold Ltd. (NYSE: KL) is gold mining growing company with highly productive yet low-cost mining operations in Canada and Australia.

Last month, the company reported its revenue in Q4 2019 totaled $412 million, 47% higher than Q4 2018 and an 8% increase from the previous quarter. On a year-over-year basis, both higher gold sales and an increase in gold price contributed to about half of the $132 million increase in revenue. The overall fundamental picture is looking healthy and if the technical overview is alignment with this idea then it would drive investors to buy the stock.

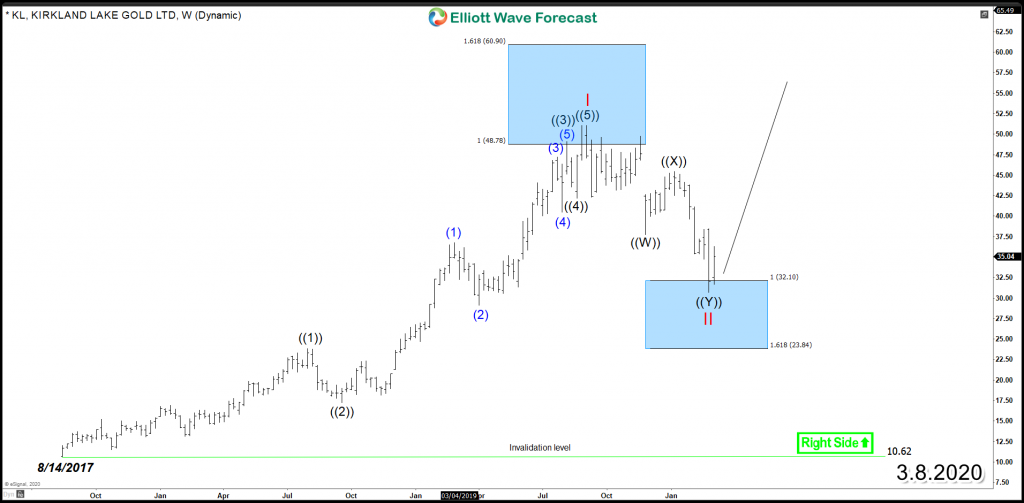

Since IPO, KL traded higher within an impulsive Elliott Wave structure which reached equal legs area $48.7 – $60.9 from September 2018 low where it ended 5 waves advance then started correcting the previous cycle in 3 swings.

Down from September 2019 peak, KL ended up doing a double three correction lower toward equal legs area $32.1 – $23.84 where buyers showed up again looking for 3 waves bounce at least. Up from there, it has the potential to rally higher and break to new all time highs which would open a bullish sequence for the stock with a minimum target at extreme area $71 – $80 . Consequently, traders can look for buying opportunities during pullbacks in 3 or 7 swings as the overall picture for the stock remain supported within a bullish trend.

KL Weekly Chart 3.8.2020