Teladoc Health (NYSE: TDOC) is a multinational telemedicine and virtual healthcare company based in the United States. It offers an app-based medical consultations which present a safer solution for patient during the current pandemic conditions.

The stock is obviously offering better options for investors compared to regular times as online services are getting a higher demand since last month. TDOC is still up 64% this year despite the majority of stock market being down an average of 25%.

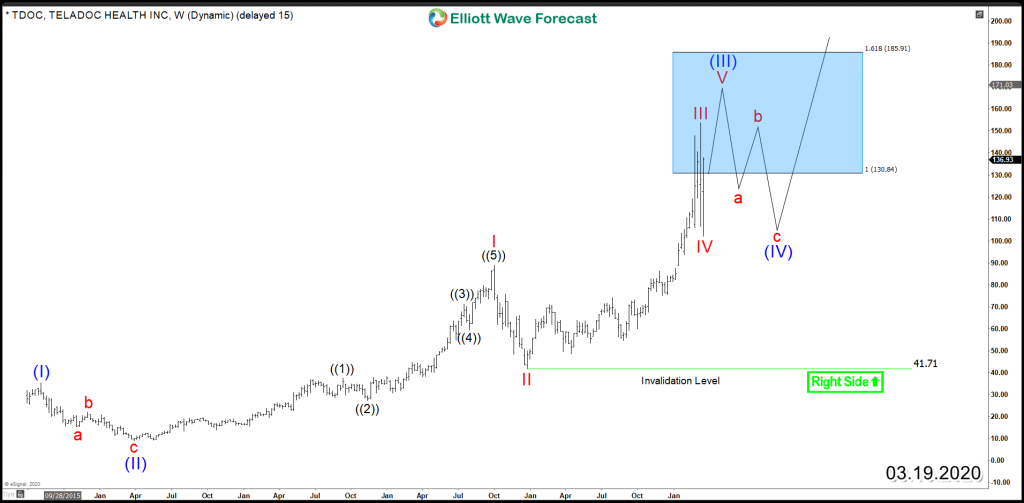

Taking a look at the Elliott Wave structure for the stock, we can notice that TDOC is currently still trading within an impulsive cycle since IPO and it’s in the process of ending a 5 waves advance from 2016 low within wave (III) which already reached the target area at 100% Fibonacci extension level 121.52 and still can see 161,8% Fib Ext area at $170.8 before a larger 3 waves pullback takes place in wave (IV). The blue box presented in our chart is a High-frequency area where the instrument is likely to end cycle and make a turn as traders tend to take profits within that area.

Consequently, Investors should be still looking for buying opportunity during the next daily correction because of the impulsive bullish nature of the the cycle which will present investment opportunity in the future when the stock corrects in 3 or 7 swings after ending the current 5 waves advance.

TDOC Weekly Chart