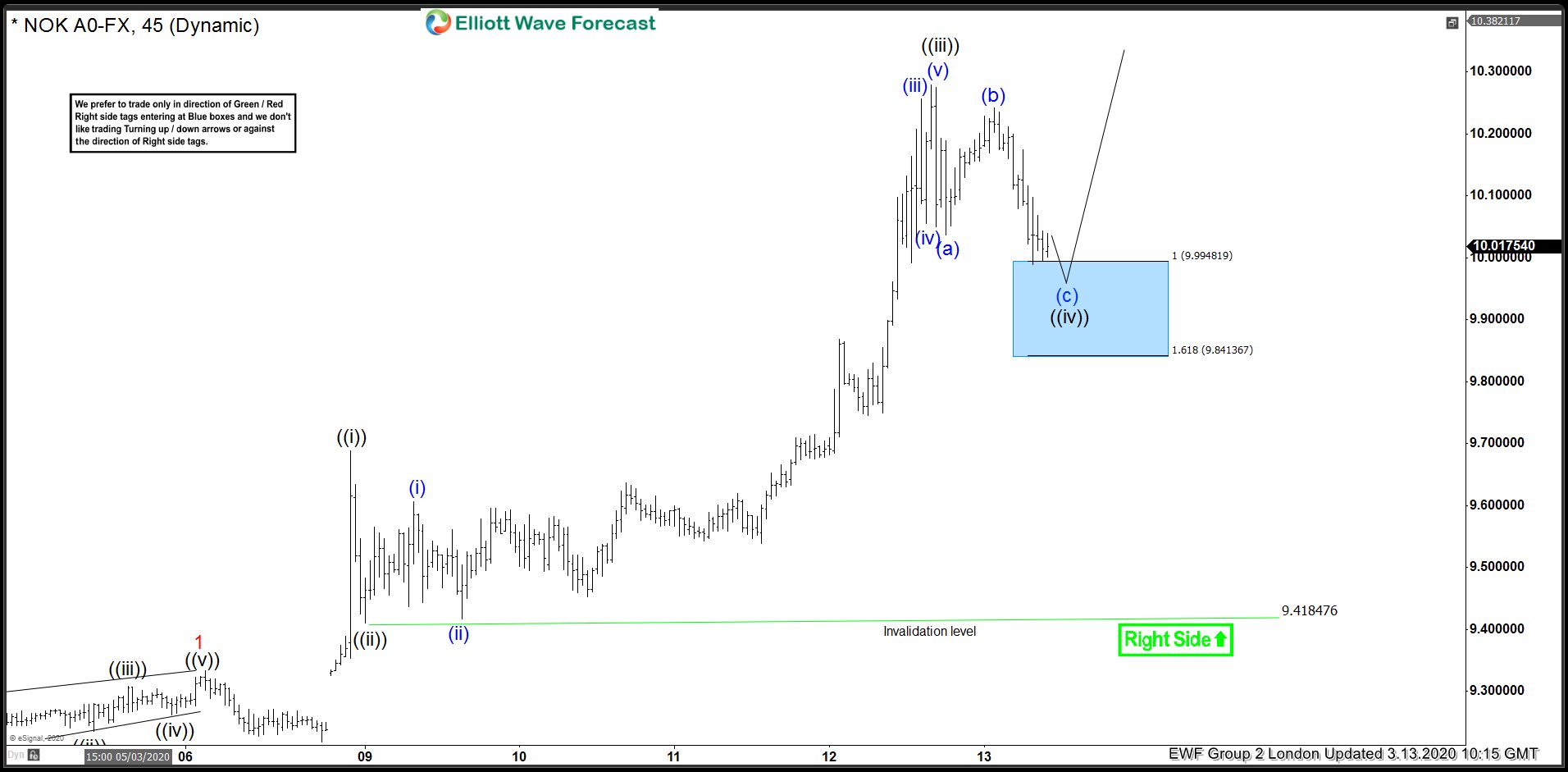

In this blog, we are going to take a look at the Elliottwave chart of USDNOK. The chart from March 13 London update shows that the cycle from March 9, 2020 low unfolded as 5 waves impulsive structure. The rally in wave ((iii)) ended at 10.2785 high. Based on Elliottwave theory, a 3 waves pullback should happen before the rally to the upside resume. While above 9.4185 low, the pullback in 3,7, or 11 swings is expected to find support. Wave ((iv)) pullback unfolded as a zig-zag. The 100% extension of wave (a)-(b) where wave (c) can end is at 9.8413 -9.9948 area. We showed this area with a blue box. The blue box is the area where we expect buyers to appear for an extension higher or 3 waves bounce at least.

USDNOK 3.13.2020 1 Hour London Elliott Wave Update

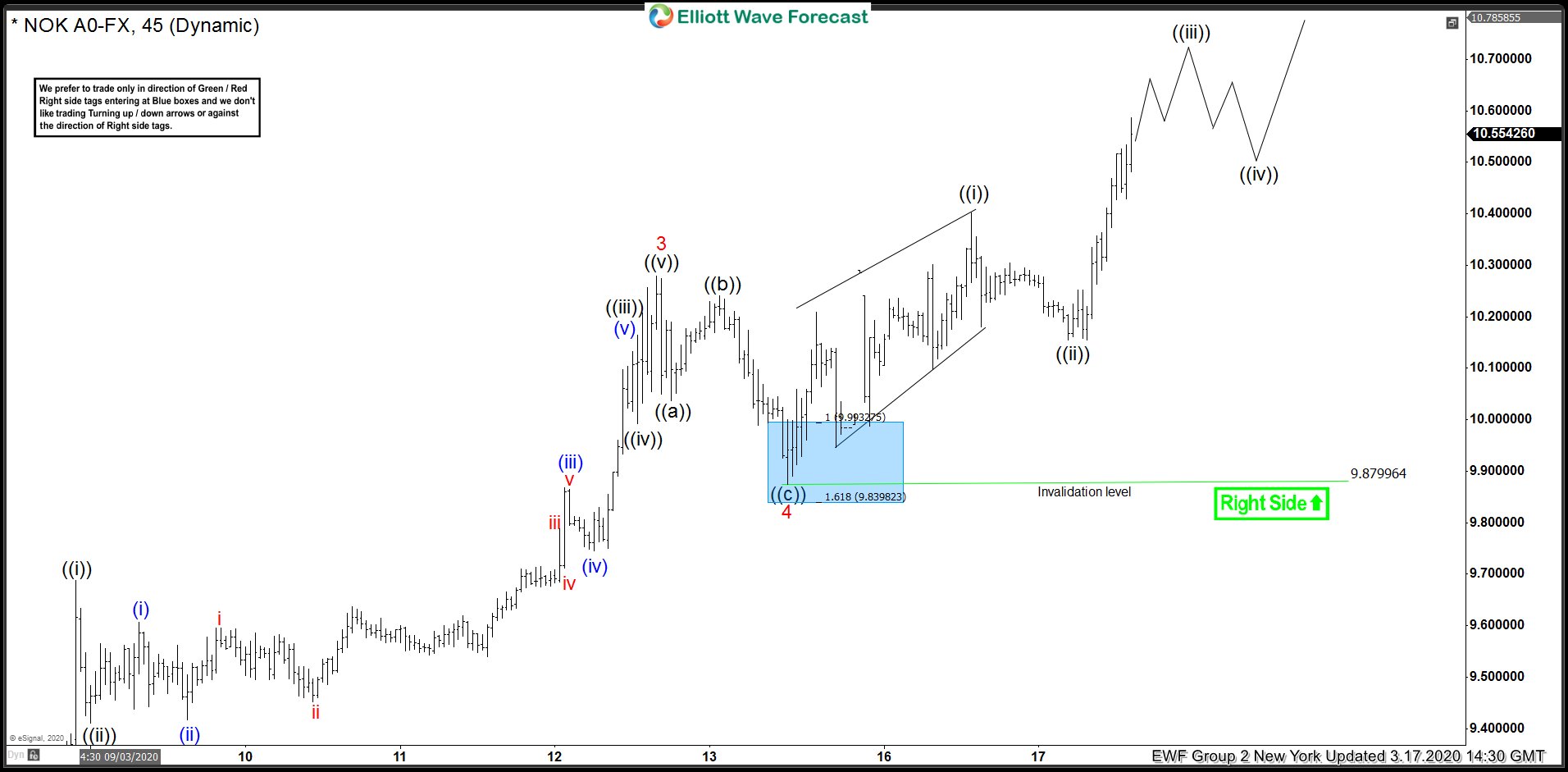

We adjusted the count on the chart below from March 17 NY update. Instead of wave ((iv)), the pullback is within wave 4. However, the chart shows that the pair found buyers within the blue box and ended the pullback at 9.8799 low. From there, the pair extended higher and broke above previous wave 3 high, confirming that the next rally higher has started. As long as the pivot at 9.8799 low stays intact, the pair can continue to extend higher.

USDNOK 3.17.2020 1 Hour New York Elliott Wave Update

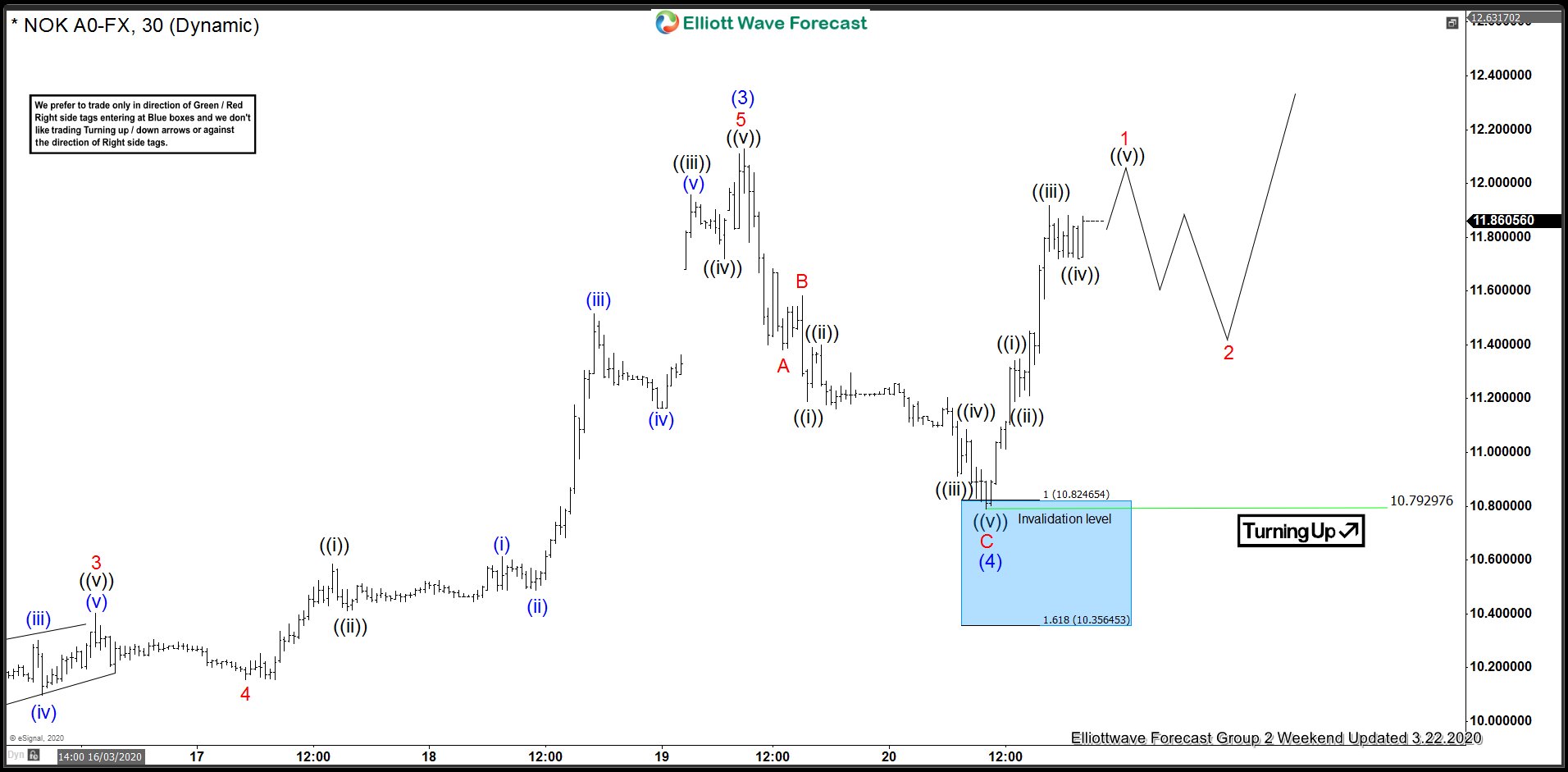

The chart from March 20 London update shows that USDNOK extended higher and ended wave (3) at 12.1283 high. The pair then did a bigger pullback in wave (4). This pullback unfolded as another zig-zag. The 100% extension of wave A-B is showed with a blue box between 10.3538-10.8245 area. As long as the 1.618 extension level stays intact, the pair is expected to find support in the blue box area.

USDNOK 3.20.2020 1 Hour London Elliott Wave Update

Chart update from March 22 weekend update shows that buyers continue to respect the blue box area. Wave (4) pullback ended within the blue box at 10.7929 low and bounced higher from there. While above 10.7929 low, the pair can continue to extend higher in wave (5) and make new highs. However, USDNOK needs to break above previous wave (3) high at 12.1283 high to confirm that the next leg higher is in progress and to avoid doing a double correction in wave (4).

USDNOK 3.22.2020 1 Hour Weekend Elliott Wave Update