Everbridge (NASDAQ: EVBG) is a company that sells communications services for notifications of emergencies. It helps businesses and governments respond to crises and threats like network outages, terrorism, active shooters, and severe weather.

During the current pandemic, Everbridge’s service demand rose significantly which supported its stock price to rally to new all timer highs breaking above 2019 peak. The move higher was important for the weekly cycle as it allowed the stock to create a new bullish sequence from IPO low.

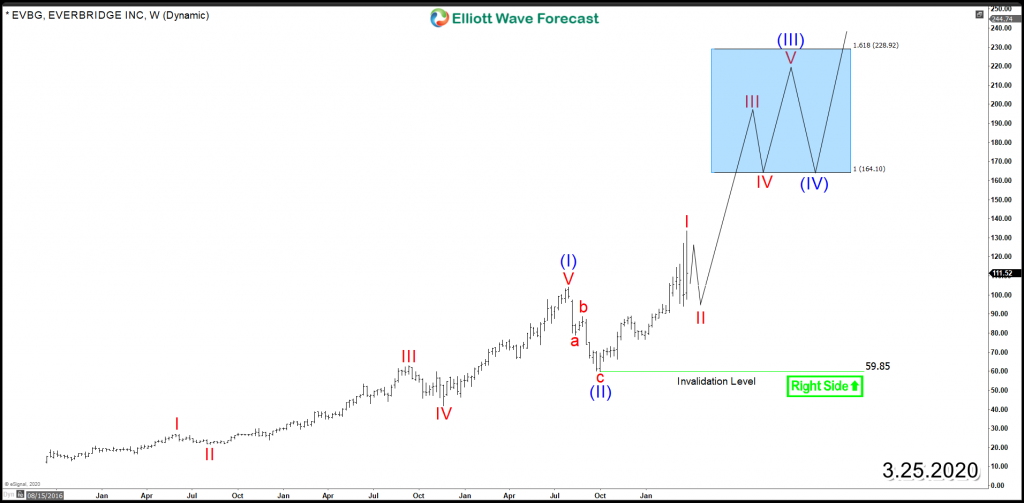

The Initial rally from 2016 unfolded as an impulsive 5 waves advance which reached a peak at $104.2 in August of last year. Down from there, a correction in a 3 waves Zigzag structure took place which managed to find buyers at extreme blue box area $64 – $49 from where it managed to resume the rally within the main bullish cycle.

EVBG rallied more than 100% from September 2019 low and established a new cycle to the upside with a target at equal legs area $164 – $228. Consequently, the pullbacks at this stage is expected to remain supported and find buyers within corrective structures in 3, 7 or 11 swings against $59.85 low.

EVBG Daily Chart

EVBG Weekly Chart