In this technical blog, we are going to take a look at the past performance of 1 hour Elliott Wave Charts of Sugar, which we presented to members at elliottwave-forecast. In which, the decline from February 2020 peak, showed the lower low sequence in an impulse structure favored more downside to take place.

But before further digging into the Charts, we need to understand the market nature first. The market always runs between the two sides i.e Buying or Selling. We at Elliott Wave Forecast understand the Market Nature and always recommend trading the no enemy areas. Those areas are reflected as the blue box areas on our charts. They usually give us the reaction in favor of market direction in 3 swings at least. Now, let us take a quick look at the Sugar 1 Hour Charts and structure below:

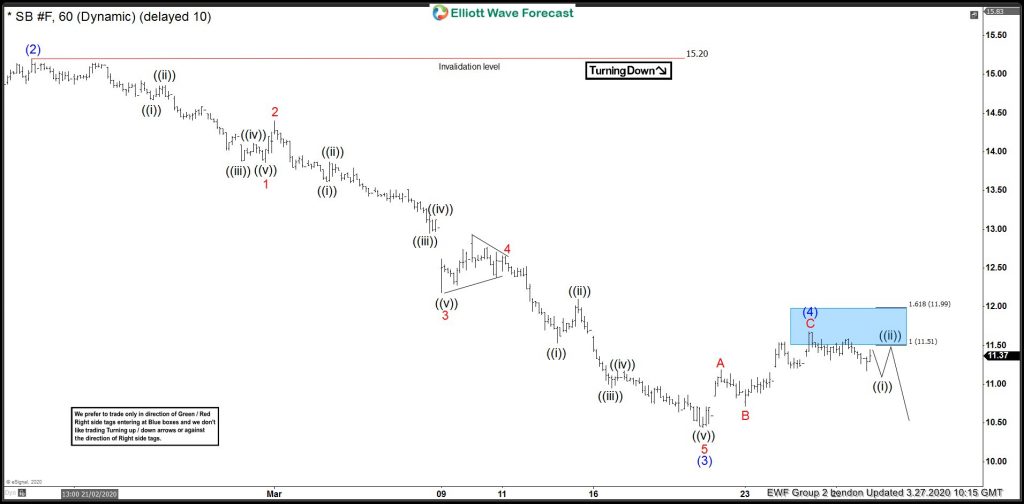

Sugar 1 Hour Elliott Wave Chart

Sugar 1 Hour Elliott Wave Chart from 3/27/2020 London update. In which, the instrument is showing an impulse decline where wave (2) ended at $15.20 high. Down from there, wave (3) unfolded in a lesser degree 5 wave structure where wave 1 ended at $13.86 low. Wave 2 ended at $14.40, wave 3 ended at $12.18, wave 4 ended at $12.65 and wave 5 ended at $10.44 low. Up from there, the Sugar made a 3 wave bounce in wave (4). The internals of that bounce unfolded as a zigzag structure where wave A ended at $11.19. Wave B ended at $10.72 low and wave C ended at $11.68 high. After seeing sellers at the blue box area i.e $11.51-$11.99 100%-161.8% Fibonacci extension area of A-B. From there, Sugar was expected to resume lower or to do a 3 wave reaction lower at least.

Sugar Latest 1 Hour Elliott Wave Chart

Here’s the Latest 1 Hour Chart of Sugar from 4/02/2020 Asia update. In which, the instrument is showing reaction lower from the blue box area. Allowed members to create a risk-free position shortly after taking the short positions.