RingCentral Inc (NYSE: RNG) is an American publicly traded provider of cloud-based communications and collaboration solutions for businesses. The company is considered the leader in Unified Communications as a Service in terms of revenue and subscriber seats. Its solutions can be used in multiple devices including Smartphones Tablets PCs and Desk Phones which allow communication across multiple channels.

RingCentral’s platform was already gaining momentum before the Corona Virus crisis, it made communications portability even more essential. the result was reflected on its stock as RNG defied the market’s plunge through the first quarter of the year, closing out with positive returns (+22%).

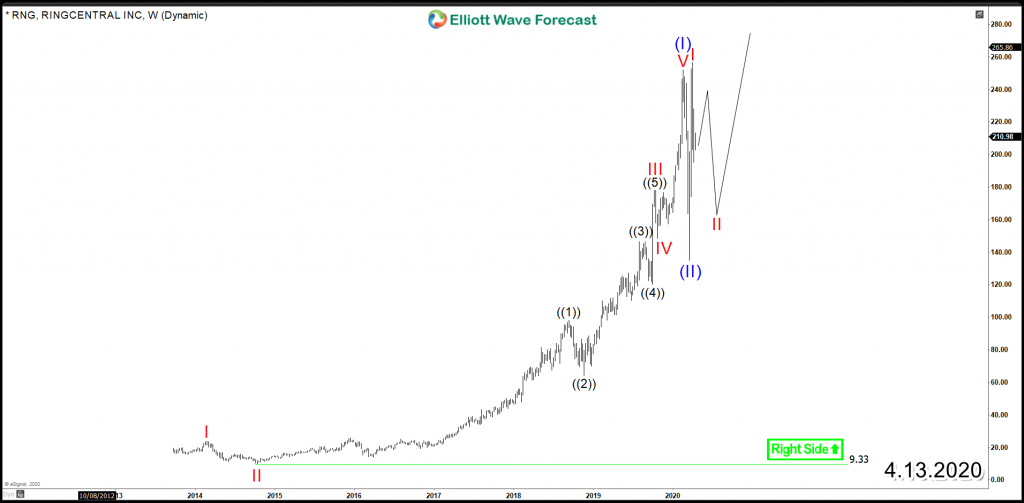

Since IPO, RNG rallied higher within an impulsive Elliott Wave structure which establish the initial bullish cycle unfolding as a 5 waves advance that ended at $252 peak. Down from there, the stock corrected the entire cycle with a quick drop last 2 months before again resuming the rally within the main bullish cycle.

Last month, RNG managed to break to new wall time highs creating a new bullish sequence which will be aiming for a target at equal legs area $386 – $542. Therefore, the stock is expected to remain supported during current pullback above $134.8 low and find buyers after 3 or 7 swings correction which will allow buyers to look for opportunities to join the bullish trend.

RNG Weekly Chart