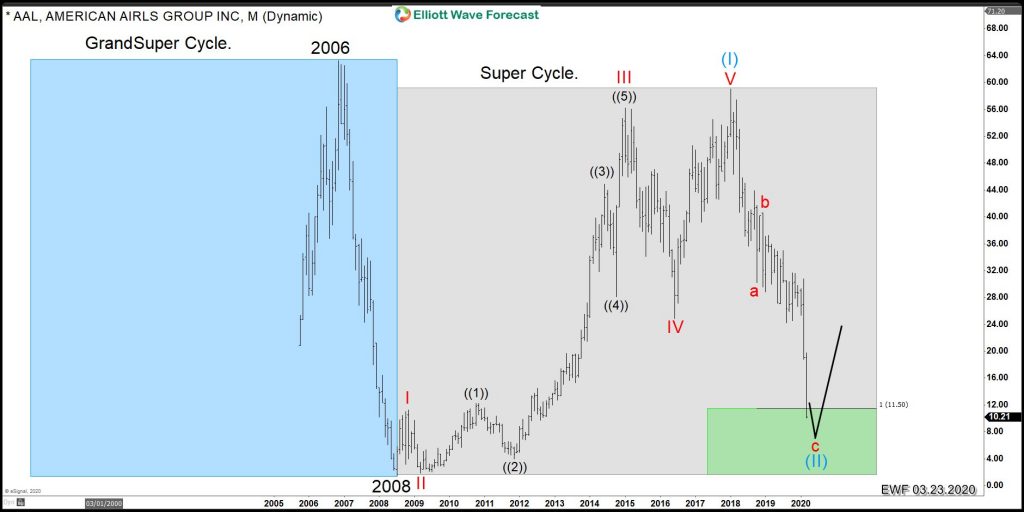

The Dow Jones Transportation Average ($TRAN) is a running average of the stock prices of twenty transportation companies with each stock’s price-weighted to adjust for stocks and other factors. As a result, it can change at any time the markets are open. The figure mentioned in news reports is usually the figure derived from the prices at the close of the market for the day. Some of the components of the Index like $AAL, $DAL among others have experienced huge declines to the point that $DAL is correcting Grand Super Cycle whereas $AAL is correcting Super Cycle degree as we are showing in the following chart:

AAL Correcting Super Cycle from 2008 low

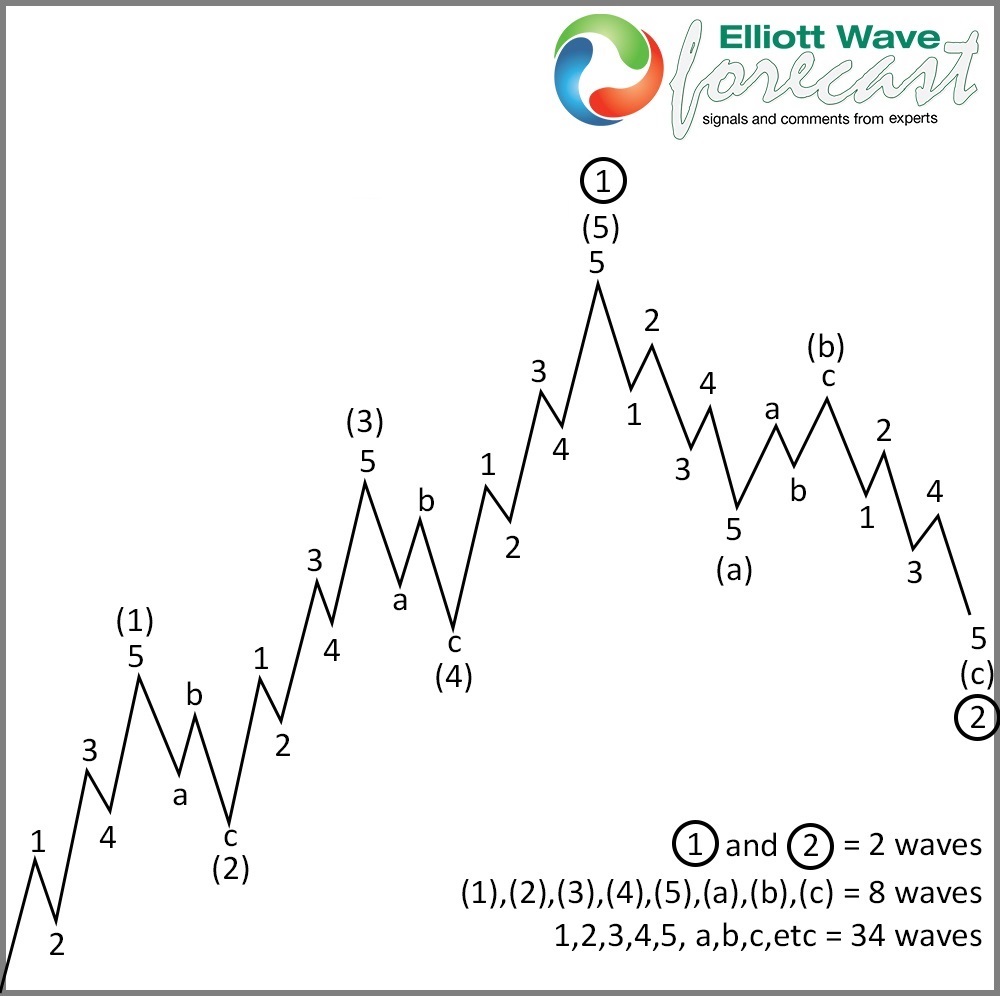

$AAL which is showing the huge dip and running out of space to the downside which means based on the current price, it is very difficult to see the stock make a big bounce and then do another leg lower similar to the one from February 2020 peak. Wave structure of the $TRAN Index is very similar to Indexes like $SPX, $SPY and $DOW, they all have an advance since the all-time lows which relates to a Super Cycle degree ending at 2000 and another Super Cycle starting at 2009 and ending at 2018. The Elliott wave theory proposes that the Market advances in five waves and corrects in three waves. The theory also explains the idea that one of the three advances in five waves within the higher degree five waves should be extended when compared to the other two. Figure below shows this concept:

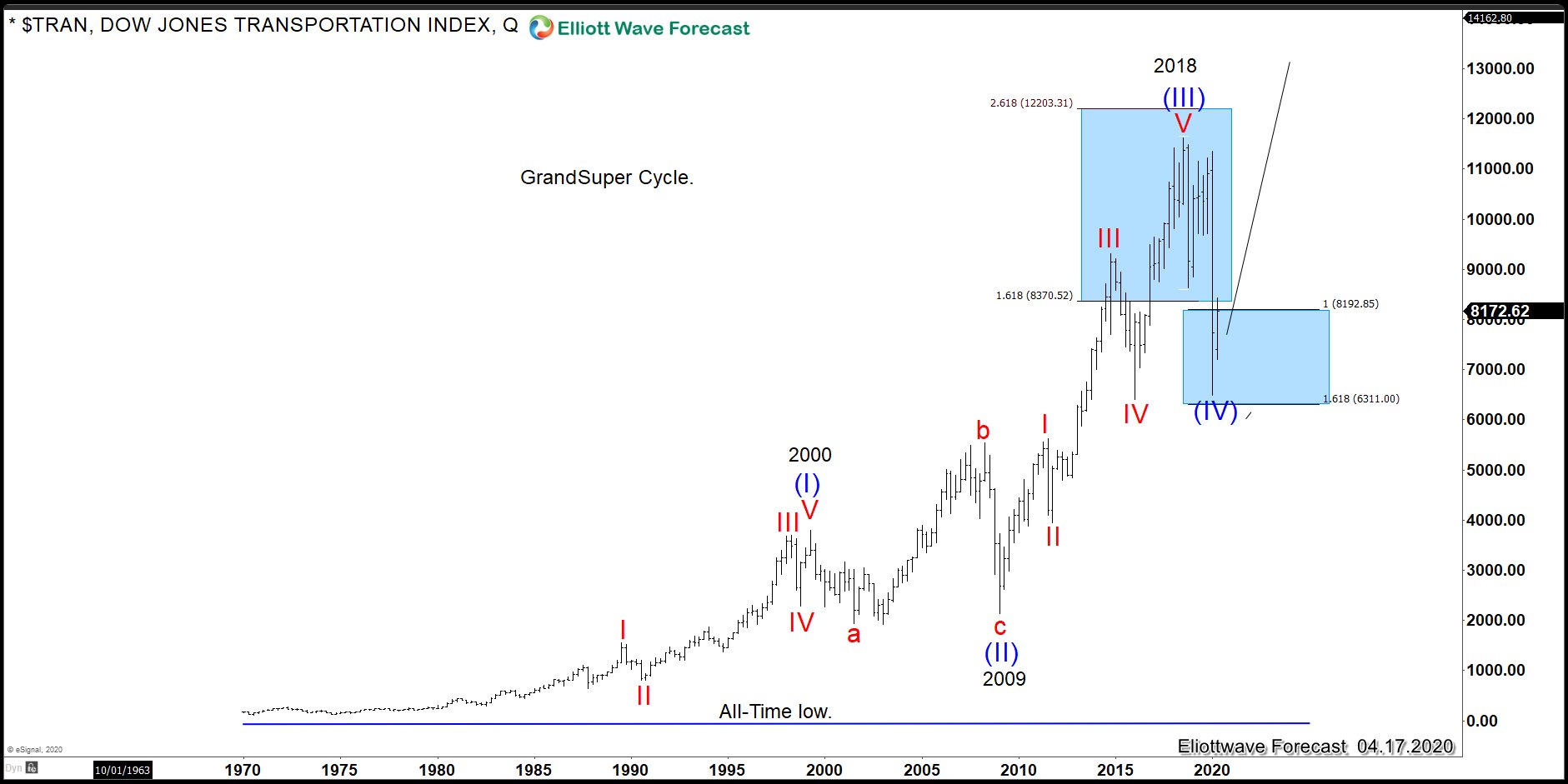

Above figure shows a classic Five waves advance with the subdivisions in which each one is a five waves advance and also shows the two corrective sets in the wave (II) and (IV). Back to the Dow Jones Transportation Index from the all-time lows, the advance is in three waves so far or three cycles, there are two impulses or five waves and one corrective. The cycle from all-time lows into 2000 is a clear five waves, also the advance since 2009 into the 2018 peak, but there is a huge clue which is the extension in wave (III), the way extensions are created is measuring the first leg from all-time lows into 2000 and placing at lows of 2009, we at Elliottwave-Forecast have our own guidelines and one of them is that the moment the extension passes the 161.8% of the previous relationship, we start to favour an impulse. Let’s take a look at the chart below.

The Dow Jones Transportation Average ($TRAN) Long-Term Elliott Wave View

Chart above shows the Grand Super Cycle with labels and also shows the extension relationship between the two cycles. It is very clear this is an impulse in the making and should be another five waves cycles at least to complete the Grand Super Cycle advance. The pullback from 2018 has developed in three waves which has already reached the Blue Box buying area. We believe the pull back ended up being a Flat Elliott wave correction which is a 3-3-5 structure and we believe the cycle ended, at least the one from 01.17.2020 confirming the Flat structure or three waves decline. The Index can not break 3.18.2020 low because then it will become a five waves decline from 2018 peak, which means it would then bounce and do another leg lower. As we mentioned above that scenario would only happen if last month’s low is broken. As of right now the Index is holding a Bullish Pattern which is three waves pullback after ending five waves advance since 2009 and more importantly after ending three waves higher with extension from the all time low.