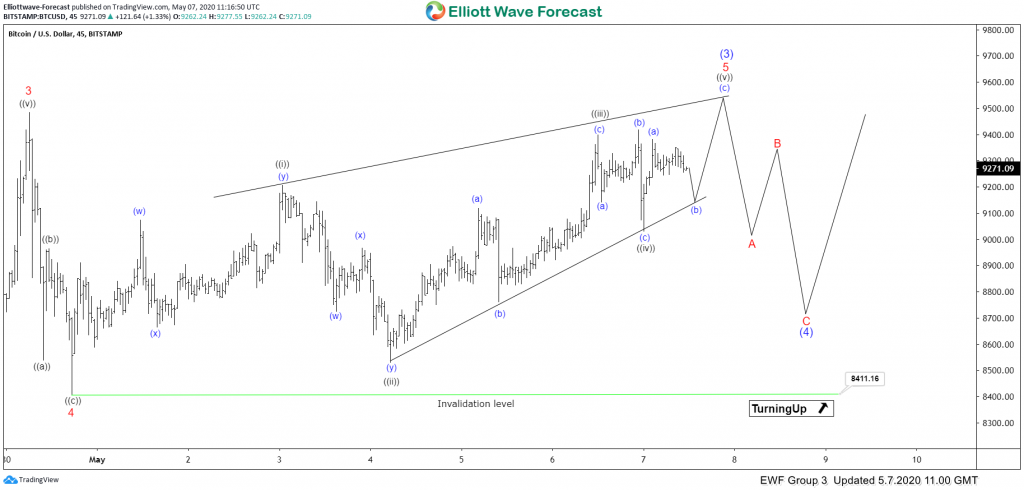

Rally in Bitcoin (BTCUSD) from April 16, 2020 low is unfolding as a 5 waves impulse Elliott Waves structure. Up from April 16 low, wave 1 ended at 7306.15 and pullback in wave 2 ended at 6757.75. The crypto currency then resumed higher in wave 3 towards 9485.26. Internal of wave 3 unfolded as another 5 waves impulse in lesser degree. Up from wave 2 low at 6757.75, wave ((i)) ended at 7193.13 and wave ((ii)) pullback ended at 7031.07. Wave ((iii)) ended at 9300, wave ((iv)) dips ended at 9011.77, and finally wave ((v)) of 3 ended at 9485.26.

Pullback in wave 4 is proposed complete at 8407. Bitcoin still needs to break above wave 3 at 9485.26 to avoid a double correction. Wave 5 remains in progress as an ending diagonal. Ending diagonal is a 5 waves structure with 3-3-3-3-3 subdivision and wedge shape. Unlike regular impulse, a diagonal can have an overlap between wave 1 and 4. In the chart below, we can see an ending diagonal with 3-3-3-3-3 structure, wedge shape and overlap between wave ((i)) and ((iv)). Expect wave 5 rally to end soon as an ending diagonal. This should also complete wave (3) in higher degree. Afterwards, Bitcoin should pullback in wave 4 to correct cycle from April 16 low before the rally resumes again.

Bitcoin 45 Minutes Elliott Wave Chart