$FXY Elliott Wave & Longer Term Cycles

Firstly the $FXY instrument inception date was 2/12/2007. The instrument tracks changes of the value of the Japanese Yen versus the US Dollar. There is plenty of data going back into the longer term 1970’s time frame available for the currency cross rate in the USDJPY. The foreign exchange pair shows a larger degree time frame low is in place in October 2011 at 75.57. Comparatively, the FXY instrument reflects a price high at 130.22 in October 2011.

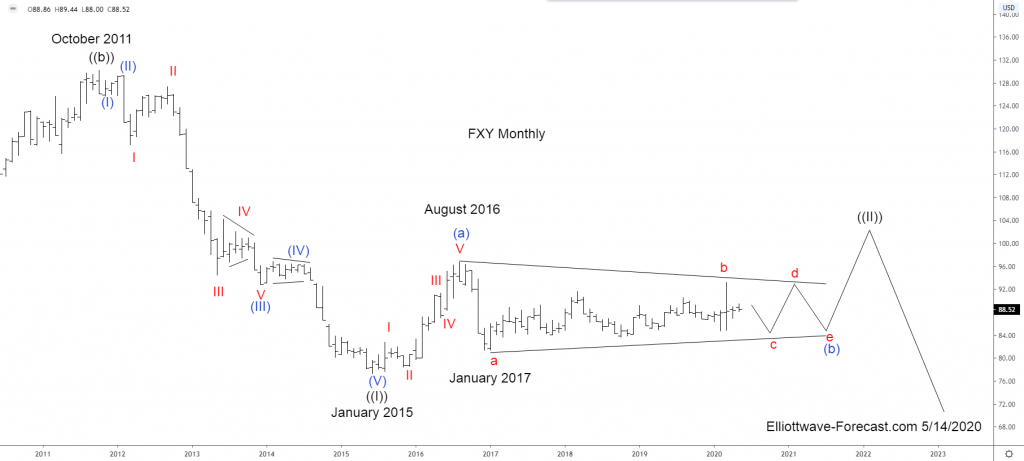

The analysis continues below the FXY Monthly chart.

Secondly the FXY instrument mirrors USDJPY price highs and lows inversely as the initial above paragraph suggests. In the FXY instrument the decline from the October 2011 high into the January 2015 lows is an Elliott wave impulse. Internally there are a couple of degrees shown there in the red & blue colors that finished the black wave ((I)). From the January 2015 lows the bounce higher in both price and momentum indicators suggested the cycle lower had ended there.

The analysis continues below the FXY Weekly chart.

In conclusion: As the FXY weekly chart suggests the instrument ended a larger degree cycle in an Elliott wave impulse of five waves lower in January 2015. The bounce from there is in five waves as well however of smaller degree in the wave (a) in blue that ended August 2016. The price action from there has been sideways and in three swing moves. Moreover this leaves the impression the instrument is in a triangle wave (b) in blue. That suggests price will be constricted for some time in between the red “a” 81.33 lows & “b” 93.23 highs. While this plays out with price remaining above the January 2017 lows the FXY can see a turn higher. It can reach the 100.87 – 105.51 area before the larger degree time frame bearish cycle takes over again taking prices substantially lower.