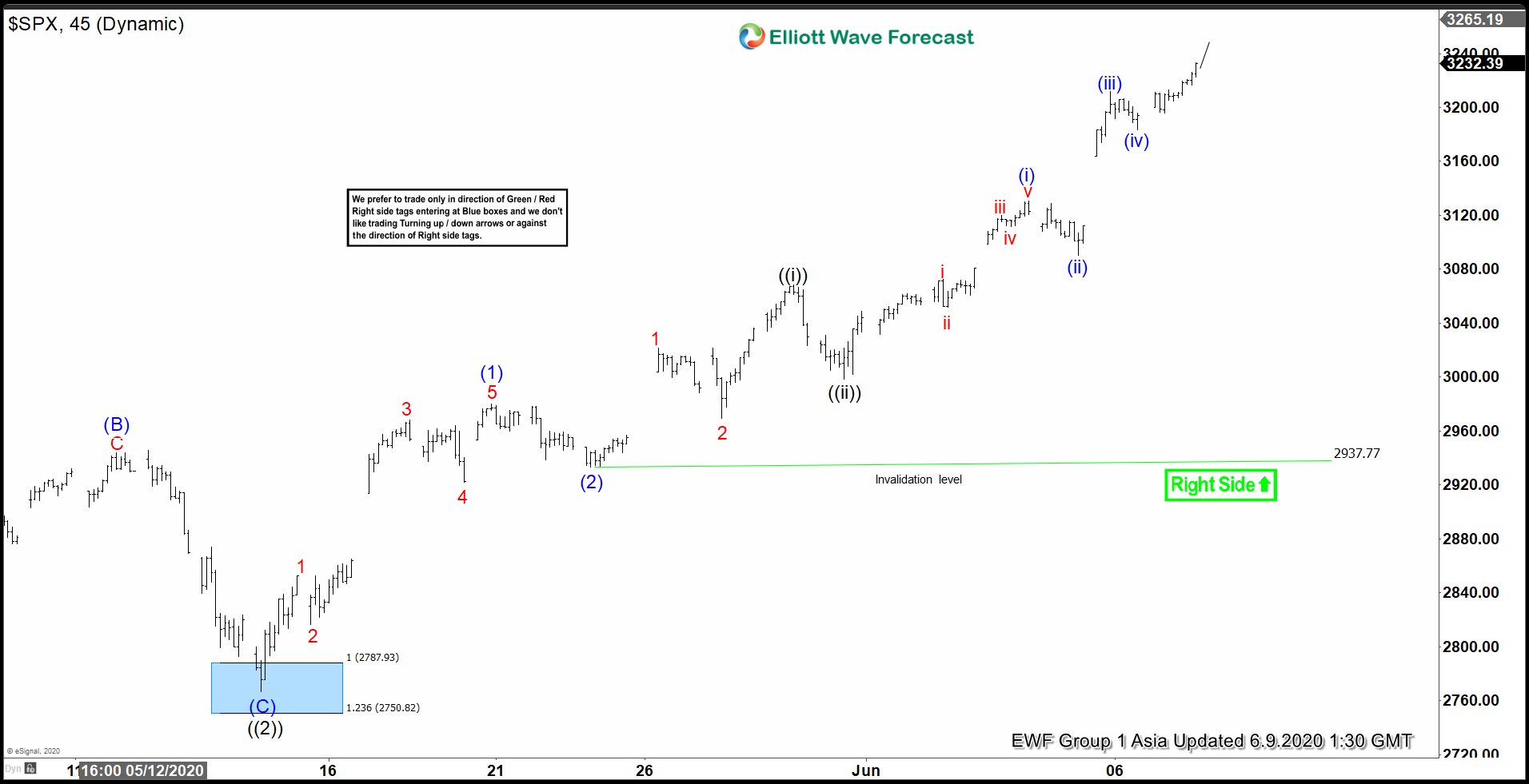

Incomplete bullish sequence in S&P 500 (SPX) from 3.23.2020 low suggests the Index should stay supported. Up from the Covid-19 selloff low on 3.23.2020, Index has resumed higher as a 5 waves Impulse Elliott Wave structure. Wave ((1)) ended at 2954.86 and pullback in wave ((2)) ended at 2766.64. Index has resumed higher in wave ((3)) with the internal as another 5 waves Impulse in lesser degree.

Up wave ((2)) low, wave (1) ended at 2968.09 and wave (2) dips ended at 2933.59. Index then resumes higher in wave (3) which subdivides in further 5 waves. Wave 1 of (3) ended at 3021.72 and wave 2 of (3) ended at 2969.75. Expect a few more highs to end wave 3 of (3), then Index should pullback in wave 4 of (3) before another leg higher to complete wave 5 of (3). Afterwards, it should see wave (4) dips followed by 1 more push higher to end wave (5) of ((3)).

Near term, while pullback stays above 2937.77, and more importantly above 2766.64, expect Index to extend higher. Potential target higher is 100% – 123.6% Fibonacci extension from 3.23.2020 low which comes at 3528.2 – 3707.9. As far as pivot at 2937.77 low stays intact, expect pullback to find support in 3, 7, or 11 swing for more upside.

SPX 45 Minutes Elliott Wave Chart