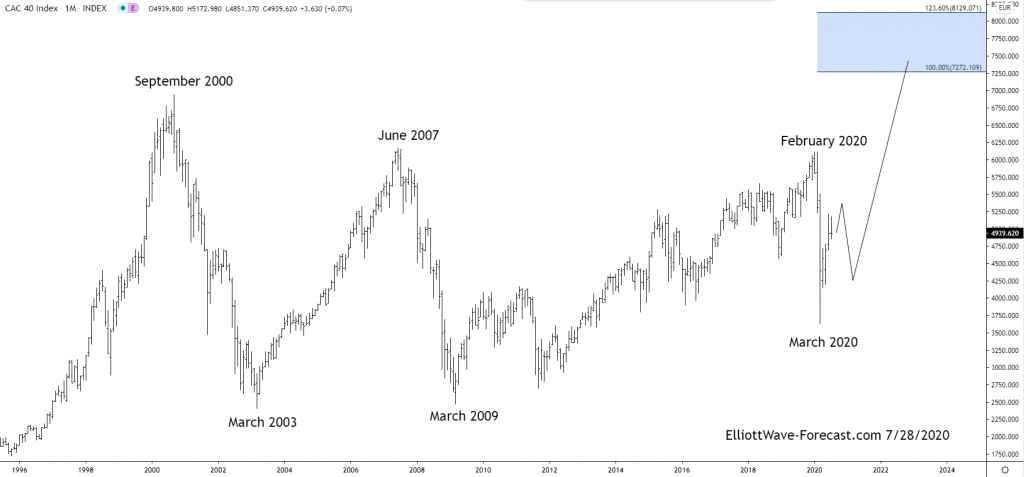

The Longer Term Bullish Cycles of the $CAC40

Firstly the CAC 40 index has been trending higher with other world indices where in September 2000 it put in an all time high. From there it followed the rest of the world indices lower into the March 2003 lows which was a larger degree pullback. From there the index rallied with other world indices again until June 2007. It then corrected that rally again as did most other world stock indices. It ended this larger degree correction in March 2009. From those 2009 lows, the index shows an incomplete swing sequence that favors further upside.

Secondly, in February 2020 the uptrend cycle from the March 2009 lows ended with the pullback into the March 2020 lows. While above there the next longer term target area is highlighted on the chart. The analysis continues below the chart.

$CAC40 Index Monthly Chart

The target extension areas are measured as per the following. Use a Fibonacci extension tool on a charting platform. On this chart, point 1 will be at the beginning of the cycle at the March 2009 lows. From there on up to the February 2020 highs will be point 2. The point 3 will be down at the March 2020 lows. The extension areas shown are the same as long as price remains above those March 2020 lows. As of now, the index appears to have an Elliott Wave impulse higher in progress toward say around the 5500 area before it corrects the cycle from the March 2020 lows. It should stay above there while continuing the trend higher.

Lastly in conclusion, the extension areas higher shown on the chart is where the index should be able to reach during this period of multiple world indices bullish trends higher.