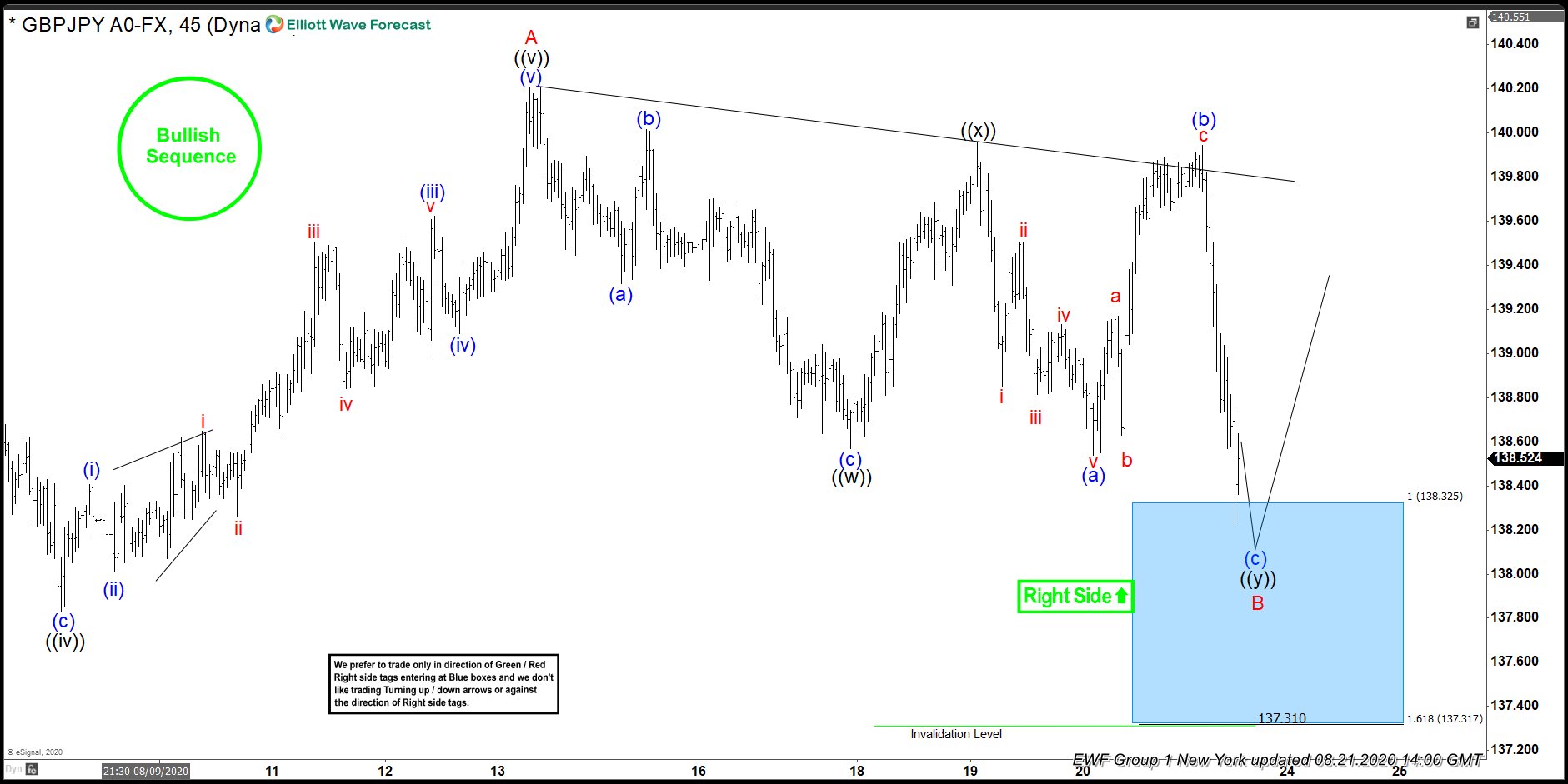

In this blog, we are going to take a look at the Elliott Wave chart of GBPJPY. The pair is showing a bullish sequence from March 18 low. Therefore, the dips in 3,7, or 11 swings are expected to continue to be supported for more upside. The 1 hour chart update from August 21 shows that the pair has ended the cycle from June 21 low as wave A at 140.20 high. The sub-waves of the rally unfolded as 5 waves impulsive structure. Elliott Wave theory dictates that 3 waves pullback should happen afterwards before the rally continues.

Pair then did a pullback in wave B, which unfolded as a double three correction. Down from wave A high, wave ((w)) ended at 138.57 low. The bounce in wave ((x)) ended at 139.95 high. The pair then declined lower in wave ((y)). The pullback reached the 100-161.8% extension of wave ((w))-((x)) at 137.31-138.32. That area is highlighted with a blue box. As long as 161.8% extension stays intact, expect pair to see 3 waves bounce at least or resume the rally higher from blue box.

GBPJPY 8.21.2020 1 Hour NY Elliott Wave Chart

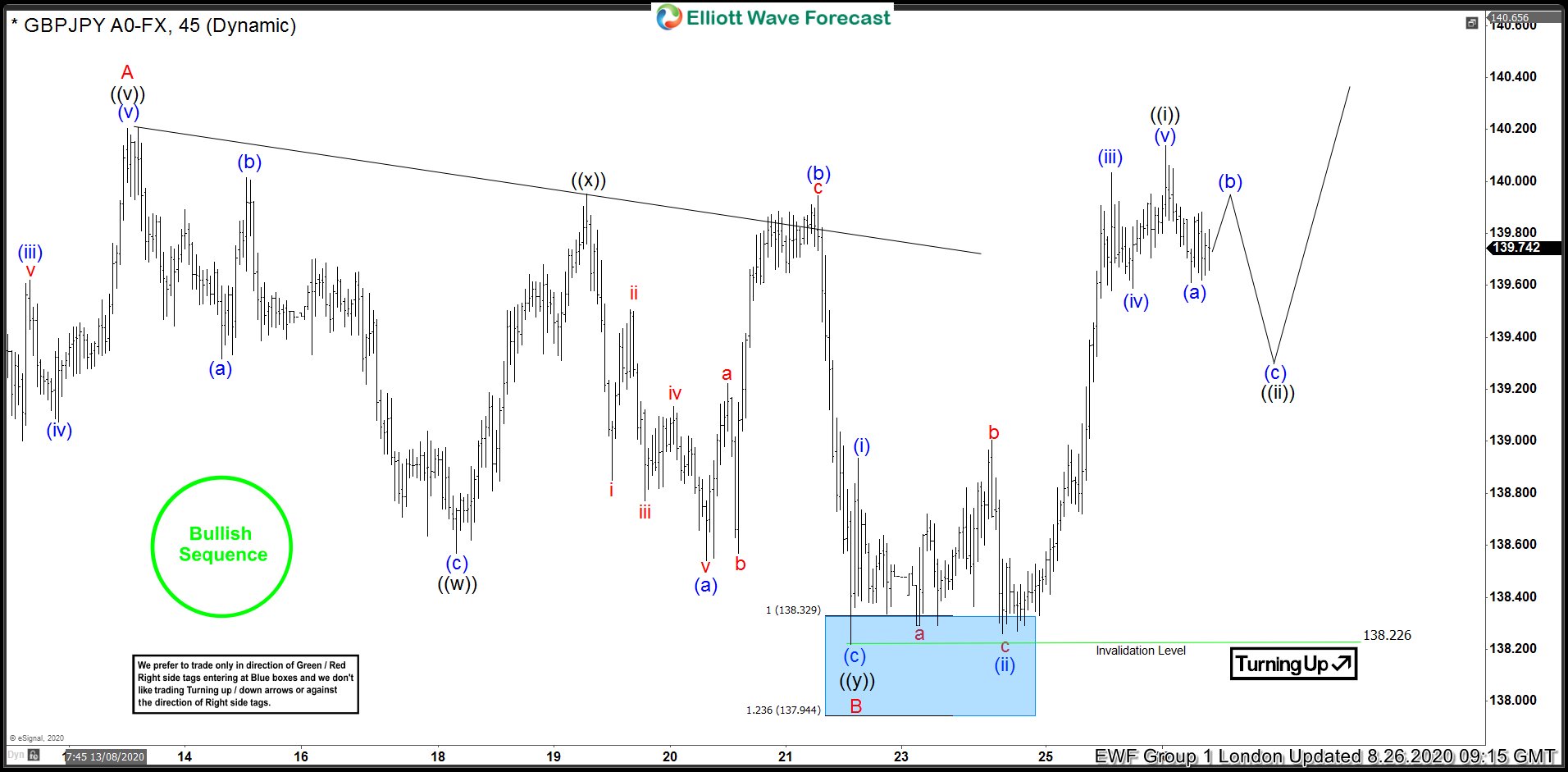

The 1 hour chart update from August 26 shows that pair ended wave ((y)) at 138.22 low, which is within the blue box area. This also ended wave B in higher degree. From there, the pair has extended higher. The rally from blue box ended as wave ((i)) at 140.03 high. Wave ((ii)) pullback could unfold before pair resumed higher again. As long as the pullback stays above 138.22 low, the dip in 3,7, or 11 swings should find support.

GBPJPY 8.26.2020 1 Hour London Elliott Wave Chart

1 hour London chart update from September 2 shows adjusted count for GBPJPY. Now, wave ((i)) is proposed ended at 141.61 high and wave ((ii)) pullback ended at 139.99 low. From there, pair has resumed higher in wave (i) of ((iii)), which ended at 142.71 high. Wave (ii) dip ended at 141.30 low. The rally higher has broken the previous wave A high, confirming that the next leg higher is already in progress. As long as the low at 139.99 stays intact, expect dips in 3,7, or 11 swings to continue to find support for more upside.

GBPJPY 9.2.2020 1 Hour London Elliott Wave Chart