On September 10/2020 AUDJPY registered a temporary top and started to trend lower. When a market is trending it will make higher highs and higher lows in a bullish trend and lower lows lower highs in a bearish trend. Support and Resistance levels/zones are the basics of technical market analysis and traders use these levels/zones to trade breakouts or retests of these levels/zones. At EWF we always encourage traders to trade with the trend and not against it.

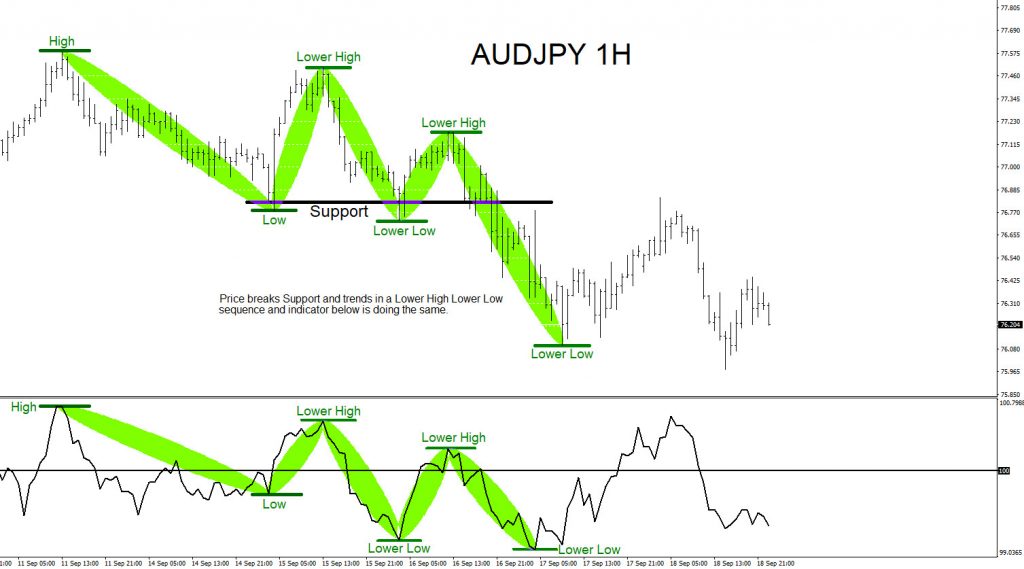

The chart below confirms AUDJPY was trending lower making lower lows lower highs with the oscillator moving in unison with the price chart also making lower lows lower highs. SELLERS entered the market when price broke below the support level (black) which pushed the pair lower.

AUDJPY 1 Hour Chart September 18.2020

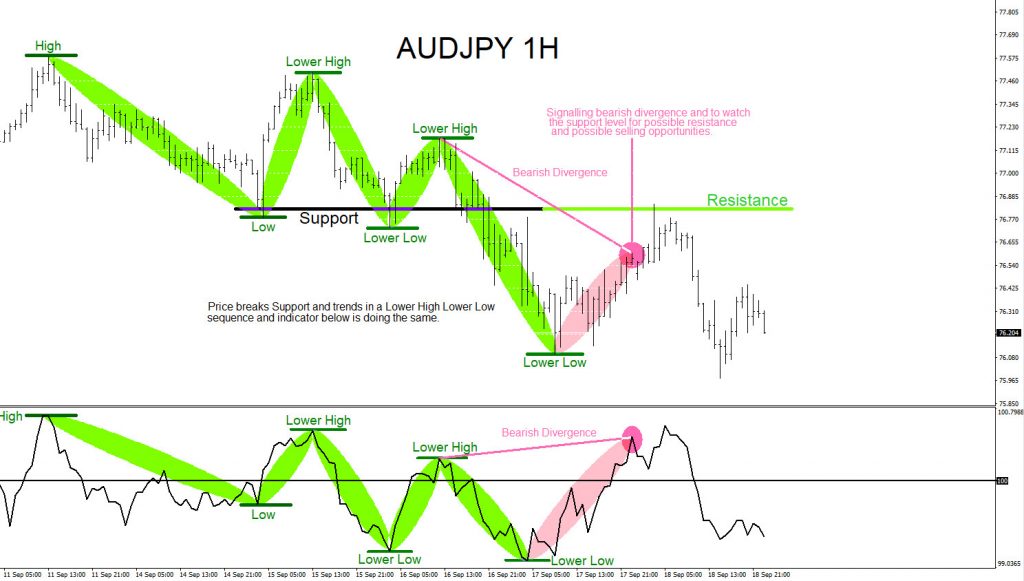

After SELLERS pushed price lower AUDJPY found a temporary lower low which then the pair started to make a correction pullback higher. The chart below shows the market was signalling SELLERS to watch for more selling opportunities. Bearish divergence pattern (pink) was already showing a higher high on the oscillator while price chart was not, signalling traders to watch a retest of the support level to become a possible resistance level.

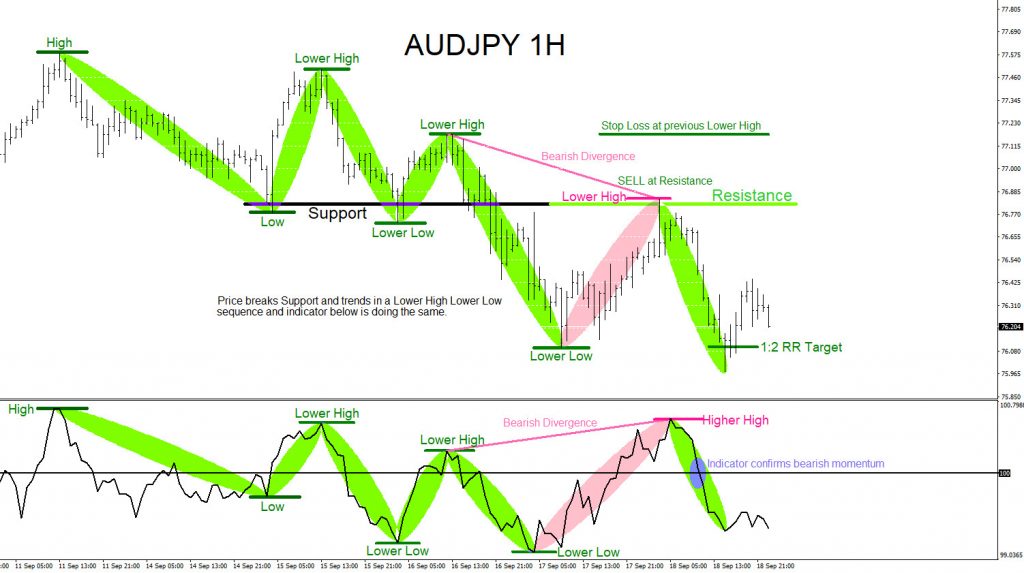

Price retests and hits the previous support level where SELLERS get in the market pushing AUDJPY lower. Support becomes resistance and bearish trend continuation divergence pattern (pink) terminates with price making lower highs and oscillator making higher highs signalling more SELLERS have entered the market looking for another round lower. Oscillator confirms bearish momentum and the pair eventually hits the 1:2 RR Target. When trading a trend sequence hard stops should be placed above the previous lower high when selling and higher low when buying.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX