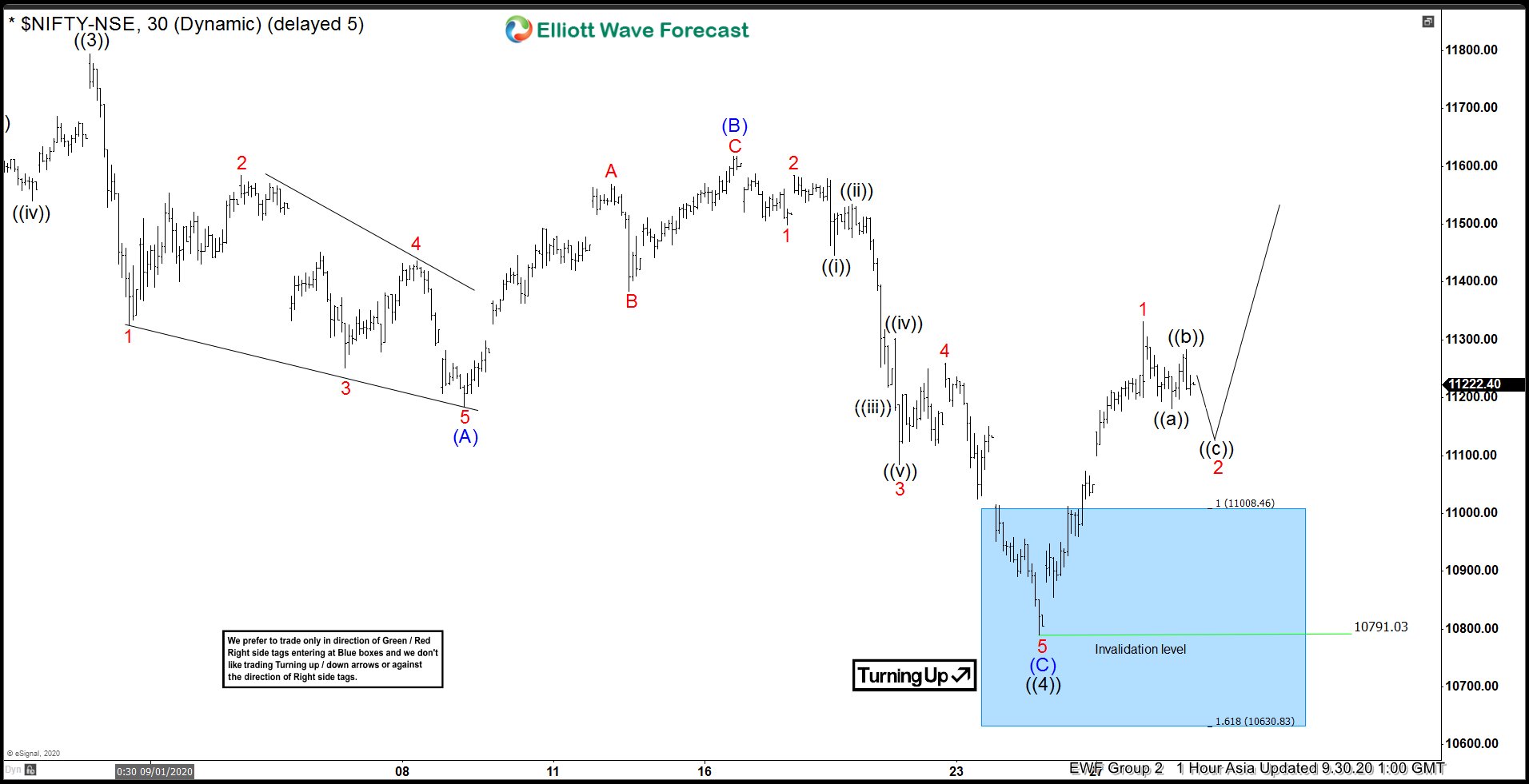

Elliott Wave view of Nifty suggests the cycle from March 24 low still remains in progress as a 5 waves impulse. The 30 minutes chart below shows the rally to 11794.25 ended wave ((3)) of this impulse from March low. Pullback to 10791.03 ended wave ((4)) as a zigzag Elliott Wave structure. Down from wave ((3)) high at 11794.25, wave 1 ended at 11325.85 and wave 2 bounce ended at 11584.95. Wave 3 then resumed lower to 11251.70, wave 4 ended at 11429.55, and wave 5 ended at 11185.15. This ended wave (A) of the zigzag in higher degree.

Wave (B) bounce ended at 11618.10 as a zigzag in lesser degree where wave A ended at 11568.9, wave B ended at 11383.55, and wave C ended at 11618.10. Index then resumed lower in wave (C) towards 10791.03 with subdivision as a 5 waves impulse. Down from wave (B) high at 11618.10, wave 1 ended at 11498.50, wave 2 ended at 11584.10, wave 3 ended at 11084.65, wave 4 ended at 11259.55, and wave 5 ended at 10791.03. This ended wave (C) of ((4)) in higher degree. Index has since turned higher from the blue box area. Up from 10791.03, wave 1 ended at 11239.35. Near term, pullback in wave 2 is expected to find support in 3, 7, or 11 swing against 10791.03 low for further upside.

Nifty 30 Minutes Elliott Wave Chart