In this technical blog, we are going to take a look at the past performance of 1 hour Elliott Wave Charts of Google ticker symbol: $GOOGL, which we presented to members at elliottwave-forecast. In which, the rally from 24 September 2020 low unfolded as an impulse structure. Thus suggested that it’s a continuation pattern. And as per Elliott wave theory after a 3 waves pullback, it should do another extension higher in 5 waves impulse structure at least. Therefore, we advised members not to sell the stock & trade the no enemy areas ( blue boxes) as per Elliott wave hedging remained the preferred path looking for 3 wave reaction higher at least. We will explain the structure & forecast below:

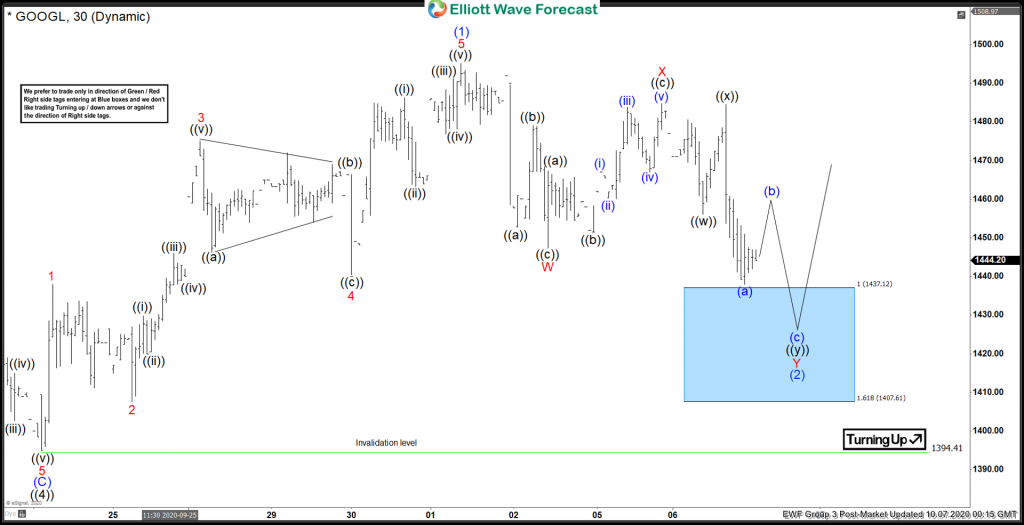

Google 1 Hour Elliott Wave Chart

Above is the 1 hour Elliott Wave Chart from 10/07/2020 Post-Market update. In which, Google made a pullback in wave (2) to correct the cycle from the 9/24/2020 low. The internals of that pullback unfolded as a double three structure where wave W ended at $1447.35 low. Wave X bounce ended at $1484.70 high and wave Y was expected to reach $1437.12- $1407.61 100%-161.8% Fibonacci extension area of W-X. From there, buyers were expected to appear looking for another extension higher or for 3 wave reaction higher at least. Therefore, our members knew that buying at blue box area remains the preferred path for a 3 wave bounce at least.

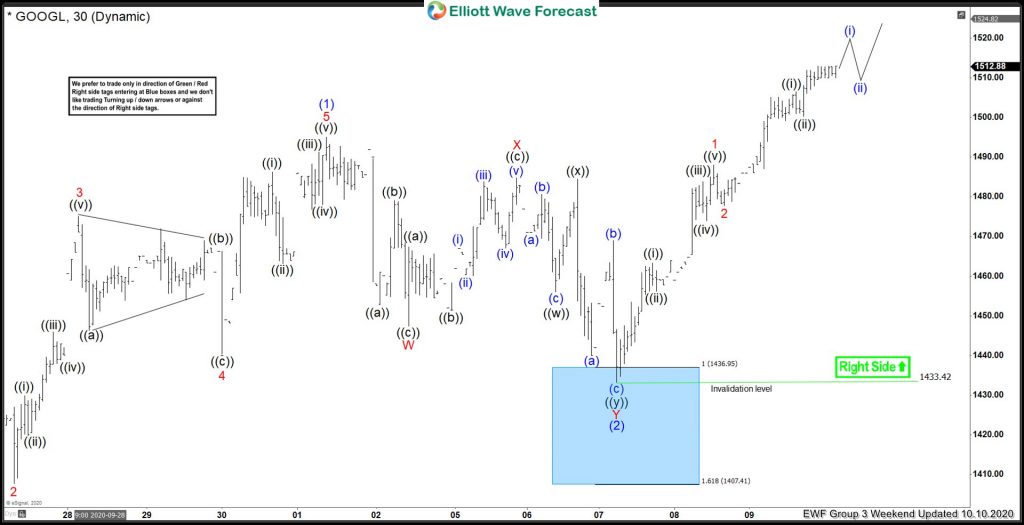

Google 1 Hour Elliott Wave Chart

Here’s the Latest 1 Hour Elliott Wave Chart from the Weekend update. Showing Google reacting higher from the blue box area as we expected. Allowed members to create a risk-free position shortly after taking the longs at $1437.12- $1407.61 blue box area as per Elliott wave hedging. Right now, the stock has already made a new high above the prior wave (1) peak at $1495.07 high confirming the next extension higher for wave (3).