Gold and related Index such as Gold Miners Junior (GDXJ) maybe ready to make the next move higher. The next important catalyst in the market is the US election and the second Coronavirus relief package. Nancy Pelosi and Treasury Secretary Steven Mnuchin continue to have discussion about the size and language of the stimulus bill. As the election is getting closer however, there’s skepticism whether Congress can approve the package before the election. Furthermore, Republican senators have indicated they won’t approve the bill even if the White House and Democrat can agree on the bill.

It’s however certain that the second stimulus package will come. The question is not whether it will come. Instead, the question is when will it come and how big. There is a belief among market participants that if Joe Biden can win the White House and Democrats can take over the Senate, Democrat can introduce a much larger stimulus package. As of now, the White House proposed $1.8 trillion package while Democrat proposed $2.2 trillion.

When the second stimulus package comes, it’s likely to create further support for the stock market. In addition, US Dollar should resume lower as the monetary and fiscal stimulus continue to debase the currency. One beneficiary for currency debasement is Gold and by extension Gold Miners. We wrote an article about Gold Miners Junior ($GDXJ) back in July 21 calling for further upside as it broke a 7 year basing pattern. Here’s the link to the article: Gold Miners Junior (GDXJ) breaks 7 year base

Since then, it has retraced the breakout base as chart below shows:

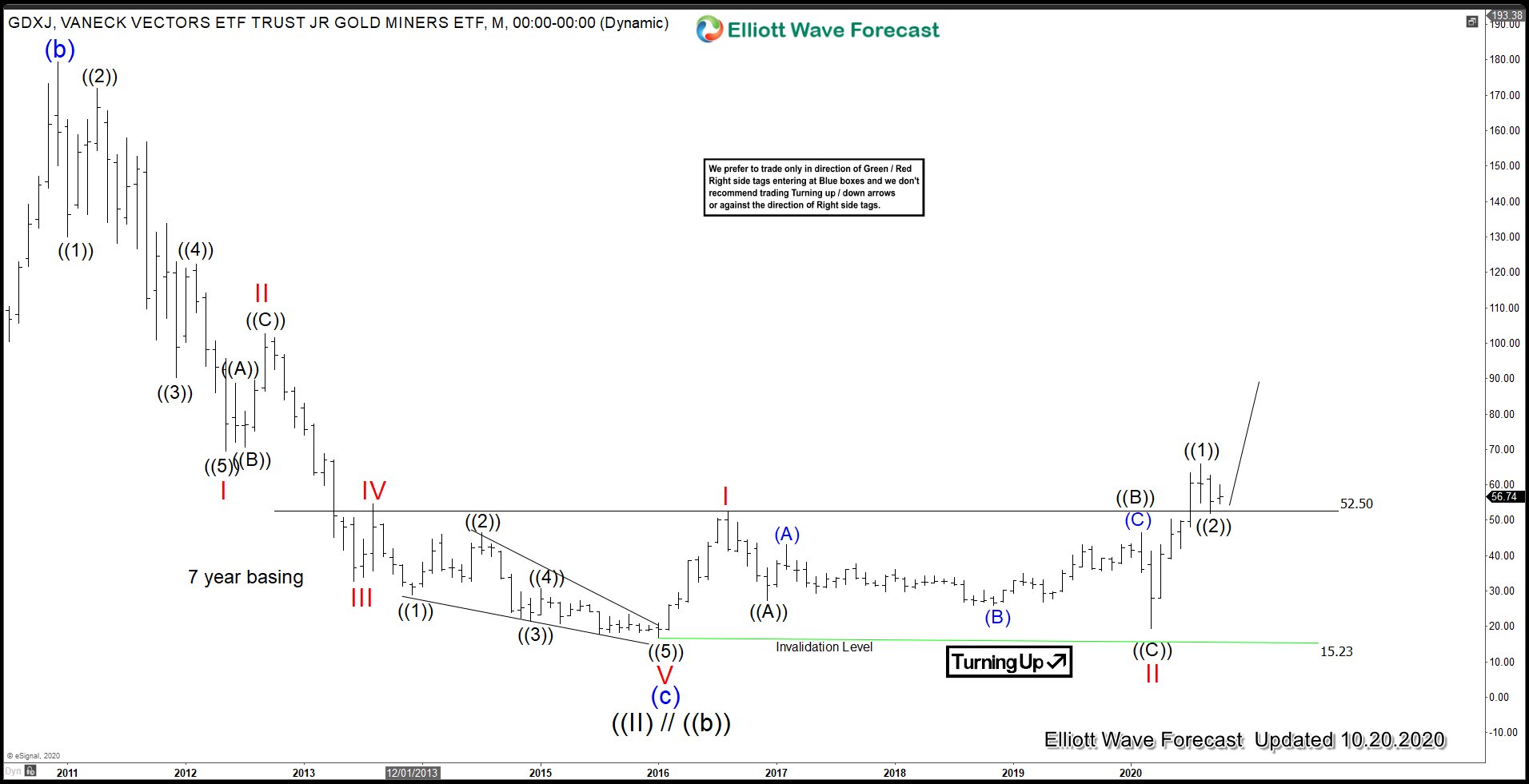

GDXJ (Gold Miners Junior) Monthly Elliott Wave Chart

After the initial breakout above $52.5 in July, the Index has retraced the resistance-turned-support at the same level. There’s a possibility that the Index can resume higher again now. US election and further prospect of stimulus may become the catalyst for the move higher.

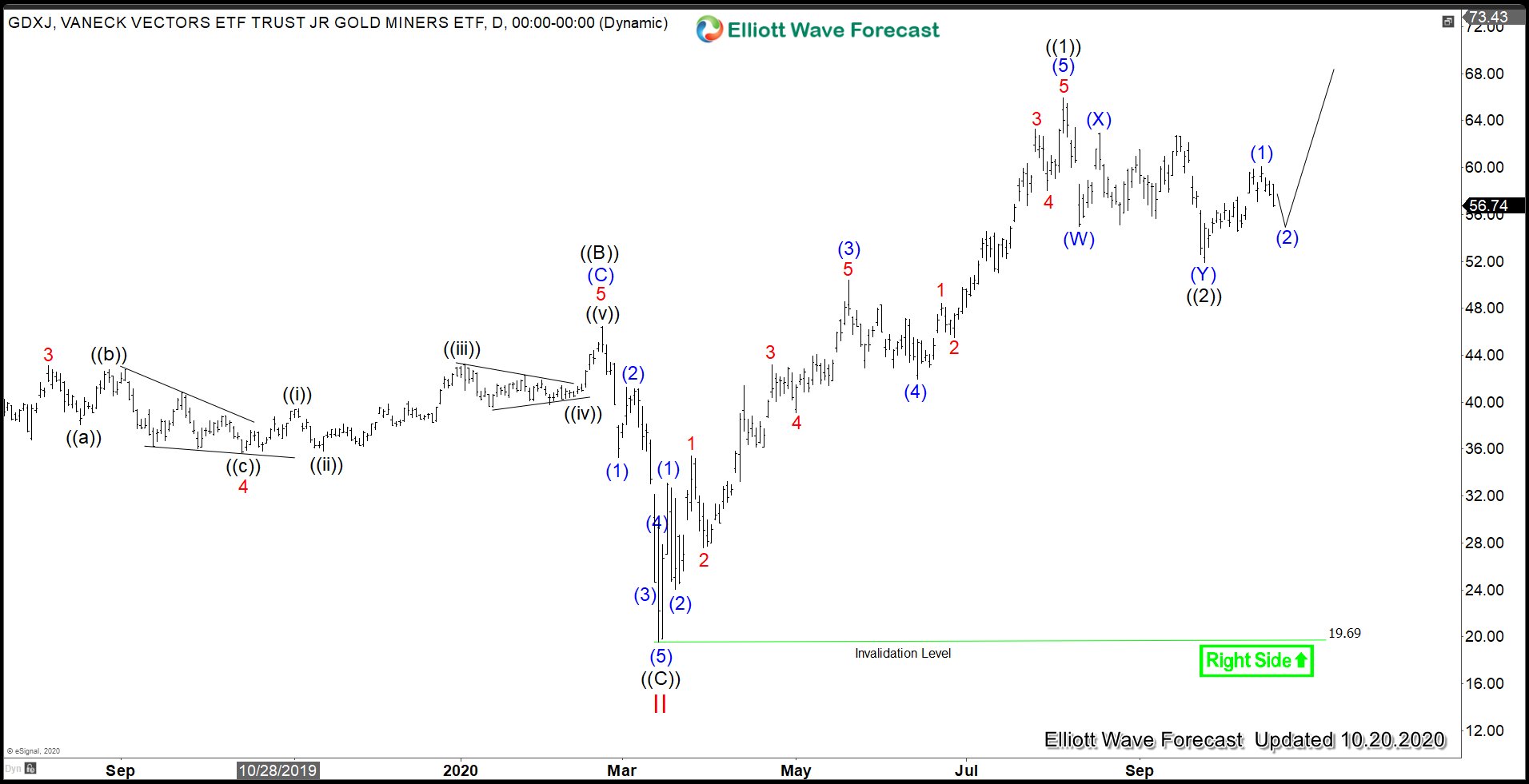

GDXJ (Gold Miners Junior) Daily Elliott Wave Chart

Gold Miners Junior ($GDXJ) Daily chart above shows it did a double three (W)-(X)-(Y) correction in the past 3 months to end wave ((2)). It has since turned higher but still needs to break above wave ((1)) at $65.95 to avoid a double correction. The Index now has a chance to resume higher and the next leg higher will get confirmation once it breaks above $65.95.