The Real estate market has always been related to the world indices. It provides an alternative investment to holding stocks. Many investors are nervous of the volatility in the stock market due to the constant exposure in media. The ease of owning/selling stocks as well as the lower capital requirement makes it a popular speculative investment vehicle. In contrast, housing market requires significantly larger amount of capital, and the news media does not report the up and down of the market in daily basis.

Similar to the stock market, real estate market also runs in cycles. It has a beginning, an end, and also a target. The key for every investor is to identify when to buy and when to sell. There are two types of real estate market, the buyers market and the sellers market. In a seller’s market, it is easy to sell a property because there’s a lot of buyers in the market place. On the other hand, in a buyer’s market, it is hard to sell a property because there are many sellers and fewer buyers.

It is a very simple concept, but it’s difficult to time the property market. Many buyers buy at the peaks and many investors end up holding the properties when the market switches. To understand the market, Elliott Wave Theory helps with the ideas of the cycles and the cycle degrees. A cycle by definition is s a series of events that happen repeatedly in the same order or similar forms. We get a cycle from Latin cyclus and Greek kuklos, both meaning “circle. The Theory provides different degrees of cycles, which we explain below.

Elliott Wave Labelling Cycles

Grand Super Cycle : ((I)) (((II)) ((III))((IV))((V)) ((a)) ((b))((c)) ((w)) ((x)) ((y))

Super Cycle : (I) (II) (III) (IV) (V) (a) (b) (c) (w) (x) (y)

Cycle : I II III IV V a b c w x y

Primary : ((1)) ((2)) ((3)) ((4)) ((5)) ((A)) ((B)) ((C)) ((W)) ((X)) ((Y))

Intermediate : (1) (2) (3) (4) (5) (A) (B) (C) (W) (X) (Y)

Minor : 1 2 3 4 5 A B C W X Y

Minute : ((i)) ((ii)) (( iii)) ((iv)) (( v)) (( a)) ((b)) ((c)) ((w)) ((x)) ((y))

Minutte : (i) (ii) (iii)(iv)(v) (a) (b) (c) (w) (x) (y)

Subminutte : i ii iii iv v a b c w x y

The idea is that the higher degree the cycle is, the fewer the oscillations and the longer the periods. Stock Market traders most of the time are trading in shorter cycle below the Cycle degree. In real estate market, it’s better to trade above the Cycle degree. This makes it easier to enter and exit the market due to a lesser number of oscillations.

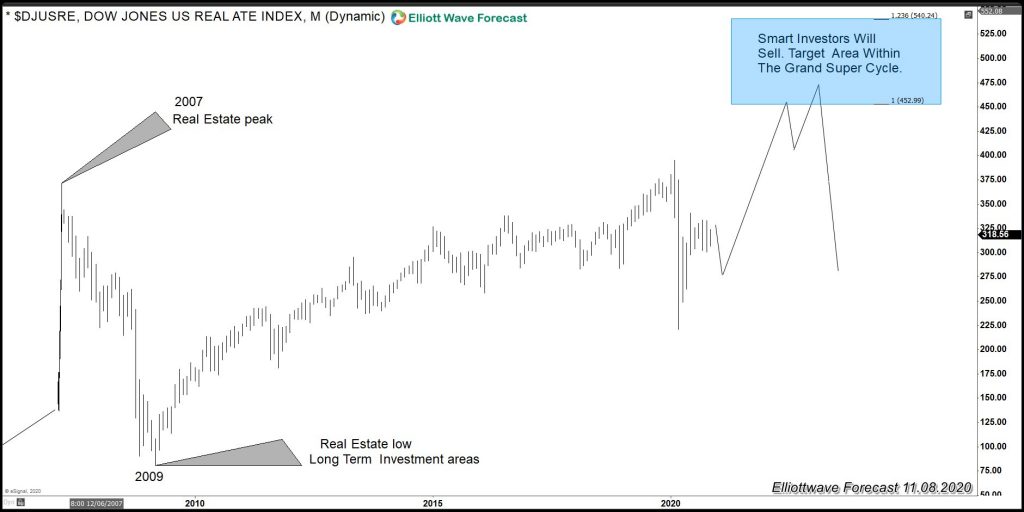

Dow Jones US Real Estate Index (DJUSRE) Monthly Chart

As the chart above shows, the real estate market has taken the peak in 2007. As a result, it will continue to go higher to the target which is the 100% extension since the all-time lows within the Grand Super Cycle. We show this target with a blue box. The closer we get to the blue box area, the riskier the market will be. There’s also an increasing likelihood that the market switches from a seller’s market to a buyer’s market.

The reasoning of the switch is simple. Smart investors understand when to buy or sell. Most property investors, like the stock market traders, also enter and exit the market. Everyone who bought the properties in the 2009 dip will be looking to sell them soon. The technical aspect for the switch is there and buyers should be aware that the market is in a mature stage. Although there could be a short-term joy ride, some pain in the housing market may happen in the near future.