In this technical blog, we are going to take a look at the past performance of 4 hour Elliott Wave Charts of XLV, which we presented to members. In which, the rally from 23 March 2020 lows, showed the higher high sequence in an impulse structure favored more strength to take place. Also, the right side tag pointed higher & favored more strength. Therefore, we advised our members to buy the dips in XLV in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

XLV 4 Hour Elliott Wave Chart

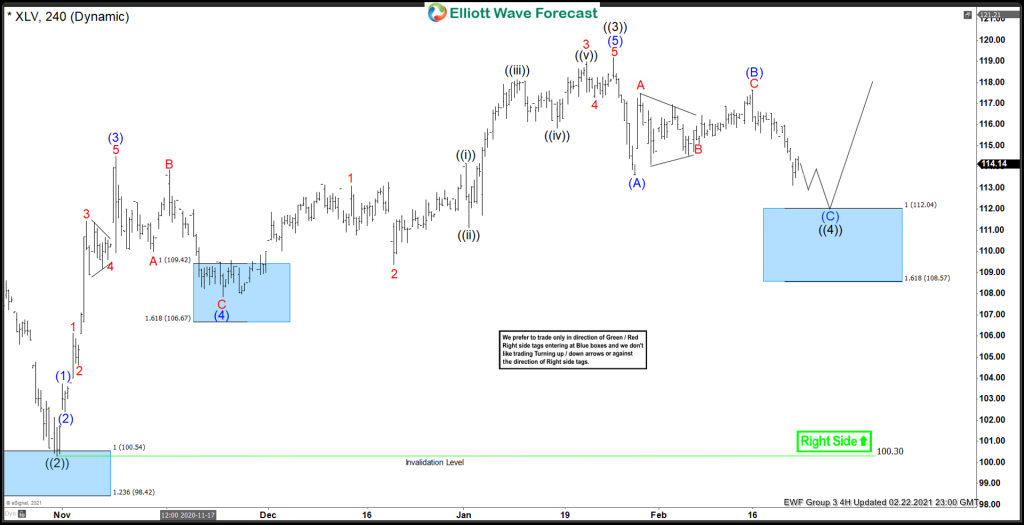

Above is the XLY 4 hour Elliott Wave Chart from the 2/22/2021 update. In which, the rally from 23 March 2020 low unfolded as 5 waves impulse structure, whereas wave ((2)) ended at $100.30 low. Up from there, wave ((3)) unfolded as another 5 wave structure when wave (1) ended at $103.73 high. Wave (2) ended at $102.41 low, wave (3) ended at $114.50 high. Wave (4) ended at $107.84 low and wave (5) ended at $119.18 high and completed wave ((3)).

Down from there, the ETF made a wave ((4)) pullback to correct the cycle from the 10/30/2020 low before the upside resume. The internals of that pullback unfolded as an Elliott wave zigzag structure where wave (A) ended at $113.63 low. Wave (B) bounce ended at $117.63 high and wave (Y) was expected to reach $112.04- $108.57 100%-161.8% Fibonacci extension area of (A)-(B). Before providing a buying opportunity looking for more upside or for 3 wave reaction higher at least.

XLV 4 Hour Elliott Wave Chart

Here’s the latest 4 hour Elliott Wave Chart from 04/03/2021 Weekend update, in which the ETF managed to reach the blue box area at $112.04- $108.57 & showing reaction higher taking place from the blue box area. Allowed members to create a risk-free position shortly after taking the longs at the blue box area. However, a break above $119.18 high still needed to confirm the next extension higher & avoid double correction lower.

Source: https://elliottwave-forecast.com/stock-market/xlv-reacted-higher-elliott-wave-blue-box/