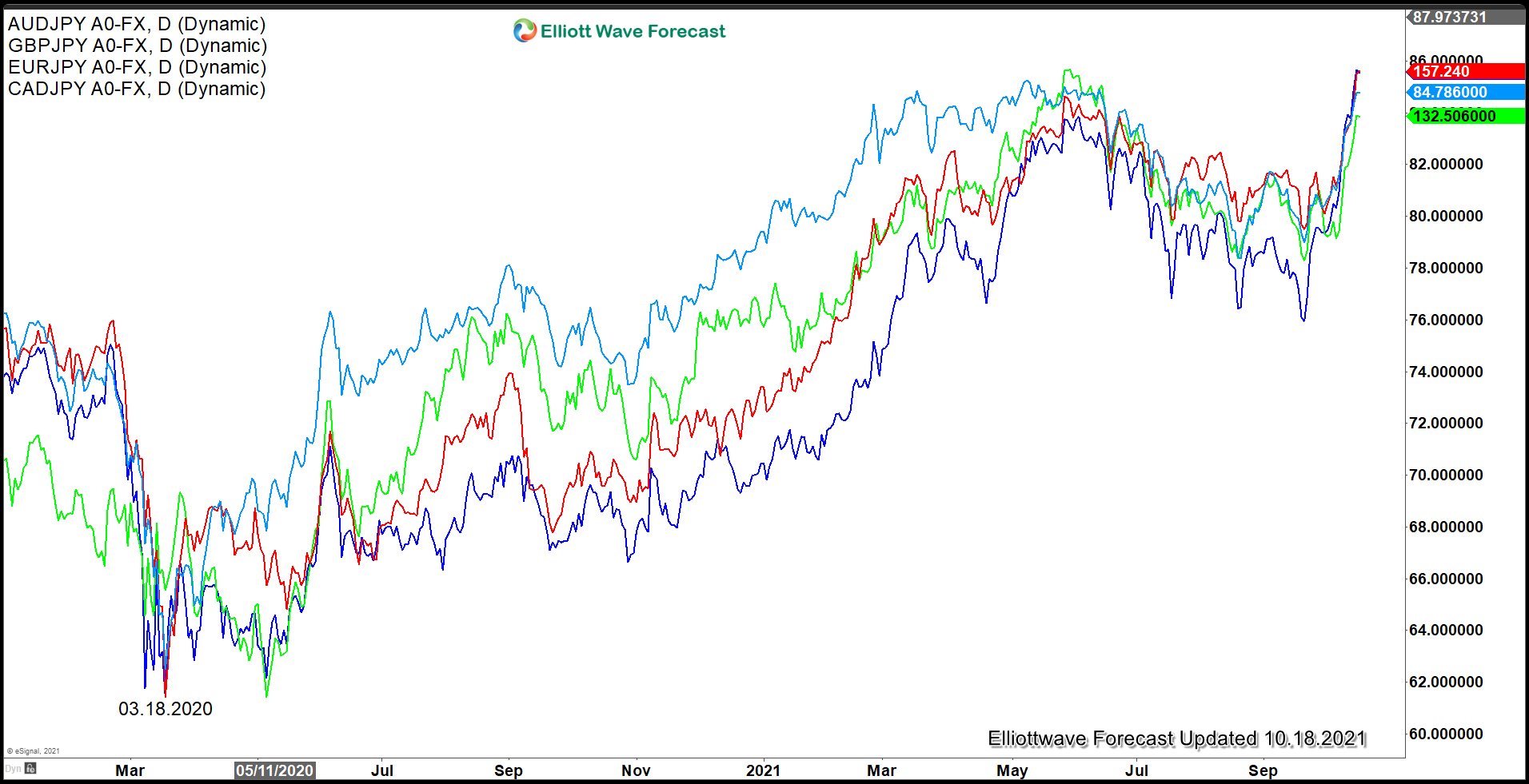

An overlay of Yen pairs below show that they clearly share the same cycle.

The chart above shows that all Yen pairs made major low on March 18, 2020. From there, they all rally together. In the past two weeks, we have seen several Yen pairs breaking to new high above May 2021 high suggesting that the next leg higher has started. Short term, we should see further upside in the Yen pairs and it can last until the end of the year. A more important question however is whether the extension higher is a new bullish cycle or still part of the cycle from March 2020 low. Let’s look at the charts below and consider the two options:

CADJPY Scenario 1: Break Higher is Extension from March 2020 Low

CADJPY last week broke above May 2021 low and one possibility is to consider the breakout as wave ((5)) from March 18, 2020 low. In this scenario, we should see pair extending higher in short term to complete wave ((5)) which then should end wave I in higher degree. Afterwards, we could see a larger pullback in 3, 7, or 11 swing to correct the entire rally from March 18, 2020 low. In the near term, while pullback stays above 84.7, expect pair to extend higher.

CADJPY Scenario 2: Break Higher is a New Bullish Cycle

The chart above shows the second scenario if the breakout is a new bullish cycle. In this scenario, CADJPY and thus all other Yen pairs will be even more bullish than the first scenario as it starts a new bullish cycle in wave III. Wave II low at 84.7 on August 20 in this case will become an important low and any subsequent dips will continue to find buyers in 3, 7, or 11 swing against this level.

The two scenarios in CADJPY above should apply to all other Yen pairs. We can either extend within wave ((5)) from March 2020 low which is less bullish scenario. Or we can also start a new bullish cycle which is very bullish. In the near term, both options suggest we would see further upside still.

Source: https://elliottwave-forecast.com/forex/yen-pairs-started-next-leg-higher/