GBPAUD has found bid due to the divergence in the monetary policy between RBA and BOE. Bank of England (BOE) this year has hiked interest rate twice to fight against inflation. However, BOE indicates that it may still need to hike a few more times this year before it stops. This should take interest rates closer to 1% or even higher. Meanwhile, Reserve Bank of Australia (RBA) does not sound as hawkish as the other central banks. In the last monetary policy statement, the RBA has emphasized that the growth in workers’ wage is significant in the UK and US. RBA has judged that wage growth of three percent or more will be necessary to deliver the bank’s inflation target of 2.5%. In other words, RBA is not in a rush to raise the rate despite the current underlying inflation at the top of their target.

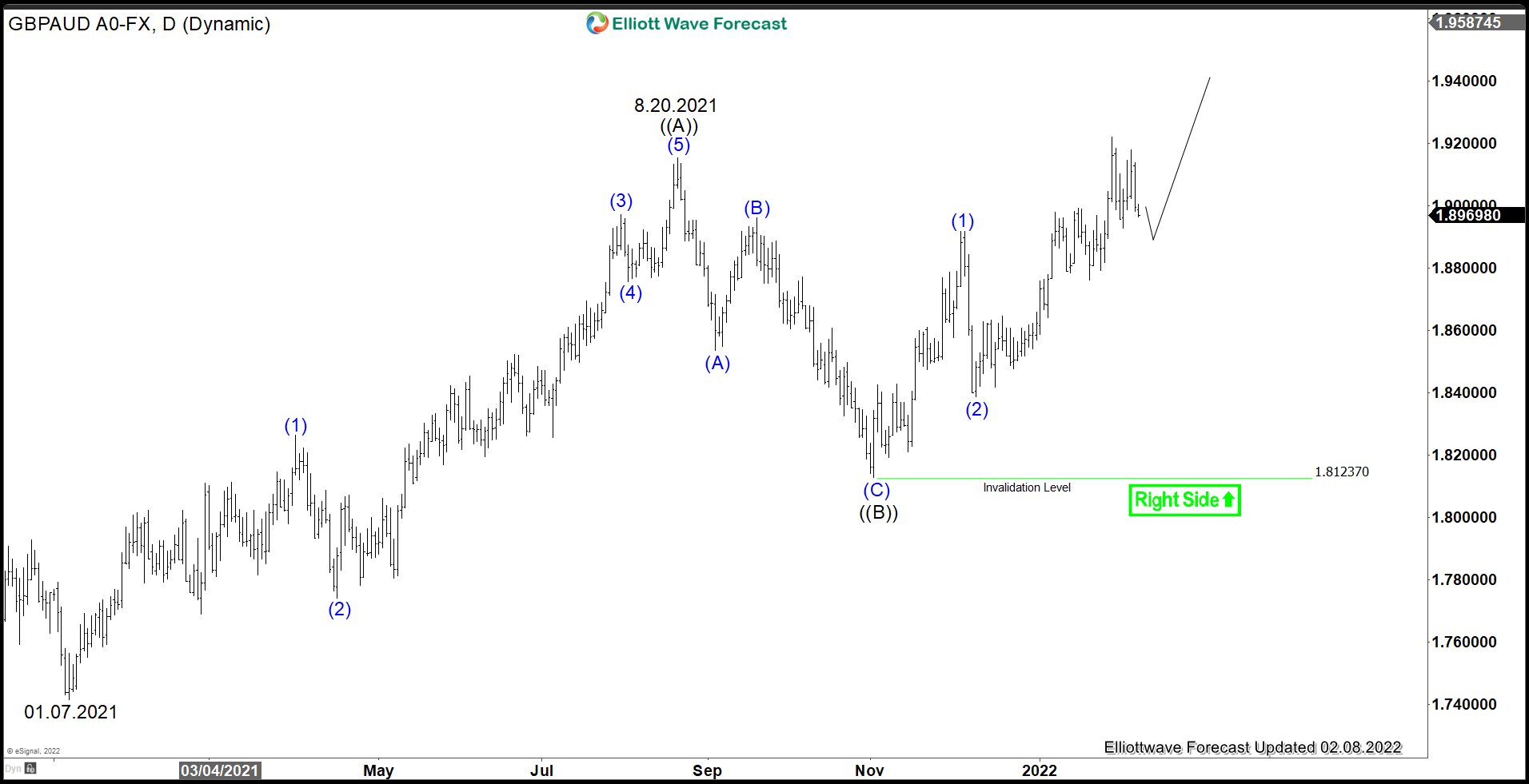

GBPAUD Daily Elliott Wave Chart

GBPAUD has broken above 08.20.2021 high (1.9154) and now the pair shows a higher high bullish sequence from December 11, 2020 low. The pair has potential target higher which can be calculated as 100% – 161.8% Fibonacci Extension from December 2020 low at 1.987 – 2.095. Near term pullback should find support in the sequence of 3, 7, or 11 swing for further upside as far as pivot at 1.8123 low stays intact.

Source: https://elliottwave-forecast.com/forex/gbpaud-bullish-sequence-favors-upside/