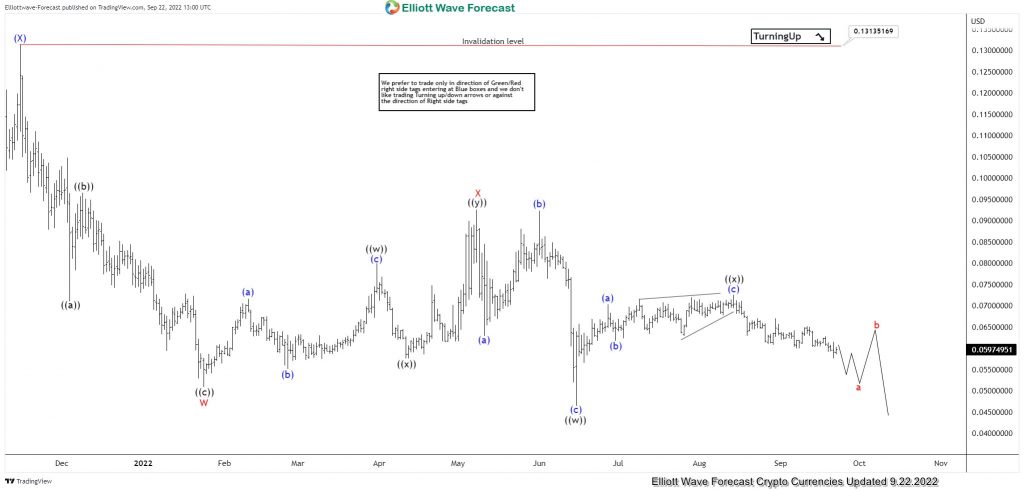

The near-term view is suggesting that the bigger correction against the all-time low unfolded as a double three structure where wave w ended at $0.0103 low, wave x bounce ended at $0.0453 high. While wave y ended at $0.0065 low and with that the correction against all-time lows ended in wave (II) pullback. Up from there, rally higher took place as 5 waves impulse structure where cycle degree wave I ended at $0.1844 high and now doing a pullback to correct the cycle from March 2020 lows within wave II. The internals of that pullback as Elliott wave double three structure where wave ((W)) ended at $0.04456 low. Wave ((X)) ended at $0.1313 high and wave ((Y)) is expected to reach $0.03166- $0.01276 area lower approximately before upside resumes. Near-term, as far as bounces fail below $0.1313 high more downside is expected to take place.

Tron TRXUSD Daily Elliott Wave Chart 9.22.2022