Hello fellow traders. As our members know, Amazon stock has completed 5 waves structure in the cycle from the 146.61. We were calling for a 3 waves bounce against the mentioned high after which we expected the price in stock to drop toward new lows. In previous blog on Amazon we shown how we called decline due to incomplete bearish sequences. In this technical article we’re going to take a quick look at the more recent Elliott Wave charts . We recommended members to avoid buying the stock and keep favoring the short side . Let’s take a look at the charts

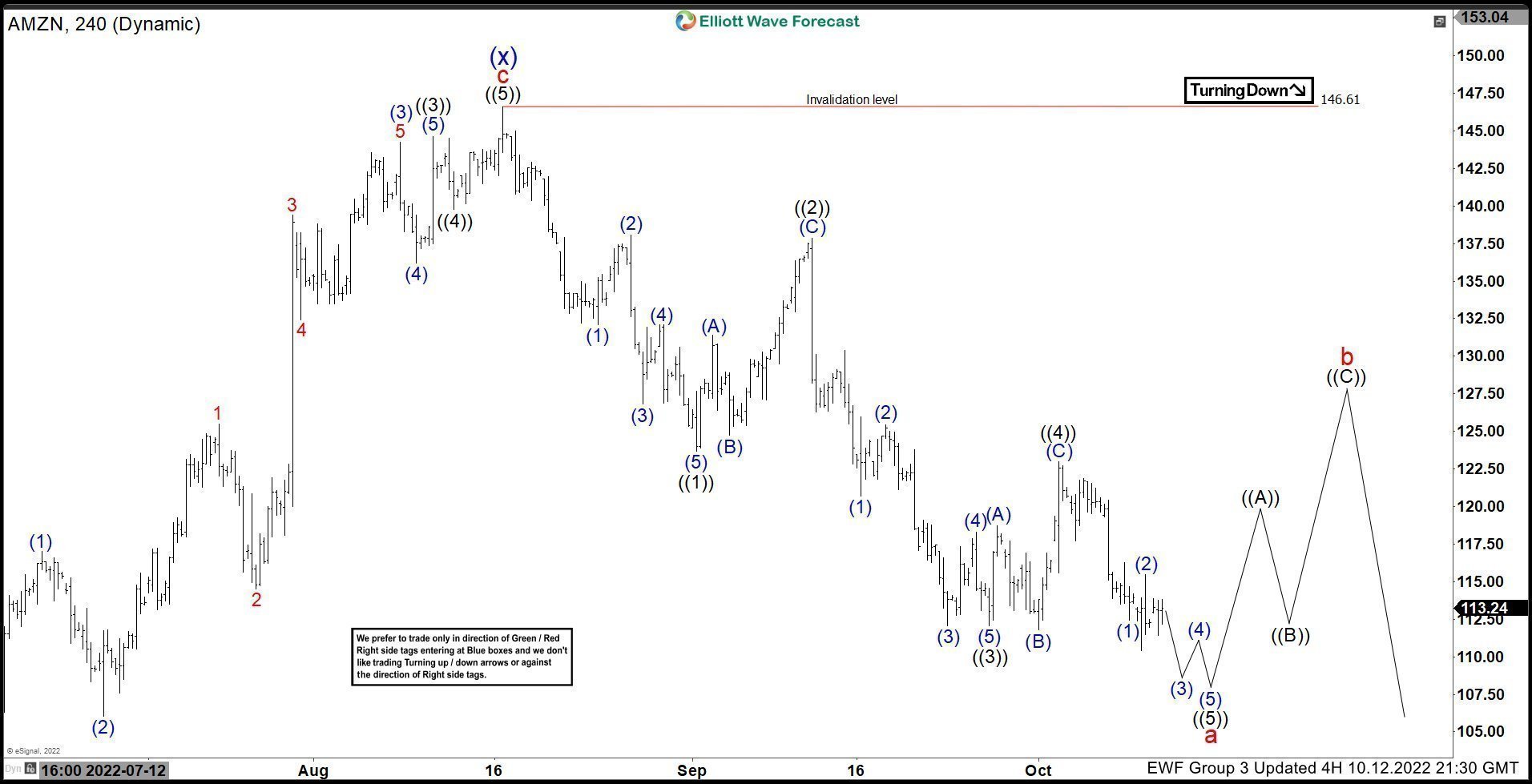

Amazon $AMZN Elliott Wave Analysis 10.12.2022

Decline from the 146.61 turned out to be unfolding as 5 waves structure. The stock reached target at 115.01-100.86 where we expect it to complete “a red “cycle as 5 waves decline. Amazon should ideally make 3 waves bounce soon in b red, before further decline takes place. We don’t recommend buying the stock in any proposed bounce and favor the short side.

Reminder: You can learn about Elliott Wave Rules and Patterns at our Free Elliott Wave Educational Web Page.

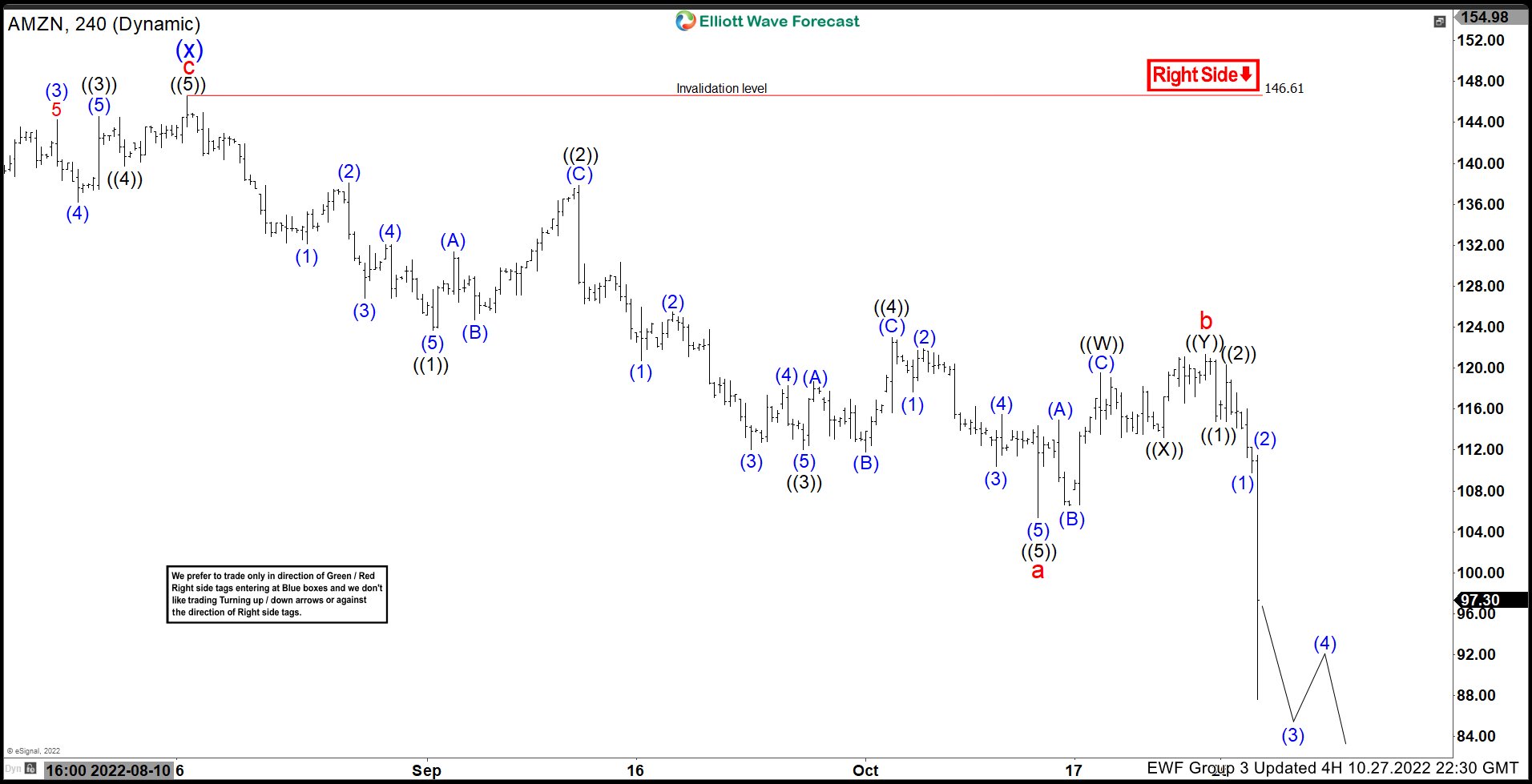

Amazon $AMZN Elliott Wave Analysis 10.27.2022

The stock made 3 waves bounce in b red. Correction ended as truncation Elliott Wave Double Three pattern at 121.51 peak. We got sharp decline toward new lows as expected. Now the stock remains bearish against the 121.51 pivot in first degree and against the 146.61 pivot in 2nd degree. As far these 2 pivots hold, Amazon $AMZN should ideally keep finding sellers in 3,7,11 swings.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Source: https://elliottwave-forecast.com/stock-market/amazon-amzn-elliott-wave-calling-decline/