Viking Therapeutics Inc. is an innovative biotechnology company developing novel therapeutics for metabolic and endocrine diseases. Metabolic and rare disease programs include novel selective thyroid receptor-β agonist approach. These and other programs are currently within phases 1, 2 and preclinical. Viking Therapeutics saw IPO back in 2015. Since then, investors can trade it under the ticker $VKTX at NASDAQ.

Viking Therapeutics Weekly Elliott Wave Analysis 03.28.2023

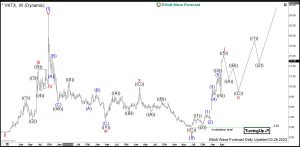

The weekly chart below shows the Viking Therapeutics shares $VKTX traded at NASDAQ. From the IPO in 2015, the stock price has developed an initial cycle higher in blue wave (I) of super cycle degree towards $24 all-time highs in September 2018. Then, a correction lower in blue wave (II) has unfolded as an Elliott wave double three pattern being 3-3-3 structure.

Firstly, 7 swings (which is equal to larger 3 swings) in red wave w of blue wave (II) have printed a low at $3.26 in March 2020. Then, a bounce has set a connector wave x at $10.09 highs in February 2021. Later on, the price has broken $3.26 lows opening up a bearish sequence. As a consequence, red wave y should have extended lower towards 100% extension or at least 61.8% extension of the red wave w. However, these values are below zero. Due to the lack of space, the price has reached $2.02 and bounced breaking the descending channel from 2018. It is the preferred view that the correction has ended in June 2022 at $2.02 lows. While above there, a new bullish cycle in blue wave (III) might have started. The target for the wave (III) is 26.01-40.83 area and even beyond.

In shorter cycles, the advance from June 2022 lows shows 5 waves of red wave I. Therefore, it is dangerous to chase the market to the upside. Investors and traders can be looking to buy $VKTX in a pullback as red wave II in 3, 7, 11 swings against $2.02 lows for an acceleration higher in red wave III of blue wave (III).

Source: https://elliottwave-forecast.com/stock-market/viking-therapeutics-new-bullish-cycle/