Hello Traders, in this article we will analyze our forecast for SPY ETF in the short term cycle. Since the short term peak of SPY from 05.30.2023 to end wave i of (iii) we have been expecting a pullback within wave ii to take place. Thereafter, we were expecting more upside within wave iii. Here at Elliott Wave Forecast we have in place a system that allows us to measure an area in which we can expect a react to take place.

We call it equal legs area or blue box area as you might have seen within our charts. These areas provide us with at least an 85% chance of a minimum of 3 waves bounce or reaction to take place. We can use these areas to enter in the market with a defined entry, Stop Loss and exit strategy. So once we had in place a and b of ii we were able to present for members the blue box buying area in which we expected to end c of ii.

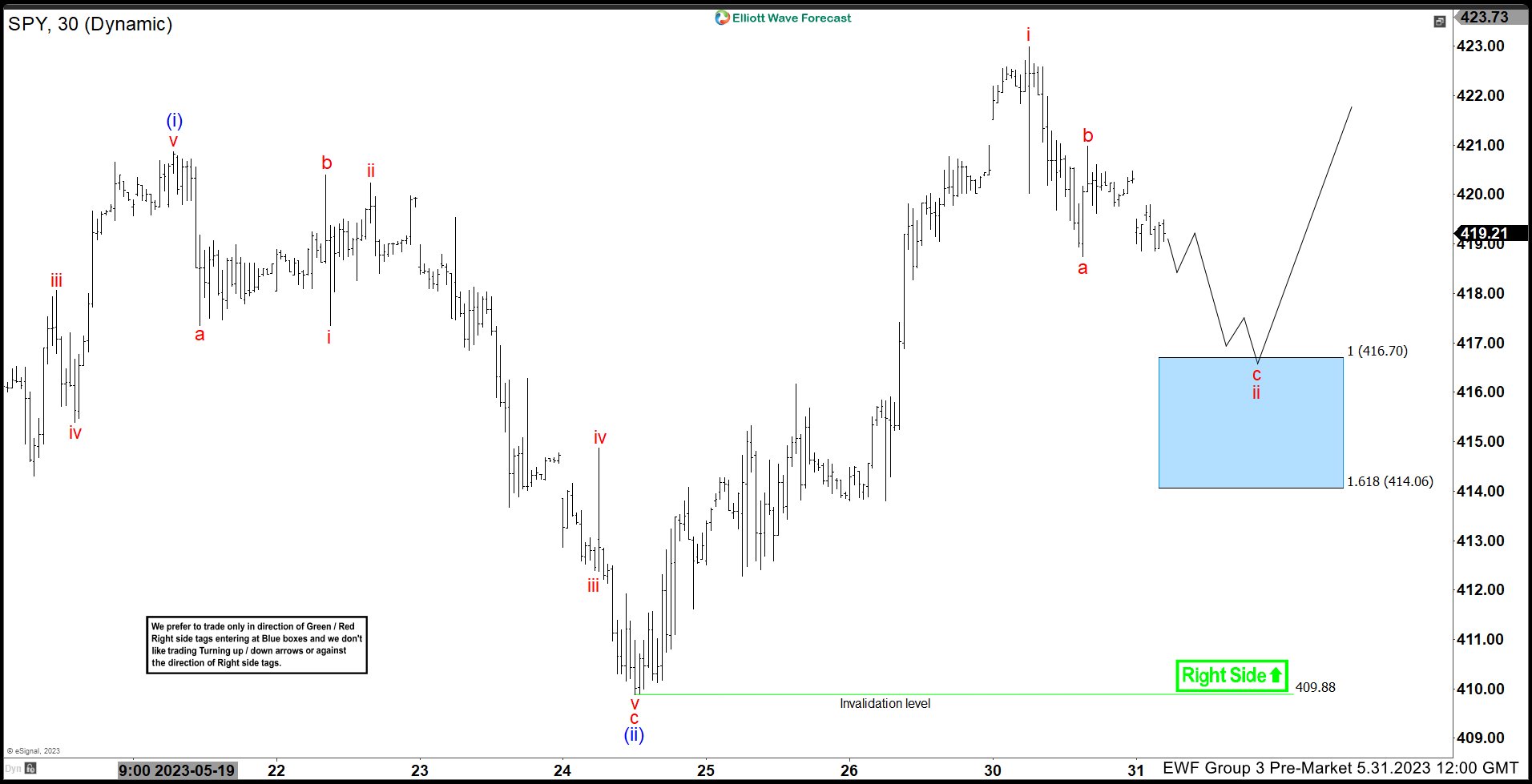

We teach how to use our system within our member’s area and live trading room. Once a member or in trial you will be able to gather more of that information under your disposal. Nevertheless, let’s have a look now at the 30 min chart of SPY as provided to members from 05.31.2023. We have been expecting more downside to reach the blue box area before turning higher.

SPY 30 min chart Pre Market Update 05.31.2023

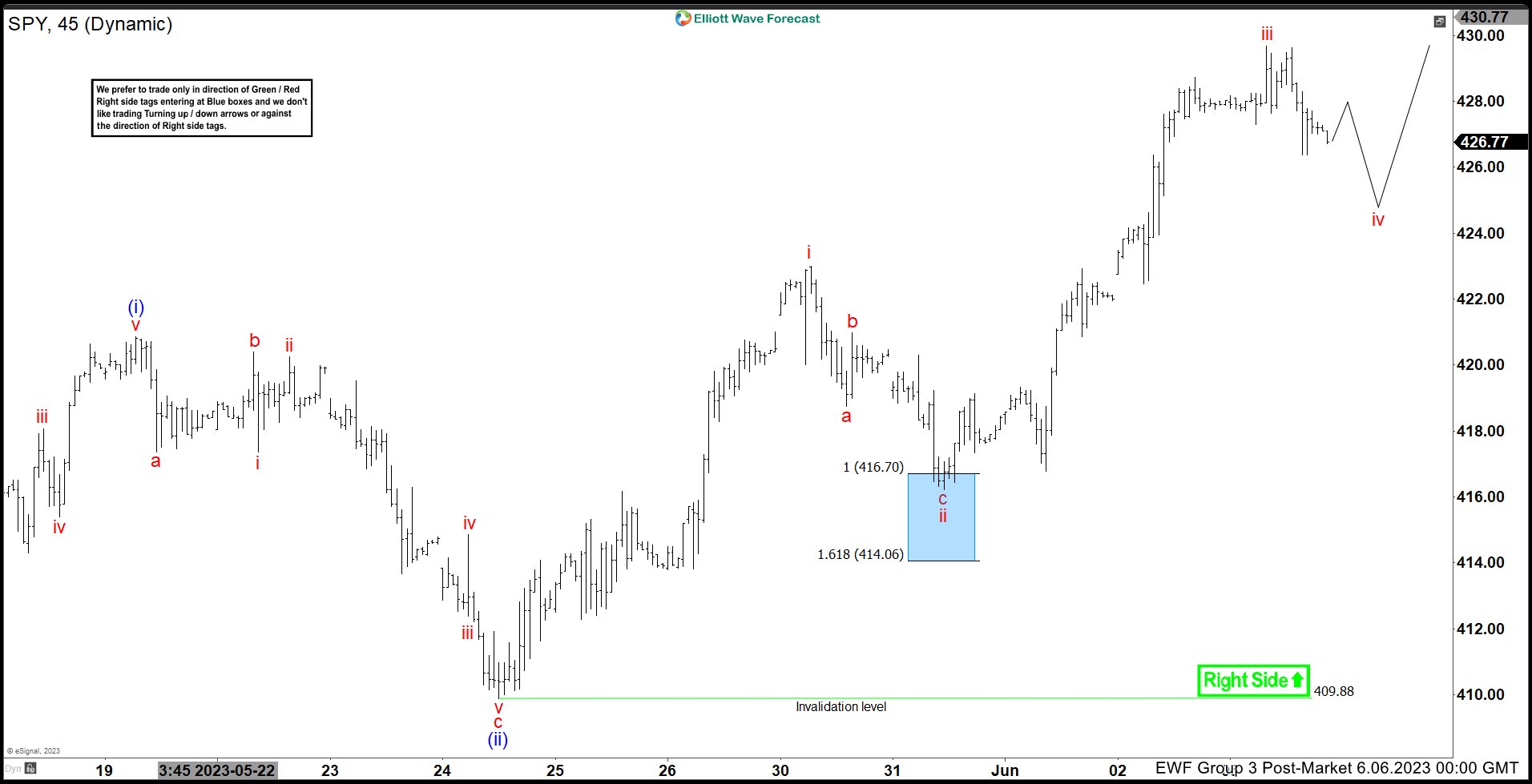

As we can see the market was expected lower within c of ii to reach the blue box area. We recommend members to always buy from the 100% extension area with a stop loss just below the 1.618 area. Fast forward, towards the latest post market update now from 06.06.2023, we will see that the market has already reacted higher and what we expect next.

SPY 45 min chart Post Market Update 06.06.2023

A strong reaction higher took place from the blue box area. The reaction higher within wave iii of (iii). And then expecting the pullback within iv before one more high in v to end (iii). You can learn more once become a member at Elliott Wave Forecast. Join us to learn the next trading opportunities in SPY and other ETFs or Stocks. Belongs to our Group 3 of instruments.