The Travelers Companies, Inc., TRV, is an American insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance through independent agents.

Weekly TRV Chart July 2023

TRV ended a great super cycle in the year of 2019 reaching a peak at $154.86 which we call the wave ((I)). Then the market made a quick and strong correction driven by the COVID19 pandemic in 2020. The company lost 50% of its value reaching $76.99 per share in March. This culminated wave ((II)) and we are currently building wave ((III)). Wave (I) of ((III)) ended at $194.51 in January 2023 building an impulse and it has been correcting in wave (II) of ((III)) ever since.

Weekly TRV Chart November 2023

In the chart above shows that TRV continued lower as expected. There were 2 structures to use in this case, a flat correction or a double correction. The flat correction has a structure of 3-3-5 and the double correction is 3-3-3. The only difference is the end of the structure. However, the pullback was a little shallow for wave (II). It cannot reach even the 100% Fibonacci extension to 152.52 and the stock turned higher from 157.33 low missing the entry.

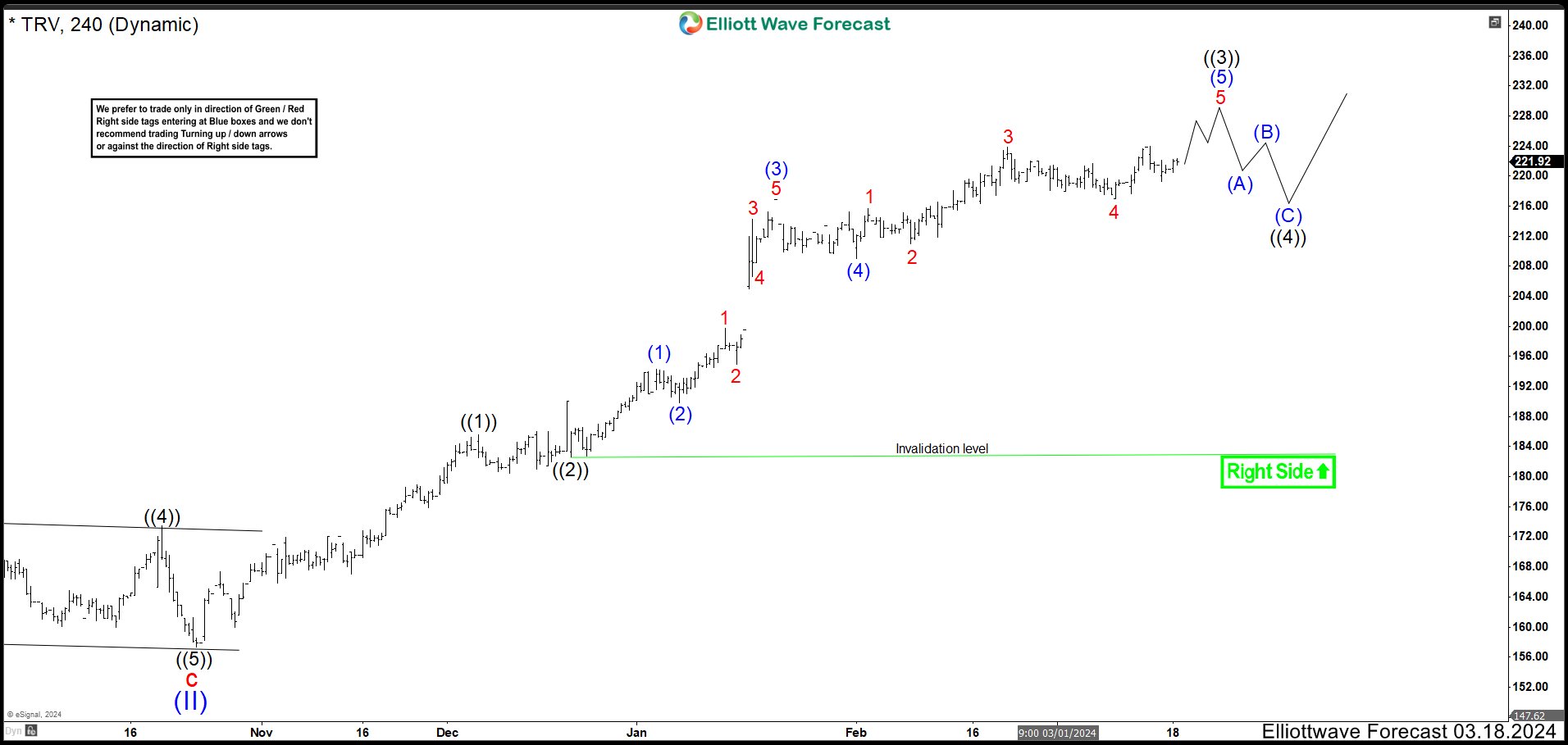

4 Hour TRV Chart March 2024

The structure above, it is developing wave I of (III). Currently there are 2 scenarios. Wave ((3)) could have completed at 224.00 high and it needs to break below 216.98 low to confirm that wave ((4)) has started. In this case, market we retest wave (4) lows before resuming to the upside. The other scenario is wave ((3)) is not completed and it is going to extend in wave 5 higher. To confirm this view TRV need to break above 224,00; therefore, we should look to end an impulse higher to complete wave ((3)) and then pullback in wave ((4)).

Source: https://elliottwave-forecast.com/stock-market/travelers-trv-strong-rally-blue-box/