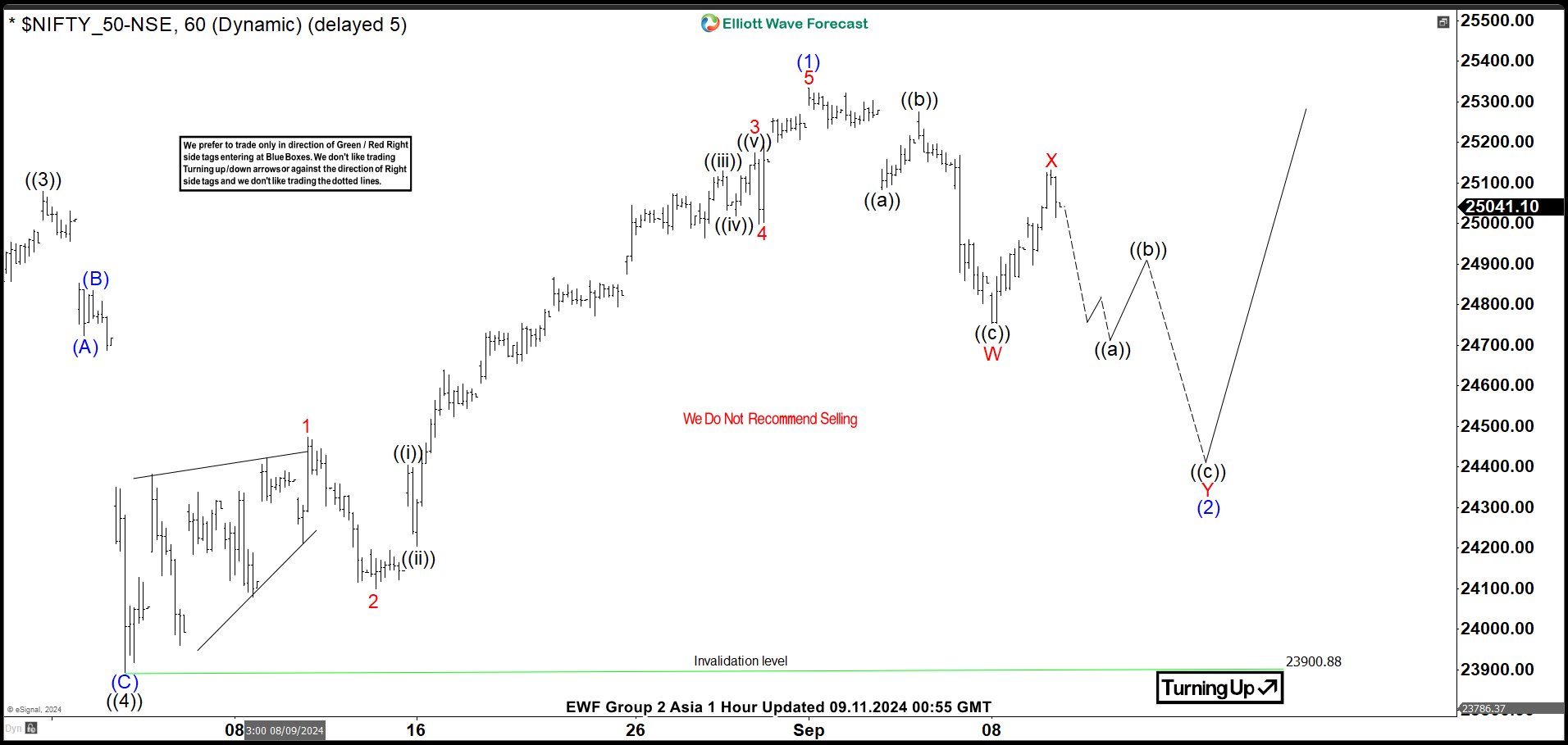

Short Term Elliott Wave view on NIFTY suggests that rally to 25078.3 ended wave ((3)). Pullback to 23900 ended wave ((4)) with internal subdivision as a zigzag Elliott Wave structure. Down from wave ((3)), wave (A) ended at 24723.7 and rally in wave (B) ended at 24835.10. Wave (C) lower ended at 23900.8 which completed wave ((4)) in higher degree. The Index has turned higher in wave ((5)). Internal subdivision of wave ((5)) is unfolding as a 5 waves impulse. Up from wave ((4)), wave 1 ended at 24472.8 and pullback in wave 2 ended at 24099.7. Index then resumed higher as a nest.

Up from wave 2, wave ((i)) ended at 24403.55 and wave ((ii)) ended at 24204.50. Wave ((iii)) higher ended at 25129.6 and wave ((iv)) ended at 25017.5. Wave ((v)) higher ended at 25174.55 which completed wave 3 in higher degree. Pullback in wave 4 ended at 24998.50. Final leg wave 5 ended at 25333.65 which completed wave (1) in higher degree. Wave (2) pullback is in progress to correct cycle from 8.5.2024 low in 7 swing before it resumes higher. Down from wave (1), wave W ended at 24753.15 and wave X ended at 25130.50. Expect wave Y to extend lower to correct cycle from 8.5.2024 low in 7 swing before it turns higher. As far as pivot at 23900.88 low stays intact, expect pullback to find support in 3, 7, 11 swing for more upside.

NIFTY 60 Minutes Elliott Wave Chart

Source: https://elliottwave-forecast.com/stock-market/elliott-wave-view-nifty-remains-bullish-august-low/