The VanEck Junior Gold Miners ETF (GDXJ) is an exchange-traded fund that tracks the overall performance of small-capitalization companies primarily involved in gold and silver mining. Launched in 2009, GDXJ provides investors with exposure to a diversified portfolio of junior gold mining companies, which are often in the early stages of exploration and development.

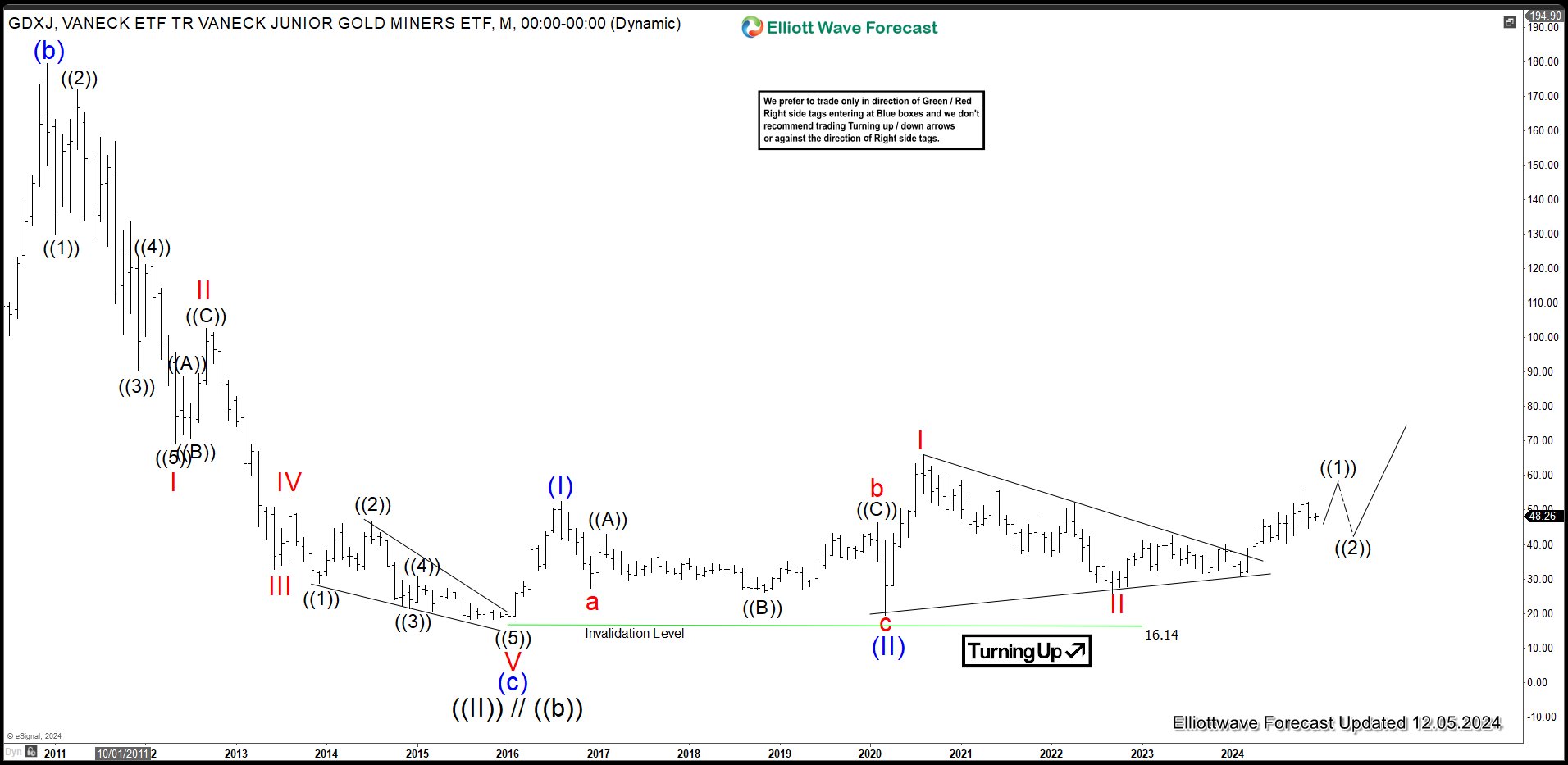

GDXJ Monthly Elliott Wave View

Monthly Elliott Wave chart in Gold Miners Junior ETF (GDXJ) shows wave ((II)) Grand Super Cycle ended at 16.14. The ETF has turned higher with internal subdivision as a possible nested impulse. Up from wave ((II)), rally in wave (I) ended at 52.5. Pullback in wave (II) ended at 19.52 and wave (III) takes the form of an impulse in lesser degree. Wave I of (III) ended at 65.95 and wave II of (III) dips ended at 25.80. Expect the ETF to extend higher as far wave II at 25.8 stays intact in the first degree, and more importantly above wave ((II)) low at 16.14.

GDXJ Daily Elliott Wave View

Daily Elliott Wave Chart of GDXJ above shows that pullback to 25.88 ended wave III. Wave III rally is in progress as a 5 waves impulse. Up from wave II, wave (1) ended at 41.16. Pullback in wave (2) ended at 30.46 as an expanded flat. The ETF resumed higher in wave (3) which ended at 55.58. Pullback in wave (4) is proposed complete at 44.11 as a zigzag structure. The ETF still needs to break above wave (3) at 55.58 to rule out any potential double correction. Near term, as far as pivot at 25.88 low stays intact, expect the ETF to extend higher.

Source: https://elliottwave-forecast.com/stock-market/gold-miners-junior-gdxj-correction-ended/