In this technical article we’re going to take a look at the Elliott Wave charts charts of Nvidia Stock (NVDA) published in members area of the website. As our members know, we generally favor the long side in NVDA, due to impulsive bullish sequences. Recently, the stock has corrected the cycle from the August 90.68 low. We got a pull back which unfolded as an Irregular Flat pattern.

Before we take a look at the real market example of Expanded Flat, let’s explain the pattern in a few words.

Elliott Wave Expanded Flat Theory

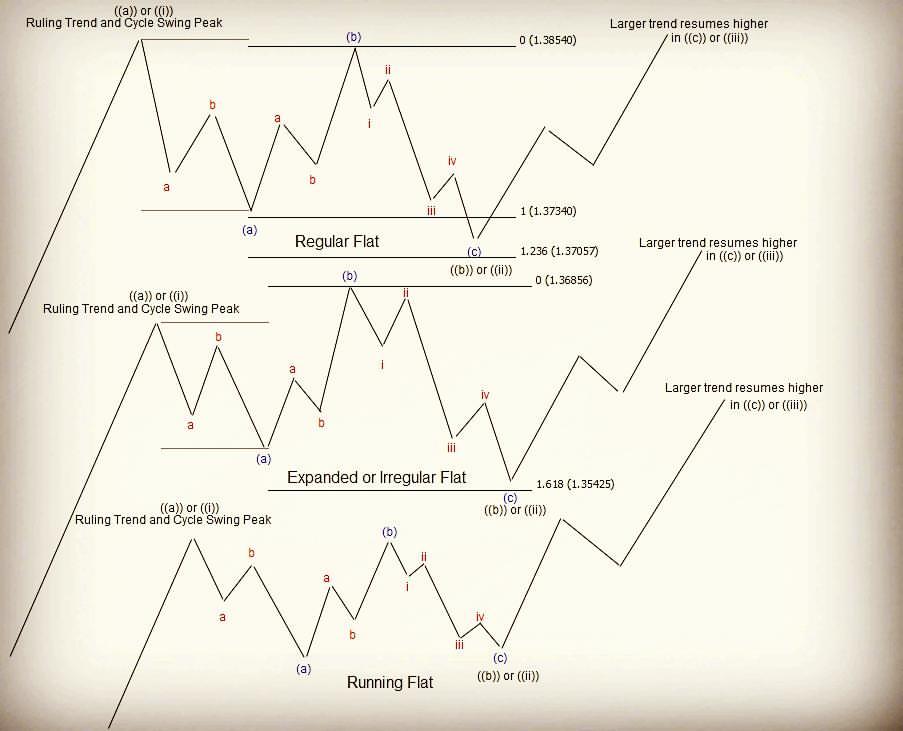

Elliott Wave Flat is a 3 wave corrective pattern which could often be seen in the market nowadays. Inner subdivision is labeled as A,B,C , with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern. It’s important to notice that in Irregular Flat Pattern wave B completes above the starting point of wave A. Wave C ends bellow the ending point of wave A . Wave C of Flat completes usually between 1.00 to 1.236 Fibonacci extension of A related to B, but sometimes it could go up to 1.618 fibs ext.

At the graphic below, we can see 3 types of Elliott Wave Flat structures

Now, let’s take a look what Elliott Wave Flat Pattern looks like in the real market

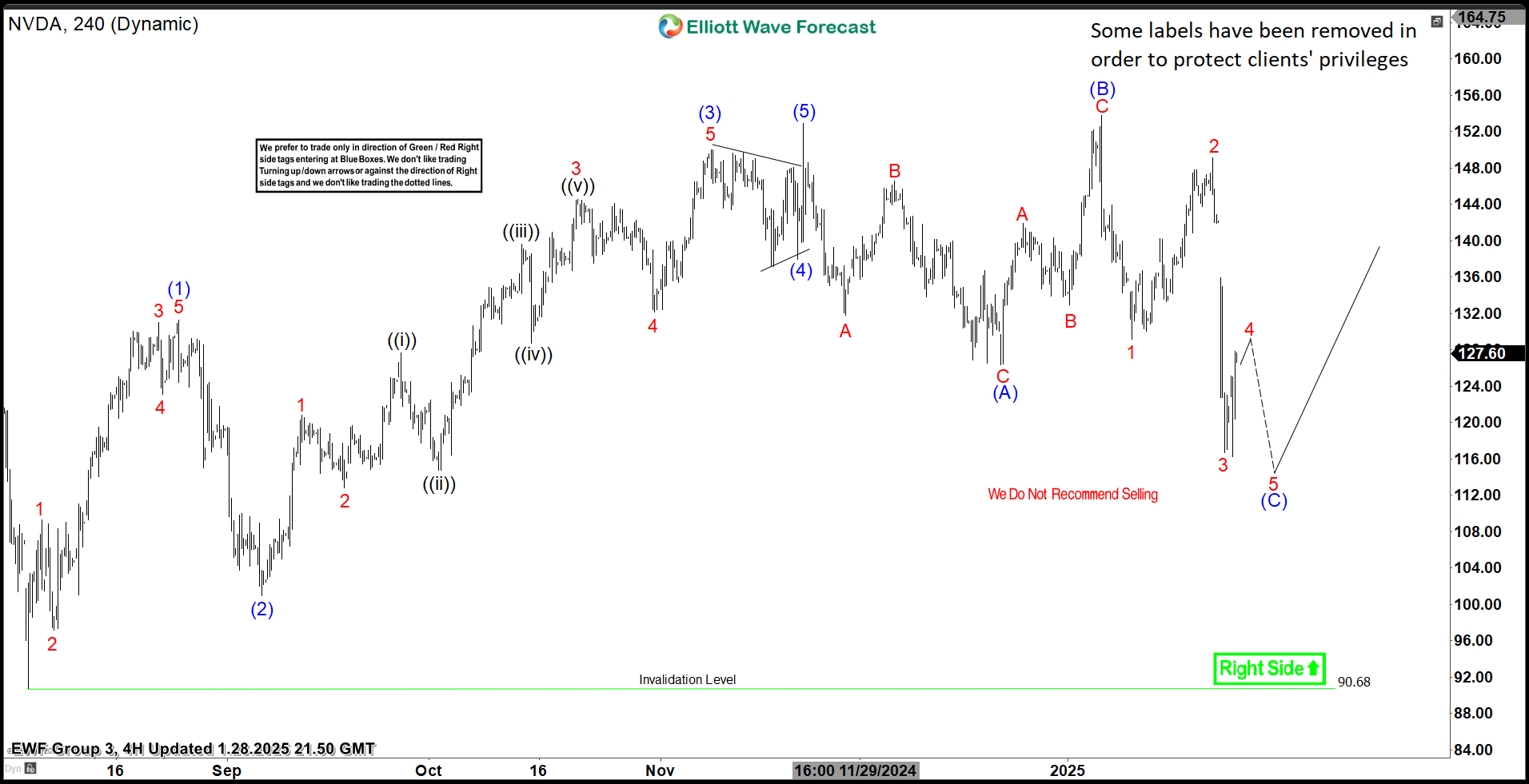

NVDA 4h Hour Elliott Wave Analysis 01.28.2025.

Currently, NVDA is correcting the cycle from the 90.68 low. Elliott Wave analysis suggests that the pullback is unfolding as an Irregular Flat Pattern. When analyzing the lower time frames, we observe that the inner subdivisions of waves (A) and (B) in blue exhibit corrective sequences. Wave (B) has broken above the starting point of wave (A), while wave (C) has broken below the starting point of wave (B), which is characteristic of an Irregular Flat pattern.

At this stage, the (C) leg still requires another wave up to complete its structure as a 5-wave move. We recommend that our members avoid selling at this stage. The target for wave 5 in red would be the inverse 1.236 Fibonacci extension of wave 4.

You can learn more about Elliott Wave FLAT and other Patterns at our Free Elliott Wave Educational Web Page

Reminder for members: Our chat rooms in the membership area are available 24 hours a day, providing expert insights on market trends and Elliott Wave analysis. Don’t hesitate to reach out with any questions about the market, Elliott Wave patterns, or technical analysis. We’re here to help.

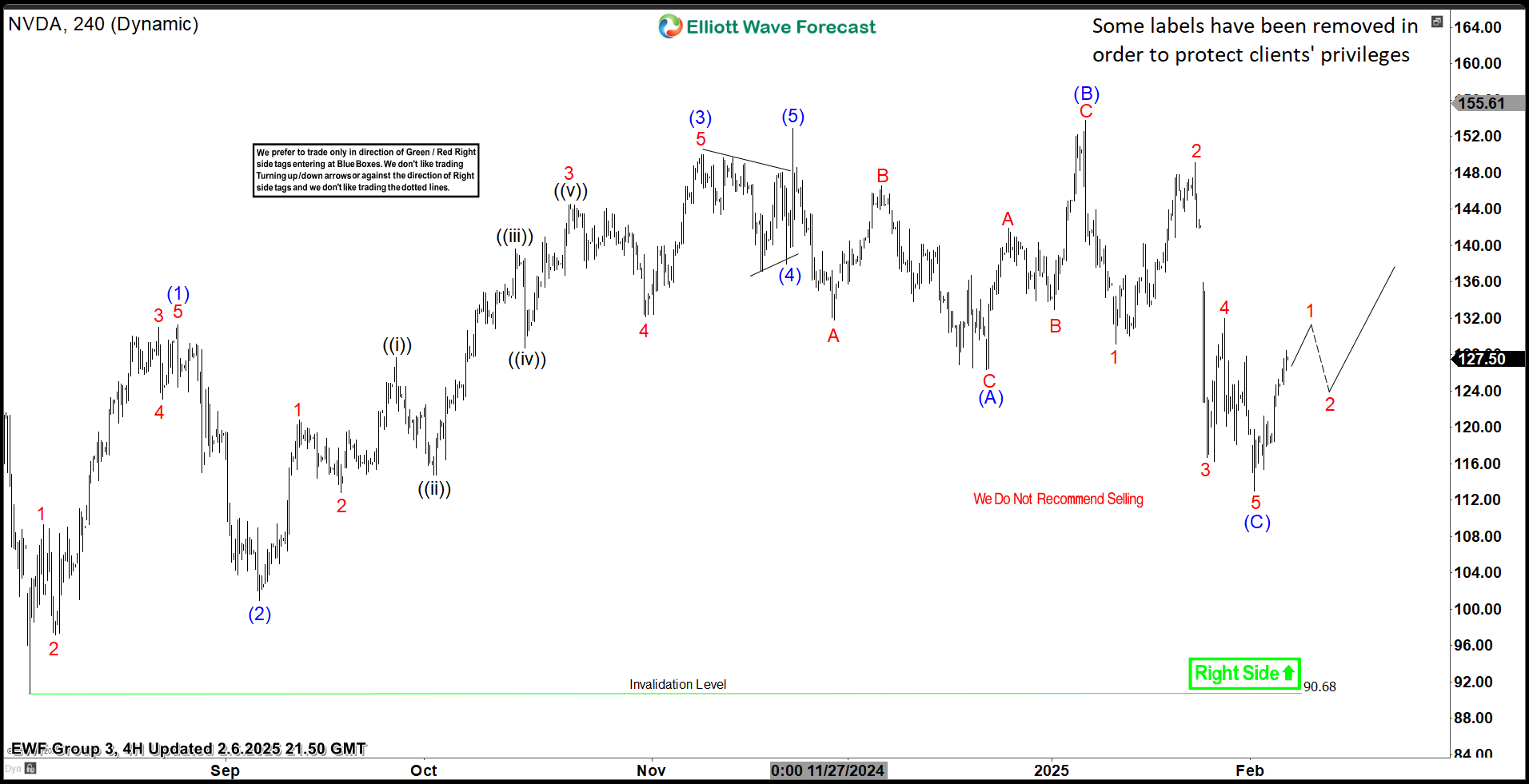

NVDA 4h Hour Elliott Wave Analysis 02.06.2025.

Nvidia made another leg down in wave 5 of (C), completing the pullback. Now, the 113.09 low is the key pivot for the proposed view. As long as the price stays above that level, we can count the correction as completed in an Irregular Flat Pattern. Otherwise, a break below 113.09 would open the possibility for further downside extension

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. For additional information on the best trading strategies for Bitcoin, visit our Live Trading Room and stay updated with the latest insights in our Chat Room.

You can find detailed information on trading setups in the membership area and in the Live Trading Room

90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test

Source: https://elliottwave-forecast.com/elliottwave/nvidia-stock-nvda-elliott-wave-flat/