Hello traders. Welcome to a new blog post that highlights the latest trade setups shared with the Elliott-wave-forecast members. In this post, the spotlight will be on the Eurostoxx-50. The post will uncover the setup that led to the recent Long position for educational purposes.

The EuroStoxx refers to a family of stock market indices that track the performance of companies across the Eurozone. The most well-known index is the EuroStoxx 50, which includes the 50 largest and most liquid blue-chip companies from 11 Eurozone countries. It serves as a key benchmark for European equities and is widely used by traders and investors for market analysis, trading, and ETFs.

The EuroSroxx-50 ($Stoxx) is clearly in a bullish sequence. Regarding this bullish cycle, we can refer to the low of September 2022 as the starting point. At this low, the index completed the supercycle degree wave (II) after it previously completed wave (I) in November 2021 following the recovery from the Covid market crashes. Thus, from the low of September 2022, a strong impulse wave sequence began as the index advanced in a series of higher highs and higher lows. Following the break of the November 2021 high, buyers have embarked on ‘buying the dips’ while the bullish cycle lasts.

There was a ‘flat structure’ pullback that ended in October 2023 for wave II and then the July/August 2024 ‘zigzag structure’ pullback that completed wave ((2)) of III. We provided a blue box Long setup for members at the extreme of the July/August 2025 dip (read here). Price recovered from these pullbacks to re-establish this bullish cycle into a fresh record high. Thus, we shared with members to remain buyers and avoid going for the shorts. Meanwhile, another setup emerged in March 2025 on the H1 chart. Let’s check it out.

EuroStoxx Long Setup – 14th March 2025

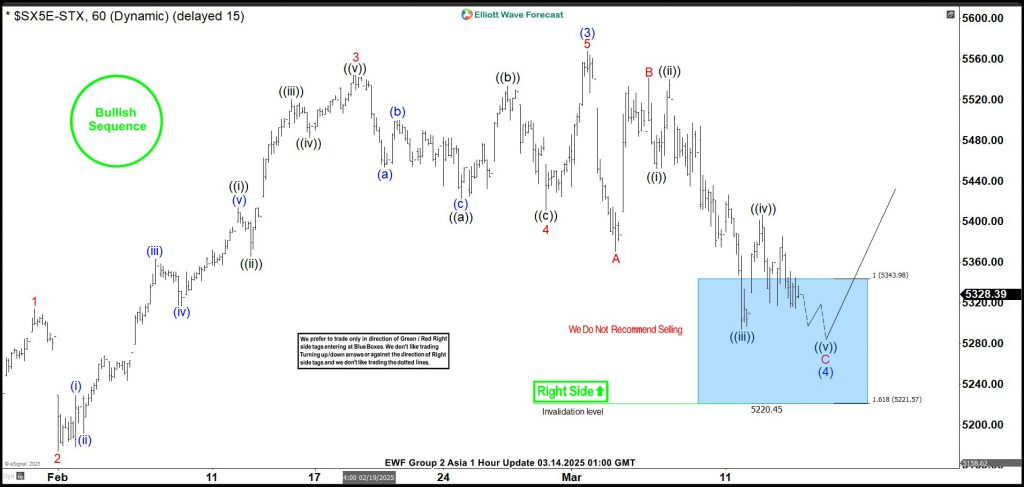

On 13th March 2024, we shared the H1 chart above with members. The chart shows the index completing a pullback in a 3-swing structure. We identified 5343.98-5221.57 as the blue box extreme zone. At the blue box, members went long and set their stop loss below the zone. We identified the first target at 5417 in the live trading room and on the trading journal for members. At the first target, we like to close half of the position and reduce the stop on the other half to the breakeven price. Thus, we call the first target the ‘risk-free’ price. This way, we can run a risk-free trade while securing some profits. What happened afterward?

EuroStoxx Long Setup Hits First Target – 17th March 2025

The chart above shows the latest EuroStoxx H1 chart. The chart shows the price separating from the blue box and hitting the first target in the process. Thus, buyers from the blue box now run a risk-free trade. The second half of the position will be open for more profit if the price rallies to the final target. Otherwise, the price hits the breakeven price and we aim to buy lower again.

EuroStoxx-50 – What Next?

If the current recovery advances as we expect, we should be able to reach the final target to complete wave (3) of ((3)) of III. The long-term weekly chart presented to members shows that wave III is still incomplete. Thus, we will continue to focus on buying pullbacks from the blue box on the H1, H4 and Daily charts.

Source: https://elliottwave-forecast.com/stock-market/eurostoxx-trade-setup-locking-profits/