Hello everyone! In today’s article, we’ll examine the recent performance of Bank of America Corp. ($BAC) through the lens of Elliott Wave Theory. We’ll review how the rally from the August 05, 2024, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock.

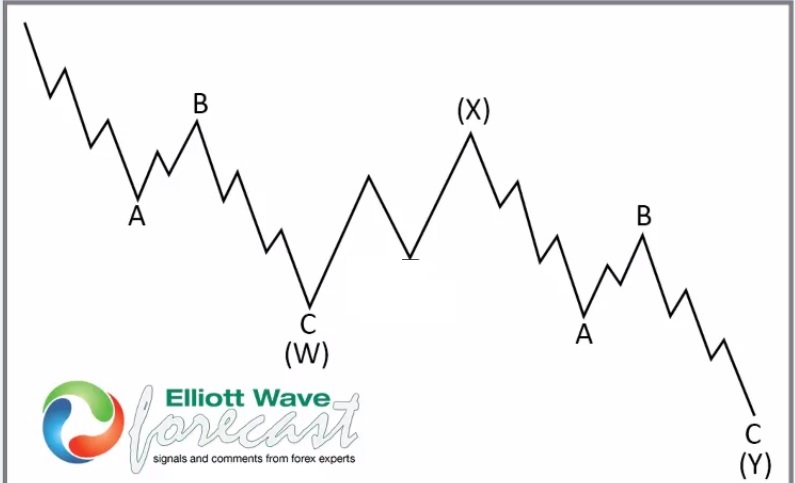

7 Swings WXY correction

$BAC 4H Elliott Wave Chart 3.04.2025:

In the 4-hour Elliott Wave count from March 04, 2025, we see that $BAC completed a 5-wave impulsive cycle beginning on August 05, 2024, and ending on January 16, 2025, at the black ((3)). As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 7 swings, likely finding buyers in the equal legs area between $41.79 and $38.58.

This setup aligns with a typical Elliott Wave correction pattern (WXY), where the market pauses briefly before resuming the main trend.

$BAC 4H Elliott Wave Chart 3.16.2025:

The update, from March 16, 2025, shows that $BAC is reacting as predicted. After the decline from the recent peak, the stock found support in the equal legs area, leading to a bounce. As a result, traders should get ready to go risk-free.

Conclusion

In conclusion, our Elliott Wave analysis of $BAC suggested that it could bounce in the short term. Therefore, traders should be proactive and get risk-free soon while keeping an eye out for any corrective pullbacks. By using Elliott Wave Theory, we can identify potential buying areas and enhance risk management in volatile markets.