Elliott Wave analysis suggests EQT Corporation is poised for a major bullish breakout, with multiple impulsive sequences unfolding across timeframes.

EQT Corporation (EQT) continues to show strong potential for further gains based on its long-term and short-term Elliott Wave structures. The monthly and daily charts both suggest that the stock is entering an impulsive phase of a larger bullish cycle.

Long-Term Elliott Wave Structure

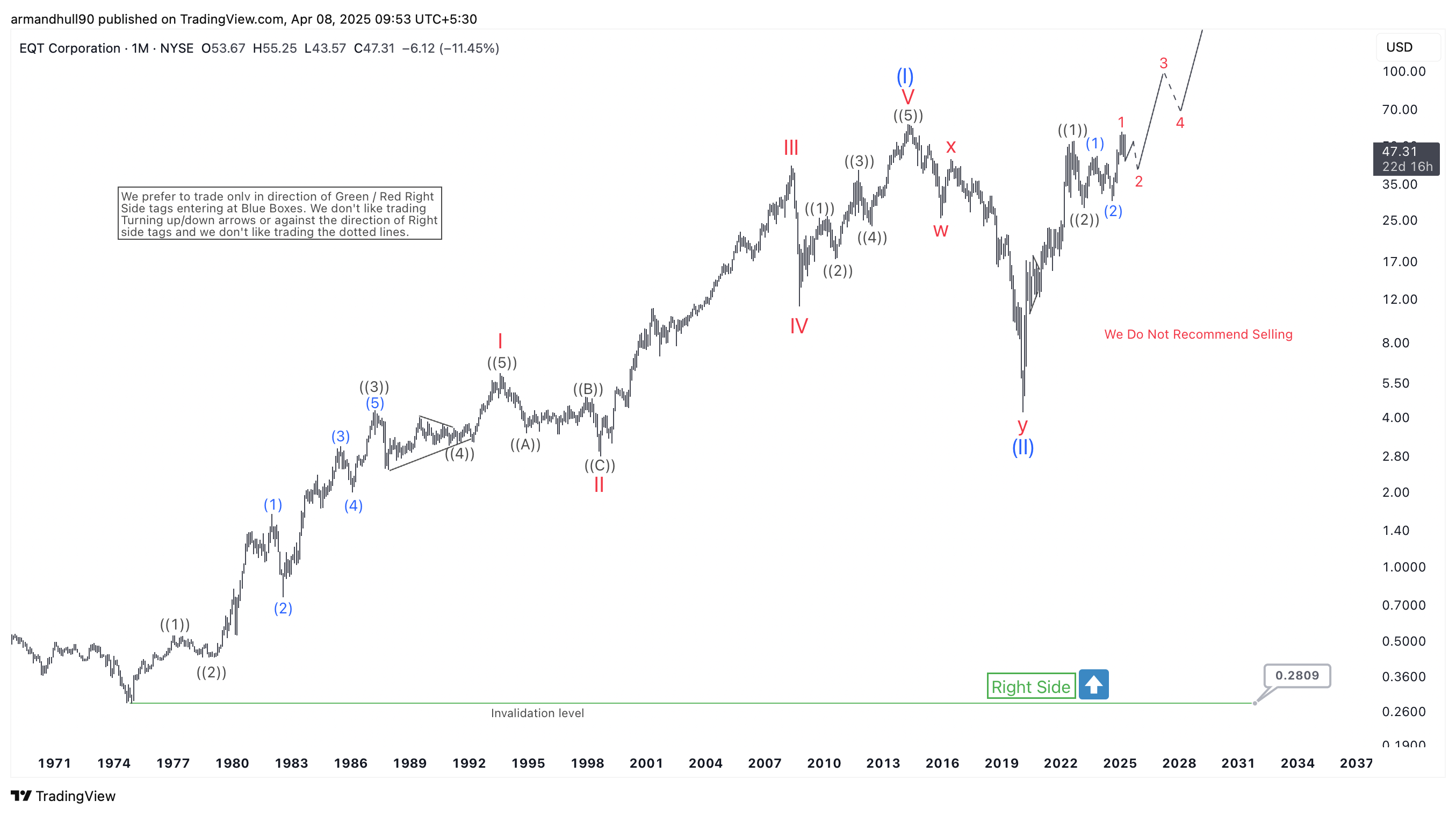

On the monthly chart, EQT has completed a major corrective cycle ending in wave ((II)), with the low marked around $4.18. This bottom represents a significant structural support. From this low, the stock began a new impulsive phase. Wave ((I)) unfolded in a clear five-wave advance, and the correction that followed as wave ((II)) is now over. EQT is currently advancing in wave (III), which is subdividing into five minor waves.

Within this new impulse, we can already see waves ((1)), ((2)) completed and ((3)) of I is in progress within larger (III). The invalidation level is placed at $0.2809, a historically distant support level that underscores the bullish bias.

The “Right Side” tag remains green, confirming the upward directional bias. Additionally, the message “We Do Not Recommend Selling” supports the idea of staying with the trend. This is especially important since the structure projects much higher prices in the coming years.

Short-Term Outlook

On the daily chart, the price action shows wave 1 and 2 of a smaller degree have completed, and EQT is currently in the early stages of wave 3. The internal structure of this wave suggests that a powerful rally may be underway.

The “Turning Up” tag and continued bullish wave progression suggest that traders should watch for pullbacks to enter long positions. The corrective wave 2 in red, unfolding as a typical (a)-(b)-(c) zigzag, appears near completion, setting the stage for wave 3 to unfold.

Conclusion

EQT offers a compelling setup for both investors and short-term traders. The multi-timeframe Elliott Wave structure suggests a strong bullish trend ahead. As long as the price stays above key invalidation levels, the outlook remains positive. Pullbacks should be treated as buying opportunities rather than exit signals.

Source: https://elliottwave-forecast.com/stock-market/958762/