IONQ inc. is a pioneer in the development and manufacturing of quantum computers, focusing on quantum computing and quantum information processing. Founded in 2015 by Christopher Monroe and Jung Sang Kim, the company is headquartered in College Park, MD.

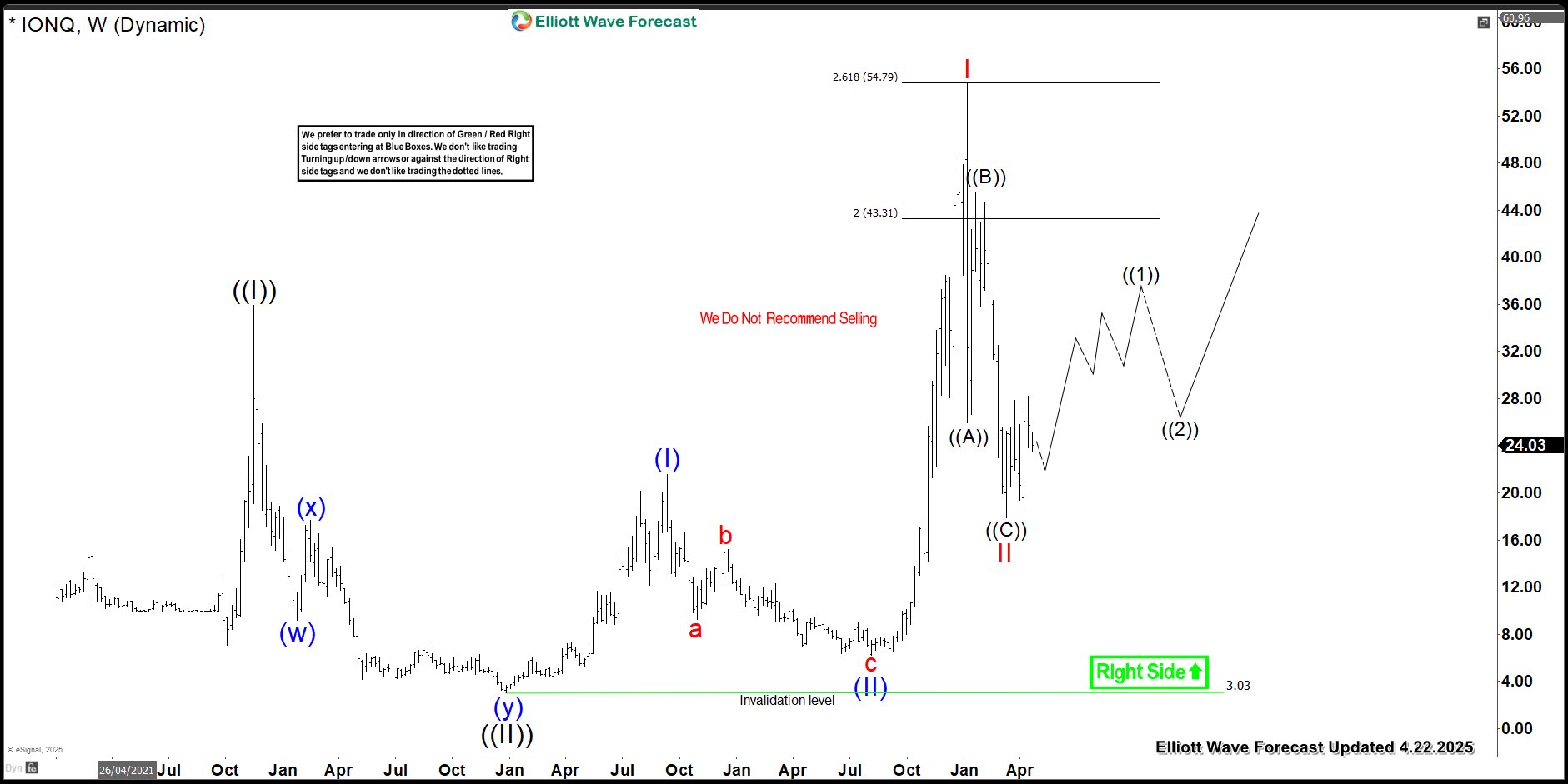

This blog post provides an in-depth technical analysis of IONQ’s stock performance, specifically its weekly chart. Key findings include:

- Two upward channels emerging from all-time lows

- A potential nest structure forming, indicating further upside potential for the IONQ ticker symbol.

In which the rally to $35.90 high ended wave ((I)) and down from there made a pullback lower. The internals of that pullback unfolded as a double three structure where wave (w) ended at $9.16 low. Then a bounce to $17.66 high ended wave (x) bounce. And wave (y) ended at $3.03 low, thus completed wave ((II)) pullback. Up from there, the stock is nesting higher in an impulse sequence where wave (I) ended at $21.60 high. Wave (II) pullback ended at $6.22 low and made a very nice rally higher. Since then the stock rallied in wave I at $54.74 high and made a 3 wave pullback in wave II. The internals of that pullback unfolded as zigzag correction where wave ((A)) ended at $25.92 low. Wave ((B)) bounce ended at $45.56 high and wave ((C)) ended at $17.88 low. Near-term, as far as dips remain above $17.88 low expect stock to resume the upside.

IONQ Elliott Wave Weekly Analysis From 4.22.2025

Source: https://elliottwave-forecast.com/stock-market/ionq-pullback-complete-next-stop-higher/