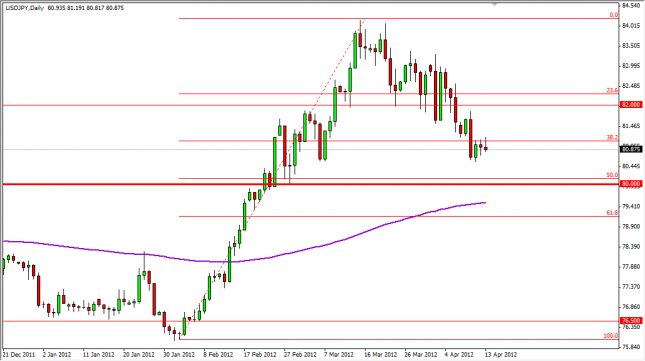

The USD/JPY pair fell slightly for the session on Friday as the “risk off” attitudes hit the markets in general again. The Chinese GDP numbers came out a bit light, and as a result many traders got nervous. The pair has been selling off in a choppy manner for a few weeks now, but appears to be heading towards the 80 support level to test it.

The area was the site of a massive breakout, and we will be looking to buy as close to the 80 mark as possible. The level is also the 50% Fibonacci retracement and where the 200 day EMA is converging to at the moment. Because of this – we buy any signs of support at that level. In the meantime, we simply wait for that to happen.

Written by FX Empire