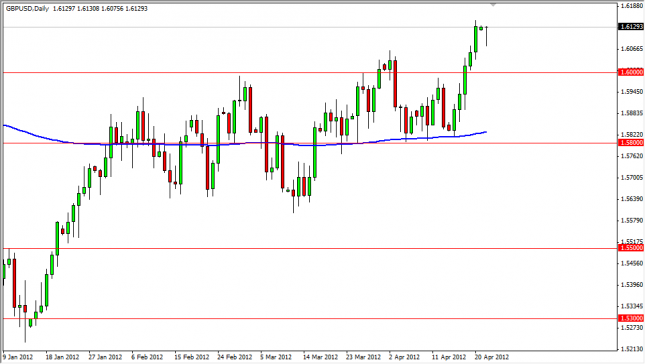

The GBP/USD pair has been racing higher lately, and the Monday session first looked as if it was going to be the pullback most traders would have needed. However, the fall was very short-lived, and it formed a hammer at the top of the market.

This candle could be a continuation hammer, showing strength if it breaks higher. However, if the market breaks below the bottom of the hammer, this would be what is called a “hanging man”, and this is very bearish. Because of this, the analysis is simple: we are buying on a break of the top of the session, and selling on a break of the lows.

Written by FX Empire