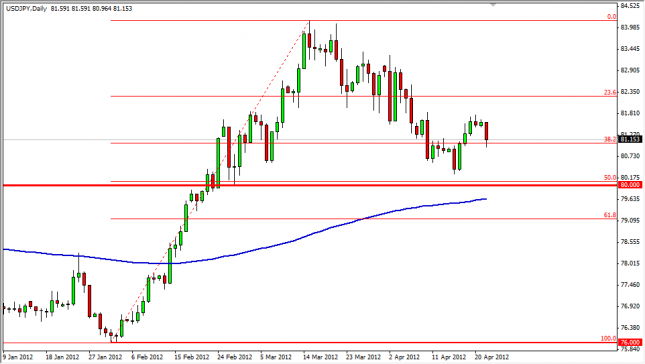

The USD/JPY pair fell during the Monday session in order to test the 81 handle. The pair has been breaking out of a longer-term downtrend over the last few months, and as long as the 80 level holds as support – this is how we see this pair overall. Because of this, we like buying dips down at this level as the pair should continue to rise over time.

The Bank of Japan is expected to announce an expansion of their asset buyback program this week, and because of this there is a real possible catalyst to this pair rising over time. Also, the Federal Reserve has a meeting on Tuesday and Wednesday that could or could not mention easing in the announcement. However, the Fed has shown lately that they are holding on easing, and this should continue to push this pair higher over time as well.

Written by FX Empire