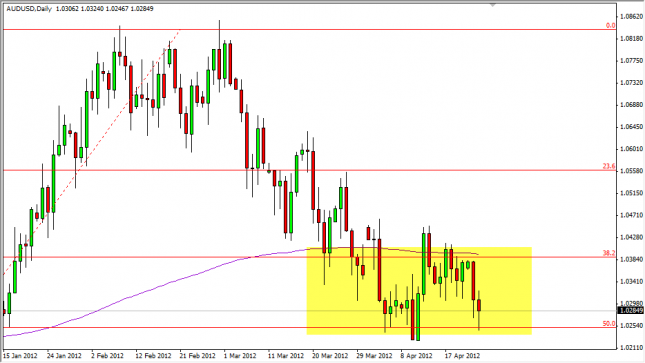

The AUD/USD pair fell for much of the session on Tuesday, but bounced at the end in order to form a hammer. This bullish sign is at the bottom of the most recent consolidation level, and it looks as if the 50% Fibonacci retracement level is trying to hold as support going forward. The 200 day EMA is just above, so although we see a lot of support at this point, it is difficult to get overly bullish at this moment.

We would be willing to buy this pair on a break of the top of the daily range, but suspect it only sets up a run to 1.04 or so. Of course if we manage to plow ahead to close over the 1.0450 level, we would have to hang on to any longs that we had, or even buy at that point. Selling isn’t a thought just yet – but could be if this pair continues to weaken.

Written by FX Empire