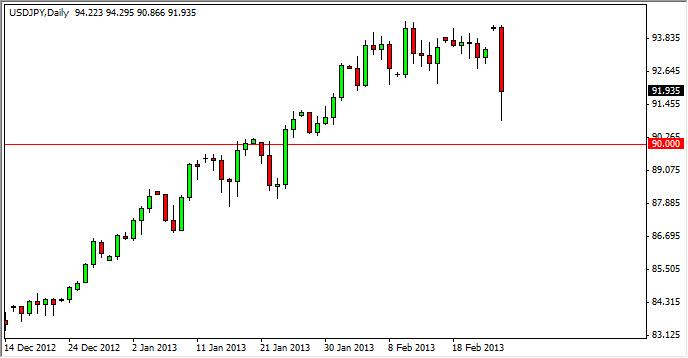

The USD/JPY pair fell off a cliff during the session on Monday, as the gap that had initially happened at the opening completely came undone. Looking at the 94 handle as resistance is become apparent that is going to take something special to break above it. We do see the 90 handle as being very supportive though, and as a result we think that this market will struggle to go below it.

When you look at this chart, you cannot help but think of all of the various headwinds out there that currently exist. During the Monday session, we saw quite a bit of volatility in reaction to the Italian elections that brought him quite a bit of anti-austerity candidates. Because of this, there were fears that the Italians with renege on certain agreements that have been placed of the last couple years involving their debt load.

Now it looks like we have a hung parliament, and that there will have to be some type of second election. Because of this, the markets panicked, and of course you saw a run back to the safety trade. This of course sold off this pair, and we went as low as 90.80 during the session, and bounced at the very end. However, we think this will eventually be a buying opportunity, but it is more than likely that we will see continued weakness as most of this candle is still full and red.

This all makes sense, because we quite frankly have been overbought. The Yen has been sold off far too much of the last couple of weeks, and pullbacks like this are needed. If we choose to continue to buy this pair, we need to see some type of pullback in order to collect more buyers.

Looking towards the rest of this week, we have the Federal Reserve Chairman Dr. Ben Bernanke will testify in front of Congress today, and that of course can always move the market. On top of that, we have the sequestration that goes into effect on Friday if Congress does not pass some type of alternate measure, which of course has some market participants worried about growth in the United States as well. We still believe in the long-term validity of a long position in this market, but think that the pullback isn’t quite over.

Written by FX Empire