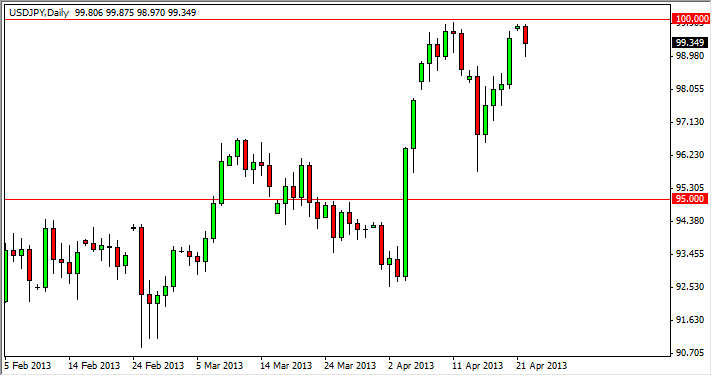

The USD/JPY pair fell during the session on Monday, as the 100 level continues to be far too resistive for the buyers in this marketplace at the moment. There is talk of a massive amount of options up there, and as a result barriers are being put up by large investors to keep the options from firing against them. If that’s the case, then it truly is only a matter of time before this market breaks out to the upside.

As soon as those options expire, there is a strong chance that the market will break through that level without too many issues. Of course, that could happen much sooner than that, so we really can’t use that as a measuring stick as to when to be involved in this marketplace. Rather, we can simply wait until we see a daily close above the 100 handle as a sign that we have broken through.

The G 20 announcement this past week of agreement with the Bank of Japan and its policies certainly has given the “green light” for this market to continue higher. It truly is only a matter of time, so we only see two possible scenarios going forward in this marketplace: buying a daily candle that close above the 100 level, or buying pullbacks that show signs of support. There is no other opportunity in this marketplace.

We see support at various levels between here and 95, so that pullback may or may not be as “ideal” as most trade we would like to take, but the truth is that this is a “one-way trade” for the next several months, if not years. Of course there will be opportunities to short this marketplace, but we are simply going to ignore those in by the dips as they offer opportunities.

The fact that the candle for the session on Monday did retreat a bit from the downside suggests that we still have buying pressure down near the 99 handle. With that in mind, we would not be surprised see this market breakout the next couple of sessions, but we would not be buying at present levels because it is simply too close to the resistance.

Written by FX Empire