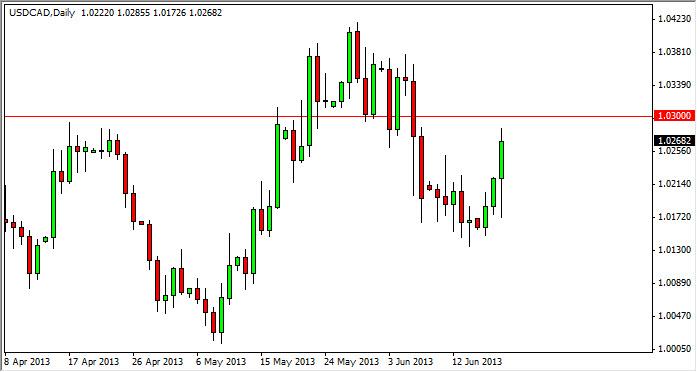

The USD/CAD pair initially fell during the session on Wednesday, but after the FMOC meeting and minutes, you can see that the market shot straight back up. This market reacted to the fact that the Federal Reserve suggested that quantitative easing would be tapered off by the end of the year, and possibly exited by the middle of next year. Because of this, the US dollar gained all around, and of course the Canadian dollar was going to fare any differently than the other currencies out there. Nonetheless, the 1.03 level has offered resistance, and the market closed below it. We need to get above the 1.03 handle in order to be comfortable going long, and if we can get above the 1.04 level, we think this market could go much, much higher. In the meantime, expect a lot of choppiness.

Written by FX Empire